Poland looks set to lead battery storage deployments in Eastern Europe, with 9GW of battery storage projects offered grid connections and 16GW registered for the ongoing capacity market auction.

Eastern Europe has languished behind other regions in developing battery storage, but this is set to change. Driven by falling costs of renewables, the closure of coal generation and the need to rapidly find alternatives to Russian gas, the accelerated installation of intermittent generation will lead to a rapid transition of their electricity markets.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Where are we now?

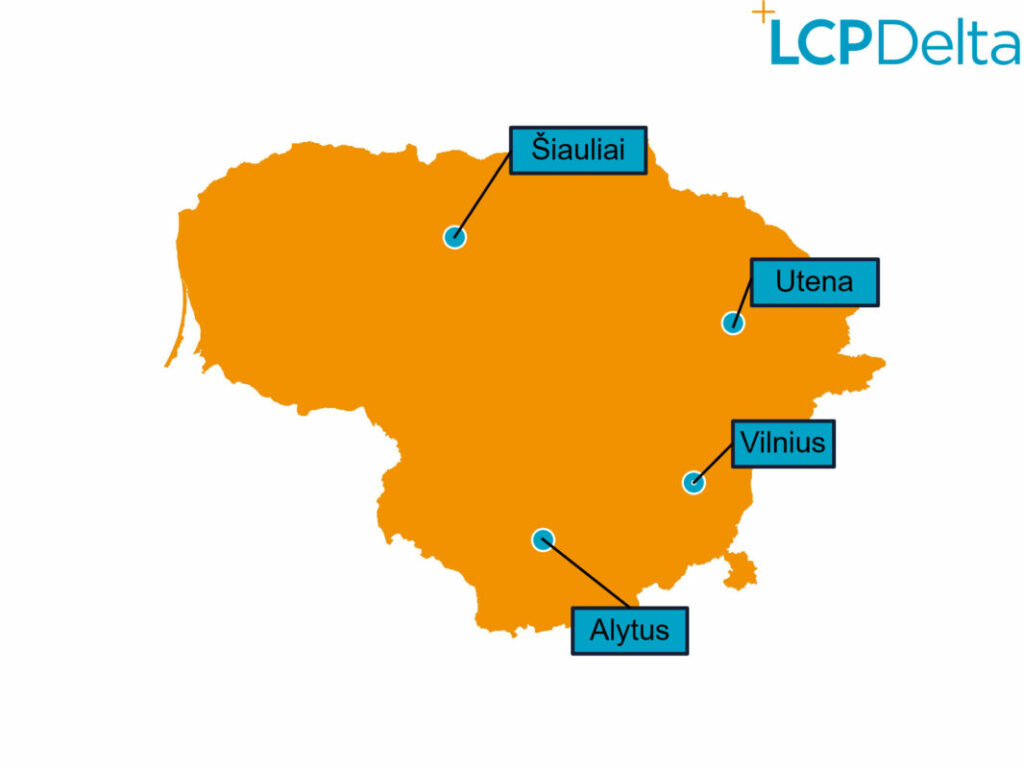

At the end of 2023, Lithuania has the most operational capacity with the energisation of four 50MW installations owned and operated as a single battery park by Energy Cells. Hungary has a small number of installations just above 30MW, while Poland and Romania have little more than 10MW of operating capacity.

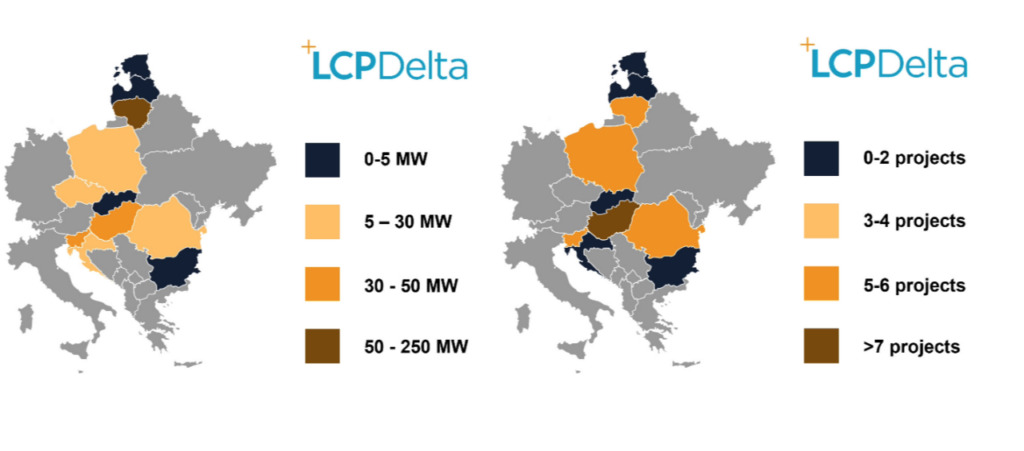

Currently operational Front of the Meter energy storage projects in Eastern Europe (MW capacity and number of projects). Source: LCP Delta STOREtrack.

One of the largest barriers has been the lack of policy development and slow implementation of the Clean Energy Package to open ancillary services to market structures that would drive the development of storage. As a result, current capacity is dominated by pilot projects with strong network operator involvement.

This is particularly highlighted by Lithuania, where the project was driven by the Lithuanian TSO to support the national transmission network. Similarly, financing of these projects is often public (either national or EU level). Energy Cells, the operating company of the Lithuanian projects, is 100% owned by EPSO-G, whose sole shareholder is the Ministry of Energy of the Republic of Lithuania.

