It has been the US’ busiest quarter to date for behind-the-meter energy storage installations, driven in part by residential adoption in the advanced markets of California and Hawaii, GTM Research has found.

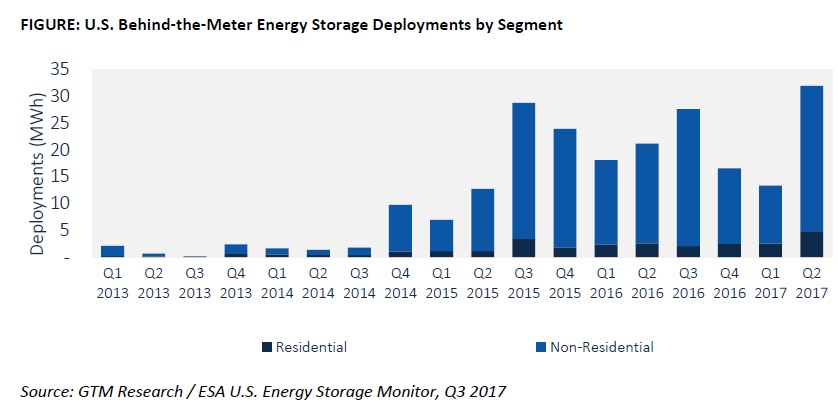

During Q2 2017, a total of 443 behind-the-meter systems, including residential and commercial market segments, were deployed. This equated to 32MWh of capacity, 27.3MWh of which was non-residential, leaving 4.7MWh to the household market. This meant a 151% increase in non-residential deployments and 89% growth in residential over Q1 2017.

The findings come from the latest US Energy Storage Monitor, the quarterly report produced by GTM in partnership with the Energy Storage Association, covering activity in Q2 2017. GTM said that in the quarter, 50.4MWh of energy storage was deployed at all scales. When looked at in comparison with the previous two quarters, this looks quite small – in Q1 2017 a massive 233.7MWh was installed and 230MWh the quarter before that. In megawatt terms, there was also a decrease, although less marked – 38MW was deployed across all scales in Q2, as opposed to 71.1MW in Q1.

However, as GTM analyst and report co-author Ravi Manghani pointed out when Q1’s Monitor was published, those quarters’ figures were dramatically skewed by the development of several multi-megawatt, long duration projects, not least of all in California, where over 100MWh of energy storage projects were expedited to meet capacity shortfall fears in the wake of the Aliso Canyon gas leak.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Behind-the-meter enjoys growth spurt

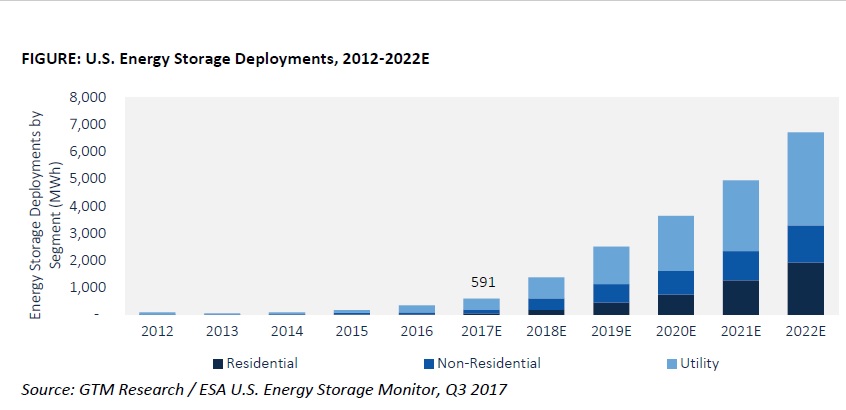

Behind-the-meter actually took its share of the overall total from just 9% in Q1 2017 to 42% in the quarter just gone. While it was 19% of the overall 2016 market, GTM expects it to hold around 26% this year and then double to 52% within five years, in 2022.

By then, the market will be worth US$3.1 billion in the US, GTM predicts, with revenues expected to grow by 43% in this year alone compared to 2016. In five years, GTM says, residential alone could be worth US$1.2 billion, while the utility segment, worth US$252 million in 2016, will be worth US$1.3 billion. Overall deployments in that year could hit 2.5GW, according to the report.

California and Hawaii’s residential and commercial markets have driven on activity in that behind-the-meter segment. GTM analyst and report co-author Brett Simon said that California’s Self-Generation Incentive Program (SGIP) had in particular been a big booster, giving customers financial incentives to install low carbon technologies including energy storage and solar PV.

“California held the lead in behind-the-meter deployments as the Self-Generation Incentive Program (SGIP) queue continues to clear. Toward the end of this year, we expect to see more SGIP-related deployment activity as the first deployments from the modified program, which opened in May, start to be interconnected,” Brett Simon said.

“Furthermore, we expect to see greater growth from California’s residential segment in the next few years given the residential carve-out under the latest version of SGIP and changes to TOU (time-of-use) rates for solar customers.”

Similarly, Hawaii’s Customer Self-Supply Program, which allows expedited permitting and other support for customers who generate PV power and use all of it onsite rather than exporting to Hawaii’s often solar-saturated grid, spurred some action. As much as 71% of all Q2 2017 deployments in the state came from that scheme.

GTM found that 11 US states are enacting policies to support growth in behind-the-meter energy storage, including New York, Nevada, California, Arizona, Connecticut, Maryland, New Jersey and Massachusetts.

The research company is expecting 591MWh of energy storage deployed at all scales in the US for the whole year.

Lithium’s lead still big but competition grows

This was actually the first quarter since 2015 in which lithium-ion battery-based systems’ lead dipped below 95% of all installations. In Q2 2017, 94.2% of all energy storage systems installed used lithium batteries, with around 5% of the market taken by flow batteries (2MW) and a further 0.5% by lead acid batteries. Nonetheless, Li-Ion remains dominant. In a recent interview with Julian Jansen, an analyst at rival firm IHS Markit, Jansen said that even with a trend towards longer duration energy storage projects at large-scale, cost reductions and the mainstream availability of lithium batteries meant the technology is expected to retain that lead for some time.

US leads Europe for investment dollars

GTM also looked at the activities of investors in the market, specifically those from the US and Europe last year, finding that US-based investors pumped a massive US$275 million into the sector during 2016, compared to US$94 million flowing in from European backers. The average deal size appears much larger from the US side – the biggest single deal there was US$200 million raised by Advanced Microgrid Solutions from CIT Bank, a company which has carried on raising funds in 2017 including a recent US$34 million Series B funding round. By contrast, eCapital’s investment in German company Sonnen was the biggest European investment, at US$85 million.