As the leading US energy storage markets continue their phenomenal growth trajectory, the role batteries can play in keeping the grid stable has been highlighted by recent heatwaves. These are also a good case study for figuring out the value of storage in dollar terms, writes Wayne Muncaster of GridBeyond.

This is an extract of a feature article that originally appeared in Vol.36 of PV Tech Power, Solar Media’s quarterly journal covering the solar and storage industries. Every edition includes ‘Storage & Smart Power’, a dedicated section contributed by the Energy-Storage.news team, and full access to upcoming issues as well as the nine-year back catalogue are included as part of a subscription to Energy-Storage.news Premium.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The recent heatwaves in Texas and California have highlighted the need for optimised market participation for battery storage, while delivering maximum value to clients and the grid. In this article, we will look at the evolution of CAISO (California Independent System Operator) battery dynamics and how these may be predictive for the ERCOT (Electric Reliability Council of Texas) market.

Heatwaves sweep the States

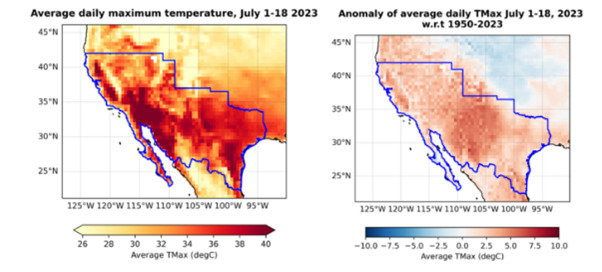

The period of June-July 2023 saw an unprecedented number of maximum load records broken in ERCOT (relative to the prior five years) as a result of the recent heat wave. Previously, ERCOT’s record for hourly demand was 79,830MWh on 20 July, 2022, but, according to the latest data from the US government’s Energy Information Administration (EIA), this record was broken every day from 26 June to 29 June of this year; the highest demand hour for each of those days was more than 80,000MWh.

Continued high temperatures drove new demand records on 12, 13 and 17 July. Those records were all topped on 18 July, when demand peaked at 82,579MWh in the 6:00 p.m. hour, central time (CT). Maximum temperatures were over 100°F in demand centres in Houston, Dallas, and San Antonio for several days during the weeks-long heat wave. To maintain grid security, ERCOT has issued calls to customers to conserve energy, and real-time prices in ERCOT over some periods this summer have soared to around US$5,000/MWh, but to-date the grid has remained reliable.

A similar situation has been seen in CAISO, which has seen high power demand due to the heatwaves. While the 2023 Summer Loads and Resources Assessment notes that the ISO approached the summer of 2023 with a moderate surplus for meeting the 1-in-10 standard, the ISO forecast demand would rise from 42,266MW on 20 July to 43,512MW on 21 July – below the grid’s all-time high of 52,061MW recorded on 6 September 2022.

On 20 July, the ISO declared an emergency alert for about an hour “due to heat conditions and higher than anticipated demand” at around 7:30 p.m. local time. This was later cancelled but over the weeks since, a number of similar alerts have been issued.

Curves, capacities and contingencies

Coal and gas power plants exhibit higher susceptibility to breakdowns in severe weather conditions compared to renewable energy sources and batteries, as demonstrated during the recent events in Texas.

Wind, solar and battery storage have all played a crucial role in meeting the demand during the most recent heatwaves. As these events are expected to become more frequent, there is likely to be a knock-on impact on the power sector of the future.

For Texas, unlike during Winter Storm Uri, the state’s grid has held up under the significant demand peaks, largely due to a shift in the type of resources used in ERCOT in recent years, especially compared with heat waves in previous years.

At the peak hour on 27 June, wind and solar provided about 35% of the power in ERCOT, with gas contributing 44%, coal 14%, and nuclear 6%. Solar power generation peaked at a record of 13,086MW on 25 June, and wind power reached a high of 24,237MW on 28 June. Non-fossil fuel resources contributed as much as 55% of total generation on 28 and 29 June and between 43%-47% in the evening peak load hours of 4:00-8:00 p.m. CT, keeping the share generated by natural gas below 50% of the fuel mix during those hours. In prior periods of high demand, such as in August 2019 and August 2022, non-fossil fuel resources never reached more than 50% of total generation in ERCOT.

Traditionally, the electricity demand curve follows a pattern with spikes in the morning and evening. However, the increasing deployment of solar photovoltaic (PV) panels has caused a shift in this curve. This is demonstrated in California: with more solar capacity coming online CAISO is routinely experiencing a dramatic drop in net load during the midday hours when solar generation is at its peak.

The big beneficiary of the ‘duck curve’ is energy storage. This is largely because batteries contribute other services and benefits to the grid besides energy. Because of their fast response times, they are ideal for providing services such as frequency regulation and flexible ramping product. In addition, batteries can moderate the extremes in daily price swings through arbitrage, by increasing demand for renewables during the very low-priced hours of the day and increasing supply in the evening to bring prices down.

