Two North American companies, Powin and Li-Cycle, were recently acquired by FlexGen and Glencore, respectively, after announcing bankruptcy.

FlexGen completes Powin acquisition

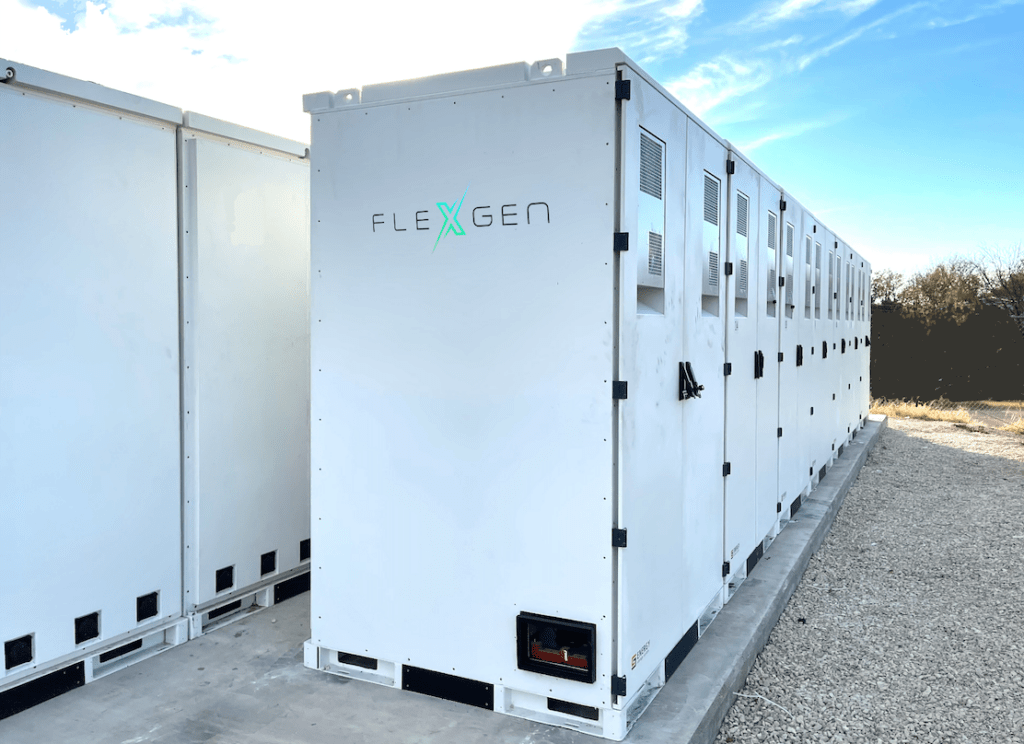

Software-focused energy storage system integrator FlexGen has completed its acquisition of most of the assets and all IP held by bankrupt rival, battery energy storage system (BESS) manufacturer and system integrator Powin.

FleGen says it now supports over 25GWh of BESS across more than 200 sites in 10 countries with software and services. Powin’s website states that the Oregon-headquartered company has put more than 11GWh of projects in the field.

Earlier this year, Powin informed its home state authorities in Oregon of potential layoffs and the cessation of business operations by the end of July, if solutions were not found. The company subsequently filed for Chapter 11 protection in June, while also launching a separate services arm business, Powin Project LLC.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

In July, FlexGen bid to take over Powin during the Chapter 11 bankruptcy proceedings.

On 6 August, the US Bankruptcy Court for the District of New Jersey approved FlexGen’s deal to acquire “a substantial portion of Powin’s businesses,” as FlexGen stated.

It also acquired Powin’s spare parts inventory. Powin’s field projects will be connected to FlexGen’s Remote Operations Centre (ROC) and FlexGen’s energy management system (EMS), HybridOS, will be available to Powin customers.

Kelcy Pegler, CEO of FlexGen, recently spoke to ESN Premium following the approval of the acquisition. Pegler explained the company’s motivation, saying:

“We’re capitalists. So, of course, we think there’s value to be derived from doing this deal, but with that aside, Powin was too important a company for these systems to be left stranded.”

In completing the acquisition of Powin, FleGen is adding former Powin employees to its team and says that existing Powin customers will continue to receive uninterrupted support and can “choose to enhance system uptime and longevity by transitioning to FlexGen’s HybridOS system.”

Notably, when speaking with ESN Premium, Pegler noted that FlexGen will not move into manufacturing.

“FlexGen is going to remain committed to our strategy. We will continue to be hardware agnostic, and we will focus on services and technology. We will continue to turn batteries on and keep batteries on,” Pegler said.

Glencore acquires lithium-ion battery recycling specialist Li-Cycle

Mining giant Glencore has acquired North American lithium-ion battery recycling specialist Li-Cycle.

The sale encompasses Li-Cycle’s Germany, Arizona, Alabama, New York, Ontario Spokes facilities, its Rochester Hub project, and intellectual property portfolio.

Glencore has assumed some of Li-Cycle’s liabilities, and its successful credit bid marks the end of Li-Cycle’s court-approved sale and investment solicitation process.

According to Glencore, the remaining Li-Cycle entities are either being wound-up under their corporate statutes or remain in creditor protection pursuant to the Companies’ Creditors Arrangement Actof Canada (CCAA) and Chapter 15 of the US Bankruptcy Code at this time.

As mentioned, Glencore now owns Li-Cycle’s Rochester Hub project. The company intends to resume construction of the project, which has had a somewhat turbulent path to completion.

Li-Cycle was forced to halt construction on its Rochester hub in 2023 due to ‘escalating construction costs’. The decision came nine months after the company secured a US$375 million conditional loan commitment from the US Department of Energy’s (DOE) Loan Programs Office (LPO) for the facility.

Republican lawmakers raised concerns about the role of Jigar Shah, the LPO director at the time, in the process. In separate letters to the LPO and Shah in November and December, Senator John Barosso highlighted some alleged specifics of his involvement, which he found “extremely concerning.”

At the beginning of 2024, the company secured a loan of US$475 million from the LPO, allowing it to restart construction on the Rochester hub. The announcement on 7 November followed Trump’s election win by two days, and Reuters reported that ‘Biden officials had hurried to finalise the loan ahead of Trump’s return’.

On 1 May 2025, Li-Cycle announced it was looking for buyers. On 14 May, the Canadian bankruptcy court appointed consulting firm Alvarez & Marsal Canada Securities as the Monitor of the business and financial affairs of Li-Cycle.

Shortly after, Glencore entered a ‘stalking horse’ offer for the company. Li-Cycle completed the sale of certain of its subsidiaries and assets on 8 August.