While decreases in costs continue to make energy storage more and more competitive, financial advisory and asset management firm Lazard has highlighted just how variable project economics can be, citing examples of US projects with 9%, 11% and 21% IRR (internal rate of return).

Lazard, which has advised the likes of Enel Green Power, Peabody Energy, Blackrock and Royal Dutch Shell, has just published its third annual Levelised Cost of Storage Analysis (LCOS), which looks at recent and expected technology and project cost declines, the economics for energy storage in various applications and a look at regulatory and policy issues.

The first edition in 2015 found industry participants anticipating costs declines for lithium-ion storage systems of 50% up to 2020, while 2016’s second volume saw the cost of energy storage set to reduce significantly over the next five years driven by economies of scale and improvements in both technology and standardisation.

The latest version finds that the industry is still expecting to enjoy cost declines in the near future, including a prediction that lithium-ion capital costs could fall by 36% in the next five years, driven by increasing demand and scaling up of manufacturing. Many of the declines in battery cell and module technology have already been achieved and cost reduction efforts could be more focused on balance of system (BoS) components and other costs, such as permitting.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

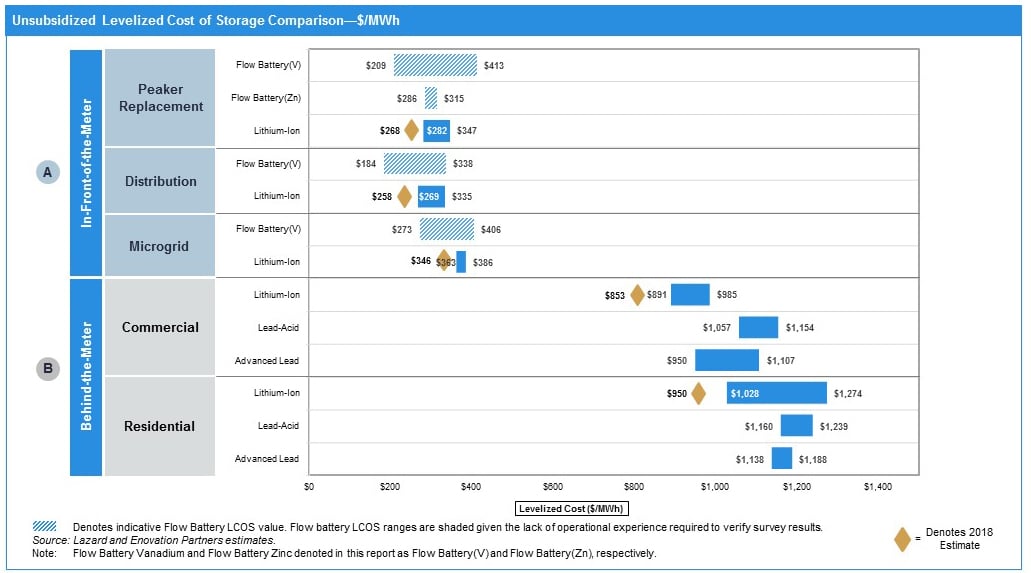

Flow and lead acid batteries will also decline in costs, but less sharply, Lazard predicted. The report also says that several potential sources of revenue are open to energy storage providers, but that the availability of these revenues depends heavily on geographical location, local regulations and markets and the ability to deliver more than one revenue-accruing service at a time.

Longer durations will be a longer time coming

The report also claims that while “specialised power grid uses” are an attractive opportunity for energy storage, no use of energy storage is “yet cost-competitive for the transformational scenarios envisioned by certain ‘Alternative Energy’ advocates”.

On this latter point, what Lazard is saying is that providing baseload power from renewables-plus-storage, and grid defection (customers going totally off-grid and becoming self-sufficient using solar and energy storage), are still some way off from being economical uses of energy storage, in most parts of the world.

As has been seen widely in the industry to date, the trick currently lies in finding projects that assist in strengthening the grid, such as providing frequency regulation and other ancillary services or in deferring spending on transmission and distribution (T&D) infrastructure. Also attractive are demand response programs and opportunities in the commercial and industrial (C&I) sector, based on lowering businesses’ peak demand, particularly in the US, Lazard said.

At the moment, energy storage is most economically viable when providing high power and flexibility to networks, rather than being rewarded for high energy density or energy storage duration. In other words, storing energy for long periods of time with batteries is still expensive enough that grid defection or providing baseload power with solar-plus-storage, for example, is still a way off from being a mainstream application for energy storage, Lazard claimed.

According to Lazard, market and regulatory forces can shape the future market and have done so in the past – one example given being transmission organisation PJM Interconnection, which has a frequency regulation market that rewards the quick response times of batteries over conventional thermal generation assets.

The advisory firm also modelled the potential value propositions for energy storage systems providing multiple, ‘stacked’ applications. Lazard said that “the stand-alone economic viability of an individual energy storage system depends on market structure, incentives and regional power market fundamentals”. It also talks about the different ways energy storage project owners can get paid, from participation in wholesale markets, to integrated utility deals, to income from customers and aggregated behind-the-meter systems.

In terms of the variability of project economics, Lazard cited the example of California’s C&I market, where demand management savings and local capacity requirements (LCR) can combine to give projects an 11% IRR, a demand management project in Brooklyn-Queens, New York, to save utility Con Edison from significant T&D spending which has an IRR of 21% and a peaker plant replacement project, also in California, with “a potentiall viable illustrative IRR” of 9%. Microgrid and residential projects looked at, however, offered “limited” returns, Lazard said, due to the relatively high installed costs of systems.

The full LCOS document and Lazard’s latest Levelised Cost of Energy (LCOE) report are available from the Lazard’s website.