It should be noted that both CAISO and ERCOT have mechanisms in place to ensure sufficient supplies during these peak periods.

In ERCOT forecasts relating to load and renewables have been conservative (overestimating demand, underestimating renewables) to ensure sufficient dispatchable power is scheduled day ahead ensuring the system remains reliable – leading to days with dramatically higher prices in the day ahead market which then don’t materialise in real time.

In addition, in June, ERCOT launched the Contingency Reserve Service (ECRS), a daily procured ancillary service that is the first such service in 20 years to be introduced to the market, which complements the four procured ancillary services ERCOT currently uses: Regulation Up, Regulation Down, Responsive Reserve Service and Non-Spin Reserve Service.

Similarly in CAISO the following types of ancillary services are traded in ISO markets: regulation up, regulation down, spinning reserve and non-spinning reserve.

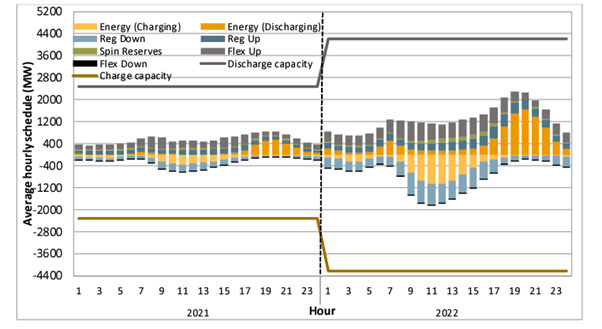

In a report issued 7 July, CAISO said that battery storage capacity grew from about 500MW in 2020 to 5,000MW in May 2023 in its balancing area. This rapid buildout has coincided with a change in battery behavior from primarily providing ancillary services to performing energy arbitrage.

Batteries provide over half of CAISO’s regulation up and regulation down requirements, but the ISO noted that the percentage of total battery storage capacity being scheduled for ancillary services has decreased as batteries have transitioned to providing more energy during the net peak hours.

Similar trends are being seen in ERCOT resulting in some interesting price interactions with the Real Time market.According to a recent publication by S&P Global, Texas accounted for nearly 70% of grid battery additions in the US in the first three quarters of 2023, resulting in a total capacity of 3,300MW.

Changing revenue streams

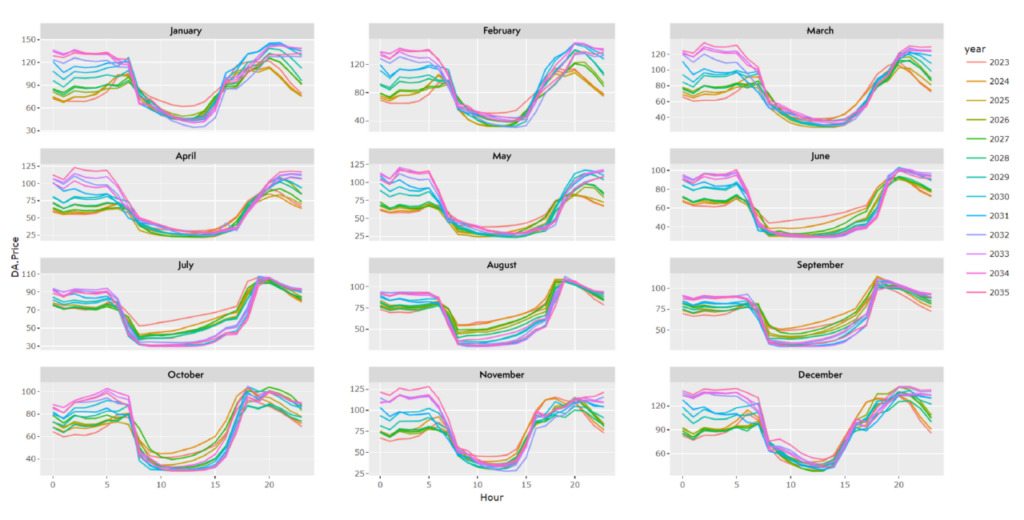

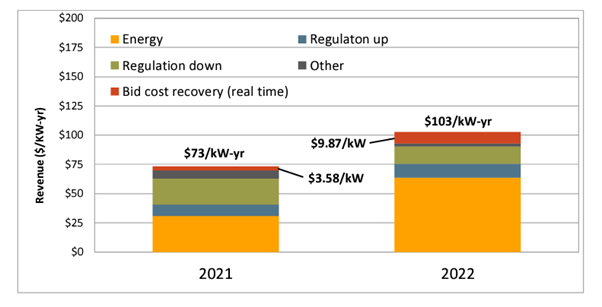

Initially in the CAISO market, batteries favoured providing ancillary services, especially frequency regulation, because it allows them to avoid deep charging and discharging cycles which cause rapid cell degradation. In the last two years, regulation services offered by batteries have increased significantly. But more recently the largest revenue category comes from the day-ahead market.

