US system integrator Stem Inc has seen its share price fall by over 40% after its financial results for the second quarter of the year, which saw falling sales, bookings and a huge net loss.

The battery energy storage system (BESS) integrator and software provider saw revenue of US$34 million in the second quarter of 2024, down 63% year-on-year.

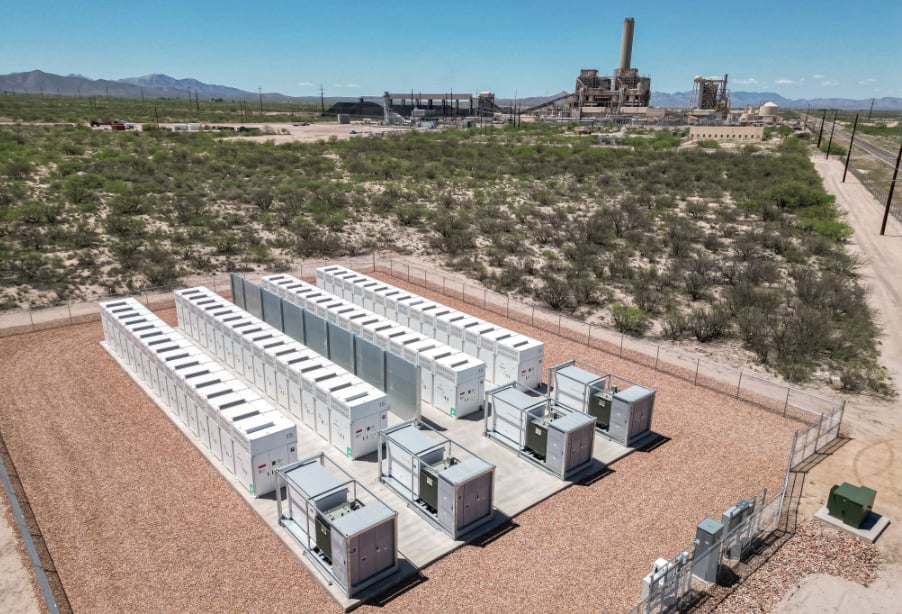

Projects completed in the quarter include three solar-plus-storage arrays in Arizona for utility AEPCO.

Its margins improved, bar an 18% increase in its EBITDA loss to US$11.3 million. However, a one-time non-cash US$547 million impairment of goodwill led to a net loss of US$582 million.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Goodwill is typically generated when a company is acquired or publicly lists on the stock market, and represents the difference between its value post-deal and its tangible assets. As Energy-Storage.news has reported, the company’s share price has fallen substantially since listing via the SPAC route (as have other SPAC firms), so the goodwill impairment may reflect a re-evaluation in light of that.

The company’s bookings also fell substantially, down almost 90% to US$25.4 million (verus US$236.4 million) in the same quarter last year. The firm said this was ‘driven primarily by increased quarterly variability associated with Stem’s continued expansion into large, utility-scale projects’. However, its contracted backlog increase by 14% from the end of 2023.

The company has subsequently revised down full-year guidance. It is now forecasting US$200-270 million in revenue, less than half the previous US$567-667 million estimate, while bookings will be US$600-1,100 million versus US$1,500-2,000 million previously guided for. It has dropped its guidance of positive adjusted EBITDA too.

The company has initiated a strategic review of the business and appointed a new CFO in Doran Hole, who was previously CFO and executive VP at renewable energy, energy efficiency and storage project company Ameresco.

The firm is trading at US$0.56 at the time of writing, down over 40% from around US$1.00 before the results release.