While the renewable energy industry has suffered significant blows such as loss of employment during the COVID-19 crisis, venture capital (VC) funding into the battery energy storage sector in the first quarter of this year nonetheless saw a significant increase over the previous year’s equivalent period.

Corporate funding overall was in fact up 88% year-over-year in Q1 2020 to US$244 million over nine deals, from US$130 million in the first quarter of 2019 from the same number of deals, according to the latest funding and mergers and acquisitions (M&A) report from Mercom Capital Group. The company tallies up and publishes its quarterly report into funding and M&A activities in the battery storage, smart grid and energy efficiency sectors, including VC funds and their investments.

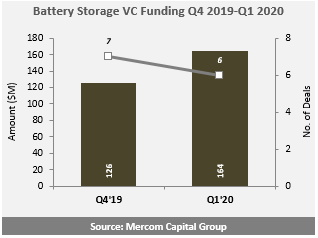

While it shows a big increase since the beginning of last year, momentum has dropped from the previous quarter when a massive US$635 million of funding went into the battery storage sector. That said, VC funding appears to be trending upwards: in Q1 2019, seven VC funding deals totalled US$78 million, in Q4 2019 seven VC deals netted companies in the sector US$126 million, whereas in the Q1 period of 2020, US$164 million was raised across just six deals by battery storage companies.

Energy-Storage.news reported in February that US developer EsVolta had secured a US$140 million credit facility for a project portfolio with industry debt financing specialist CIT the Mandated Lead in arranging it, and Mercom Capital noted that that amount raised made it the most noteworthy project financing transaction to close in the quarter. That said, this site also reported that AES Distributed Energy raised a much larger amount – US$341 million – in a transaction announced at around the same time as EsVolta’s, although the AES Distributed Energy deal was for debt financing.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Mercom Capital also noted that some significant M&A deals were announced in the sector, the most notable being the acquisition of the commercial and industrial (C&I) arm of Canadian developer NRStor by Blackstone Energy Partners.

While the full Mercom report includes more details and provides more depth on the quarter’s activities, a release seen by Energy-Storage.news did rank the top five battery storage sector deals by amount raised. These are as follows:

1. Demand Power Group – a company headquartered in Toronto, Canada, with a background in demand side response (DSR) that now also works in battery storage including uninterruptible power systems (UPS) for C&I customers. The Canadian province of Ontario has been a hotbed of activity for C&I storage for some time, due to its Global Adjustment Charge (GAC) methodology for levying demand charges. Ontario also has invested significantly in grid storage.

- The company raised US$71 million in the quarter from Star America Infrastructure Partners, with which is has formed a strategic partnership.

2. Highview Power – UK-headquartered developer of liquid air energy storage (LAES), which it calls the ‘Cryobattery’, capable of scaling up into very large systems and long durations of storage. The company has recently announced several 50+MWh projects at unnamed locations in the US and UK, as well as a 400MWh project in Vermont, USA, while CEO Javier Cavada has just recently joined the board of the US national Energy Storage Association.

- Highview raised US$46 million from Japan’s Sumitomo Heavy Industries in the quarter.

3. Advano – is among a number of companies seeking to develop advanced anodes for lithium-ion batteries, in this case using silicon rather than graphite which is commonly used at the moment. While still at the startup phase, competitors include Nanograf, a company using an alloy of silicon and graphene to make anodes, which Energy-Storage.news recently covered.

- Advano raised US$19 million in the quarter from investors including Mitsui Kinzoku SBI Investment – a group formed by two Japanese companies, mining and smelting company Mitsui Kinzoku and VC investor SBI Investment – along with controversial tech investor Peter Thiel’s Thiel Capital and VC groups Future Shape, PeopleFund, Data Collective VC (DCVC) and YCombinator.

4. ZincFive – one of a number of companies racing to commercialise battery technologies based on a zinc chemistry, ZincFive claims to have created – and deployed – the world’s first nickel-zinc rechargeable battery technology.

- ZincFive raised US$13 million from 40 North Ventures, the VC spin-off of public equity investment platform 40 North Management.

5. TWAICE – a Germany-headquartered predictive battery analytics company based on creating ‘digital twins’ of physical assets for simulation and modelling, thus promising to gain more efficiency and better optimisation from batteries, currently working in the e-mobility space.

- TWAICE raised US$12 million from Creandum, a European VC company which counts early investment in music streaming platform Spotify among its successes.

Solar Media’s new Digital Summits series has been launched to provide critical market insights, intelligence and networking opportunities to maintain our industries’ momentum. Running throughout May and June, the Digital Summits will deliver the full live event experience to your own home.

Energy Storage Digital Series: 11-15 May. See here for more information on how to take part.