During the September 2022 heat wave, batteries tended to offer a large portion of both their upward and downward capacity into the market. Batteries provided 2.4% of generation for the CAISO balancing area in hours-ending 17 to 21 from 31 August to 9 September. Net market revenue for batteries during the 10-day 2022 summer heat wave totalled nearly US$78 million, about 20% of all market revenue for batteries in 2022, but this was driven in part by the high energy prices during the period. The percentage difference between average heat wave schedules and average 2022 schedules was significant.

During the 2023 heatwaves we have seen a similar trend. ERCOT has continued to see maximum load records exceeded on an almost weekly basis. Despite this, renewable generation has ensured a relatively stable summer in ERCOT. With the latest demand record set on 31 July, in tandem a new maximum level of storage capacity was delivered to the system, during the evening peak period where while demand remained high and solar generation fell away with the setting sun, storage delivered just over 1GW of energy into the system.

July’s market conditions present a good snapshot of how the market will play out in the future, where the system is heavily reliant on a combination of renewable energy and battery storage, and can cope admirably provided both are there in sufficient levels, but where market volatility can play out in real time as weather driven generation sources ramp up or down intermittently.

As was evident in June and July, the system becomes stressed and prices can rise dramatically (as the market is designed to do) when supply is in danger of not meeting demand. In such cases Real Time market prices reached in excess of US$3,000/MWh. This is where storage can excel and return previously stored excess solar and wind generation to the grid.

To study battery performance, GridBeyond models revenues under stochastic (mainly weather driven) conditions. Analysis shows that storage assets participating in energy and ancillary markets during these extreme load summer months increase income by more than 5x over off-season months.

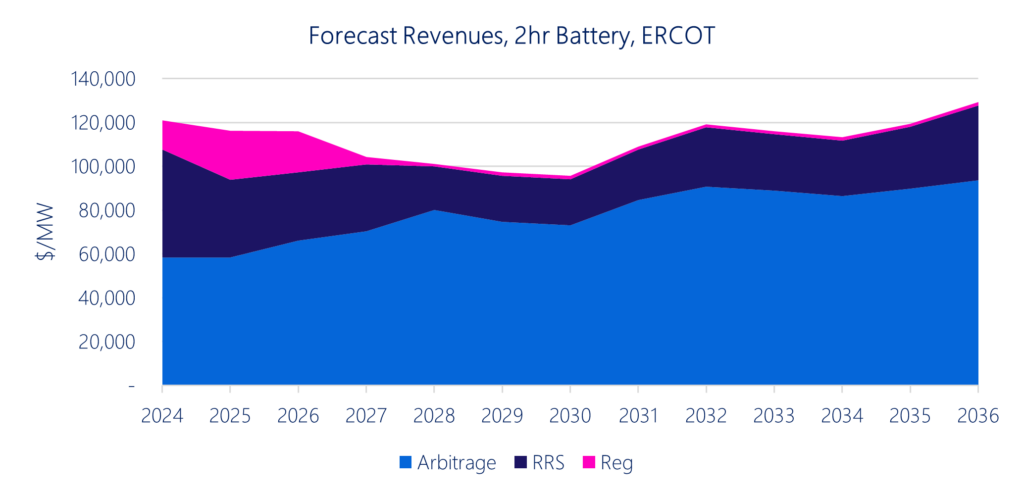

Prices are expected to decline as the markets saturate with increased battery penetration, however in the long-term, revenue from wholesale arbitrage is expected to make up a larger proportion of a battery’s gross margins. Wholesale margins make a small contribution for a 1-hour battery entering the market in 2024 and ancillary services will be the dominant revenue stream supporting the project until wholesale price volatility increases towards the end of the decade. Battery revenues range between US$100-240/kW/year over the forecast horizon as energy arbitrage becomes a larger portion of the total income.

Battery operations can be complex and require a new way of working to participate in volatile and evolving markets. In order to optimise operations, battery operators need to invest in advancing existing capabilities and acquiring new ones. These capabilities expose commercial and operations teams to real-time markets, operations and proprietary data to make trading and operations decisions and to maximise value.

As utility-scale battery development continues in ERCOT, the role storage plays will likely change as it did in CAISO. The integration of large amounts of battery storage poses new challenges and opportunities, as battery technology is fundamentally different from that of more traditional power generators like gas and hydroelectric resources.

This is an extract of a feature article that originally appeared in Vol.36 of PV Tech Power, Solar Media’s quarterly journal covering the solar and storage industries. Every edition includes ‘Storage & Smart Power’, a dedicated section contributed by the Energy-Storage.news team, and full access to upcoming issues as well as the nine-year back catalogue are included as part of a subscription to Energy-Storage.news Premium.

About the Author

Wayne Muncaster is VP North America at GridBeyond, provider of a technology platform for managing distributed and flexible energy resources. With over 20 years’ experience in the energy sector, Wayne has seen the energy landscape change significantly and is ideally placed to provide advice and education on this complex market. Wayne is a regular industry speaker and advocate for enhanced energy services and demand-side response.