Stephen Crosher, CEO of RheEnergise, discusses the future of energy and the growing importance of energy storage as part of the energy mix.

Twenty-first-century trends in energy are now crystal clear: within a generation, renewable power will dominate, and fossil-fuel assets will be, at best, chronically underutilised and probably stranded.

Transitioning to ultra-low carbon generation brings both challenges but also unparalleled opportunities. Power generation, which will increasingly serve mobility, heat, and industry, will be monopolised by wind, solar, nuclear and potentially tidal power.

There are many opportunities, worth billions, if not trillions, in financing new clean generation assets with abundant banks and infrastructure funds willing to make those investments. However, the energy system will increasingly become one where generation and supply do not match demand, and demand does not fit the generation supply profile. Everything is out of balance over short, medium, and long periods. In addition, due to climate change demands, filling the gaps with gas generation will not be a realistic long-term option.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Different forms of flexibility or energy storage systems will solve the significant mismatch between generation and demand or the intermittency problem. The solutions must provide services over different time periods, from seconds (frequently) to weeks (very occasionally). These providers of technical solutions for flexibility will become huge companies (the green unicorns) over the next 20 years, with revenues measured in billions.

A clear example of the growth we should now expect for the flexibility solution providers can be taken from a company like the wind turbine company Vestas, the world’s largest manufacturer of wind turbines. Vestas made their first sale in 1979; by 2000, turnovers were €868 million, and by 2022, revenues were €14.5 billion. The growth is not expected to slow, as there is considerable pressure to grow renewable energy generation deployment by 300% over the next seven to 10 years.

We can expect that a handful of companies will dominate the short-duration energy storage market, a further handful will dominate the inter-seasonal energy storage market, and lastly, there will be several companies that dominate the medium-duration energy storage space, such as RheEnergise.

The medium-duration energy storage space, providing grid flexibility, is the part of the market where the most significant trading volume will occur. It is the part of the market that will do the heavy lifting, at low cost, to balance the daily cycles of solar (and tidal) and the twice-weekly cycles of wind.

There will be significant investment wins in deploying capital into infrastructure, but even bigger investment win-wins into the solution providers, those providing the new physical infrastructure plant and equipment.

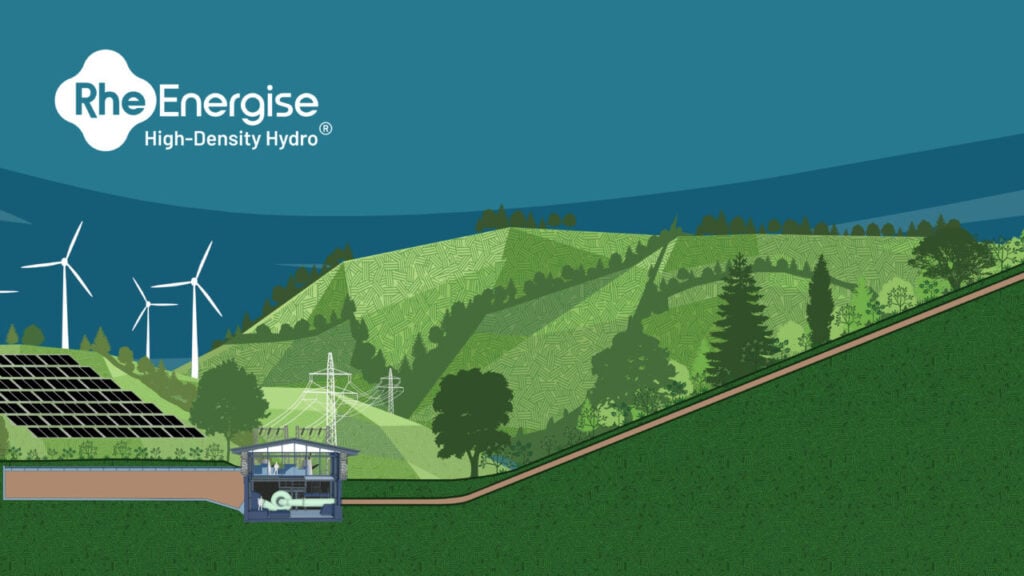

RheEnergise is a UK-based company bringing innovation to pumped energy storage with a grid-scale solution called High-Density Hydro®, providing four to 16 hours of energy storage in the 10MW to 100MW power range. The company is currently fundraising directly with family offices and institutional investors and also on Crowdcube for retail investors. The funds raised are to accelerate our commercialisation and strengthen our IP portfolio. Click here to access the page.

Investment risk warning: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you are unlikely to be protected if something goes wrong. You can find out more here.