REV Renewables and subsidiaries owned by NextEra Energy have reached settlement agreements with the US Federal Energy Regulatory Commission (FERC) relating to alleged BESS operating violations in the California Independent System Operator (CAISO) market.

Details of the settlements, amounting to over US$3.1 million, were outlined in separate stipulation and consent agreements filed with FERC on the regulator’s online docketing system on 8 August 2024.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Ancillary services to maintain grid frequency

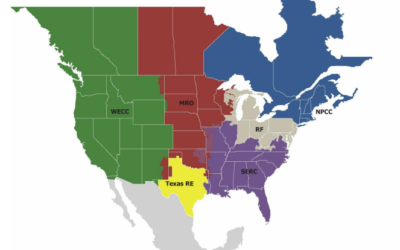

CAISO procures energy and ancillary service needs through auction-based day-ahead and real-time energy markets, with all ancillary services procured as part of the system operator’s day-ahead market.

Although REV’s 40MW Vista Energy Storage project provides CAISO with both energy and ancillary services, the recent investigation carried out by FERC’s Office of Enforcement comes from alleged incorrect information CAISO received from the IPP relating to the Vista project’s ability to provide ancillary services, specifically when it came to grid regulation.

Regulation is a type of ancillary service used by CAISO (as well as other grid operators) to maintain its grid frequency at around 60Hz. This is achieved by reducing or increasing the total amount of energy on the grid through the charge or discharge of battery storage projects which CAISO administers through regulation up and down awards.

If a developer wants a project to participate in the ancillary services market, it must hand over control of the project’s output to CAISO’s automated control algorithm. Developers receive a fee for their project being available during specific times to provide ancillary services.

Optional SoC forecasting for participating assets

When a developer submits a bid into the CAISO day-ahead market, it has the option of forecasting its expected state of charge (SoC) at the beginning of the next day, known as the initial state of charge. Market engines used by CAISO will then use this figure to determine whether a battery is given a regulation up or down award.

Under CAISO rules, batteries sized like the Vista project (with a maximum state of charge limit of 38MWh and 85% charging efficiency) may receive a regulation down award only if the initial state of charge is 4MWh or less.

Once given a regulation award, CAISO will charge or discharge the battery to ensure it is able to provide the regulation ancillary service for at least 30 minutes, known as the ancillary service state of charge constraint.

CAISO will pay the developers of the batteries for the charging/discharging to maintain specific charge levels.

REV Renewables ‘knew, or should have known’

The FERC settlement filing explains that REV predicted the initial state of charge of its Vista project would be 4MWh or less, even though the project had been given a 36MW or larger regulation up award for the final hour of the day.

The settlement filing stated that REV “knew, or should have known”, that as the project had been given a regulation up award, the ancillary service state of charge constraint would mean the project’s actual state of charge would be around 20MWh during the final hour of the day, and not 4MWh or less, like REV had forecasted.

REV predicted Vista’s initial state of charge to be 4MWh or less over 33 consecutive days, resulting in the project being granted a regulation down award for the first several hours each day across the period.

As the battery actually had around 20MWh of charge each day, there was a conflict between the operation of regulation down, which sought to charge the battery, and the ancillary service state of charge constraint, that sought to do the opposite and discharge the battery.

Under CAISO rules at the time, the system operator was required to pay REV for the charging of the battery, amounting to a total of US$1.45 million. REV also received US$185,000 for the actual regulation down awarding.

US$2.67 million settlement to the treasury and CAISO

FERC’s Office of Enforcement concluded that REV had violated certain CAISO rules in providing an inaccurate initial state of charge figure, concluding that the Vista project was not “reasonably expected to be available and capable of performing at the levels specified”.

As part of the settlement, REV agreed to pay a US$1 million civil penalty to the US Treasury and a larger US$1.67 million to CAISO. REV also agreed to complete compliance training and submit one annual compliance monitoring report to FERC’s Office of Enforcement.

Although the developer acknowledged the facts within the settlement agreement, REV stated it “neither admits nor denies the alleged violations” put forward by the Department of Enforcement.

NextEra CAISO market infringements

FERC’s Department of Enforcement also carried out a separate investigation into NextEra Energy subsidiaries, NextEra Energy Resources (NEER) and NextEra Energy Partners, and the manner in how they provided CAISO with ancillary services from portions of their Arlington Energy Center, Blythe Solar, Desert Sunlight and McCoy Solar hybrid projects between January 2022 and September 2023.

Crucially, the point of interconnection (POI) limit for each of these co-located facilities is below the combined solar and battery potential maximum output. When the combined output of these projects reached their POI limit, logic controllers programmed by NextEra would curtail the battery facilities, allowing the solar facilities to continue delivering energy to the CAISO grid.

Up until the end of 2021, this wouldn’t have been an issue. However, in December 2021, CAISO changed its regulations prohibiting co-located battery facilities from deviating from dispatch instructions when providing ancillary services, something which NextEra claims it wasn’t aware of.

According to the settlement agreement, there were 3,835 five-minute intervals during which the battery facilities at the mentioned NextEra projects deviated from dispatch instructions while holding ancillary services awards.

The Department of Enforcement claimed that NextEra earned approximately US$381,724 in revenue during the 18-month period from energy produced by the solar facilities when, under the procedural changes enacted in December 2021, they should have been curtailed.

Full cooperation from NextEra

The settlement agreement noted that NextEra fully cooperated with FERC during the investigation, and has since corrected its software to amend this issue.

As part of the settlement, NextEra agreed to pay a civil penalty of US$105,000 to the US treasury and US$381,724 to CAISO.

REV Renewables in lawsuit with system integrator

LS Power-owned REV Renewables claims that its Vista project was the largest in the US at the time of energization in 2018, and has continued to progress other battery storage projects across the country over the past few years.

This includes its 200MW Diablo Energy Storage facility located in Contra Costa County that was brought online in 2022, which happens to now be the center of a contract dispute with systems integrator Fluence – as reported in Energy-Storage.News at the end of last year.

REV is seeking a US$230 million refund from Fluence citing a catalogue of “defects, deficiencies and failures” at the Diablo project.