Poland has made significant progress this year, with the announcement of major reform to the balancing markets encouraging greater participation of battery storage in the capacity market. Last year’s auction awarded contracts to 4 storage projects with around 150MW of capacity, most of which were awarded to local developer Columbus Energy and Sweden-based developer OX2.

The delivery year for these projects will be 2027. Hype for the upcoming capacity market auction in Poland in December is building with over 16 GWs of storage assets pre-registering for the auction. Total volume and price range will be announced this coming Thursday (14 December), with more detailed results most likely in Early January.

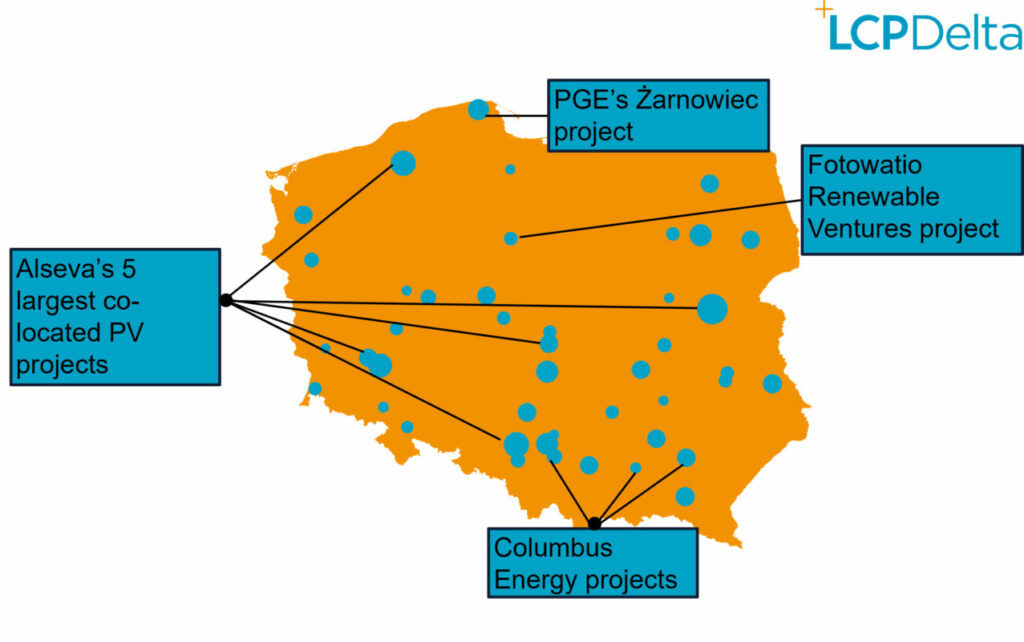

As of October 2023, around 9GW of projects have received grid connection offers from Poland’s Transmission System Operator PSE. Only 6 projects with a total capacity of around 1.5GW, have agreed on the proposed terms with the TSO, with an expected connection date post-2027.

These are mainly standalone projects including the massive Zarnowiec project developed by PGE in Pomerania Province. The list includes 9 projects co-located with PV and storage developed by Alseva and Fotowatio Renewable Ventures.

What will the future bring for other countries in the region?

Other markets in the region are set to kickstart growth with more targeted support for storage through auctions, or grants for specific projects. There are 3 types of support that we see being offered or planned:

- Storage auctions: Hungary is set to have its first storage auction for around 900MWh of new electricity storage by the end of 2026.

- Renewables auctions, with a specific requirement for storage: This is an option currently explored in Bulgaria, to help fund 1.4GW of renewables along with 350MW of storage.

- Specific grants for strategic or pilot projects: For example, some storage projects in Estonia have received funding from the Environmental Investment Centre, an Estonian state-funded financing institution.

In addition, at the EASE Energy Storage Global Conference State Secretary for Energy and Climate Policy Attila Steiner revealed that Hungary is also looking at support for long-duration storage.

Targeted support mechanisms can open the market for battery storage, especially when providing revenue certainty, a common barrier for storage in less open markets. In the longer term, policy makers should focus on opening balancing markets to storage assets, in which owners would be able to monetize their inherent flexibility.

There is often a significant gap between announcing the intention to implement support schemes and their implementation which will delay growth until the latter half of the decade.

Defining a legal framework for storage, identifying funding sources, and getting EU approval for state aid are frequently cited as causes of delays. Romania is currently facing challenges in implementing its €79 million (US$85 million) Recovery and Resilience Plan support for storage. Similarly, the Greek storage auction had a long journey from first announcement to implementation.

Early development in these countries has been dominated by two types of local entities: utilities and renewable energy developers. This is typical in early-stage markets as the local base allows an easier navigation through a potentially challenging development cycle.

As these markets mature, we expect them to attract more interest from international players looking to expand into new markets. These players will likely be on the lookout for mature or construction-ready projects, which will allow them to accelerate their market entry.

The accelerating deployment of renewables to simultaneously reduce the electricity grid’s carbon footprint while reducing dependency on gas creates the drivers for the region’s long-term storage outlook.

Poland will likely lead deployment in the region, with pockets of opportunity to be found across all other countries, but we are still at least a couple of years away from seeing significant capacity coming online.

What is STOREtrack?

STOREtrack is Europe’s leading database of storage projects, helping you keep your finger on the pulse of the European energy storage markets. The database tracks the deployment of storage across 28 countries, detailing the companies involved in each project and their role, as well as project technologies, milestones, segments and technical characteristics.

Delivered through an intuitive web based interface, users can easily interrogate both individual country and aggregate pan European trends, identify key players from role-specific leaderboards, track project evolution, and target business development opportunities.

Click here for more information or here to view the free version.