Italy’s transmission system operator Terna has awarded five-year contracts for battery energy storage systems (BESS) to provide Fast Reserve grid services in an oversubscribed pilot auction.

After Terna rolled out its plans for the pilot towards the beginning of this year, the Italian regulator approved the auction and the first one was held last week. Terna said the process was participated in by bidders offering six times the amount of capacity being tendered for. The pilot had launched with an expectation that around 230MW would be on offer, Terna received 1,327MW worth of bids, and eventually awarded contracts for 249.9MW.

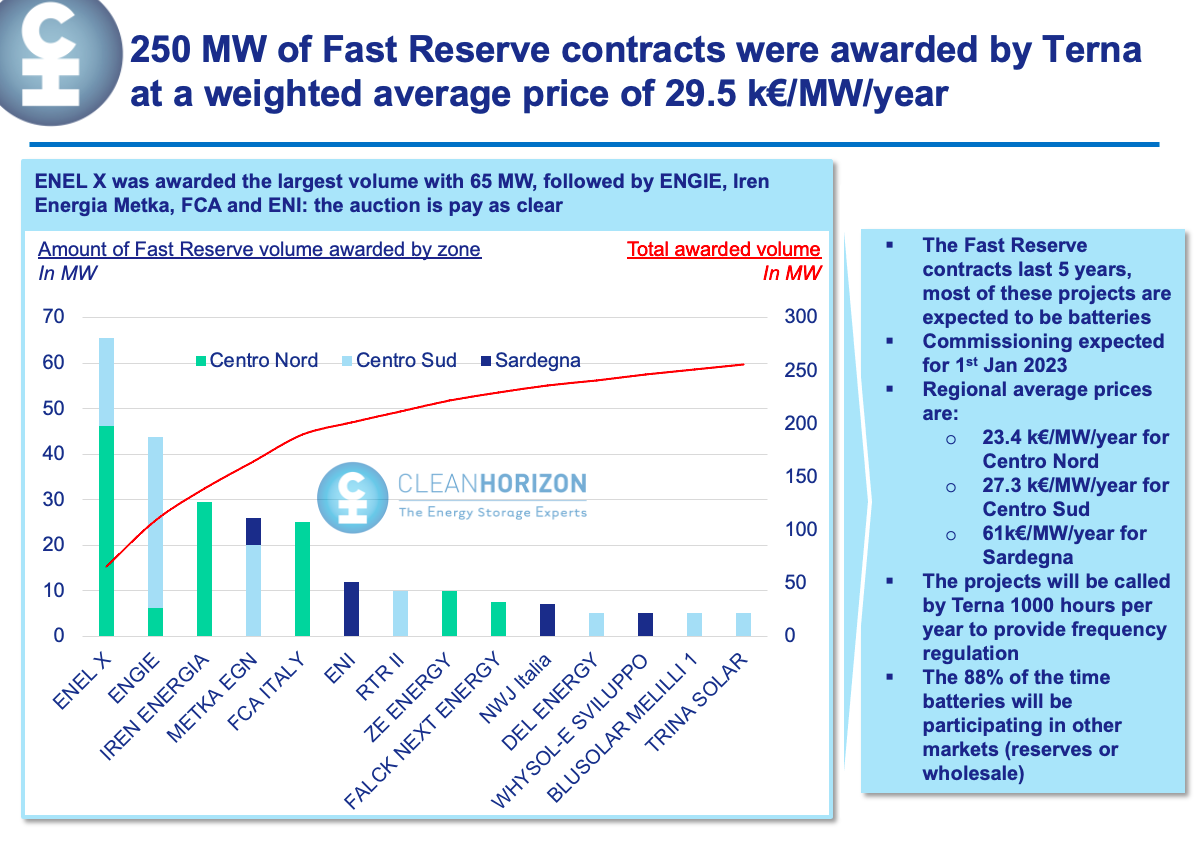

The system operator said it assigned 118.2MW in Central and Northern regions of Italy, with a weighted price of around €23,500 (US$28,530) / MW / year, 101.7MW in the Centre-South region at around €27,300 / MW / year and 30MW in Sardinia, at a weighted average price of €61,000 / MW / year. In total, 17 different entities had winning bids, for 23 units to participate.

Terna’s head of grid development and dispatching strategies, Francesco Del Pizzo said that the awarded prices were equal to about one-third of the reserve price. This, he said, confirms the “strategic nature” of electrochemical energy storage technologies i.e. batteries, as well as the “great interest” the energy market had shown in the “innovative” project. Expected pricing had been benchmarked at around €78k per MW and €108k per MW.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Fast Reserve is a bi-directional service where power either comes onto the grid or is drawn from it to help balance the supply and demand of electricity. It is a form of frequency regulation or frequency response, helping to maintain the network’s stable operation within the boundaries of its operating frequency limits.

Fast Reserve services need to kick in and respond continuously to grid signals that an error needs to be corrected with one second of receiving them. It works alongside other existing frequency regulation services such as primary reserve and the requirement to respond rapidly makes batteries well suited to provide it. Terna described Fast Reserve as an “ultra-rapid frequency reserve”.

The auction aims to help the transmission system better cope with the growing addition of shares of renewable energy, as the need for frequency regulation increases as the amount of variable wind and solar does, while also replacing the role of traditional fossil fuel plants in supplying that frequency regulation. Italy’s national climate plan, National Energy and Climate Plan (NECP), aims to support 40GW of renewable energy capacity on Italy’s networks by 2030, around 55% of energy demand.

Systems to provide 1,000 hours of service per year while netting revenues from other stacked resources

Consultancy Clean Horizon contacted Energy-Storage.news to offer its take and breakdown of the results. Head analyst Corentin Baschet said the weighted average price was €29,500 (US$35,814) / MW / year across the three tranches of awards and most of the awarded projects are expected to be batteries.

Baschet said the Fast Reserve service is similar to Enhanced Frequency Response (EFR), which is used for similar purposes on the UK’s transmission network. A 2016 auction for EFR kicked off the UK’s large-scale battery energy storage market, offering investors and asset owners some investment certainty through fixed contracts. On a related note, the grid operator for the province of Alberta, Canada, has recently also said it is beginning a pilot of auctions for fast response grid services, which was warmly welcomed by trade group Energy Storage Canada as a “step in the right direction’.

Clean Horizon pointed out in its analysis that commissioning of projects is expected to take place before the beginning of 2023, and that projects will be called on by Terna to provide the Fast Reserve frequency regulation for 1,000 hours per year from 2023-2027. Meanwhile, the batteries will be operating for the majority of the year (88% of the time) in other available market opportunities such as reserves or wholesale markets. Terna has already opened up a number of other avenues for energy storage to provide services or capacity to the grid.

The auction’s biggest winners appear to be Enel X and ENGIE, with around 65MW and 70MW of awards respectively. ENGIE’s energy storage subsidiary ENGIE EPS said that 50MW of its Fast Reserve assets will be supplied from stationary energy storage system sites of ENGIE Italia. These battery systems, which are designed to be able to respond in under 200 milliseconds, are integrate with a gas power plant, with a wind farm and on an industrial brownfield site.

ENGIE EPS also said that the remaining 25MW will come from its recently-launched vehicle-to-grid (V2G) project at a logistics hub in Turin. The company claimed this to be a world first “large-scale industrial application of V2G integrated with second-life batteries,” using around 700 Fiat 500 EV batteries.

Our publisher Solar Media is hosting the annual Energy Storage Summit once again in 2021, from 23-24 February and from 3-4 March in an exciting new format. See the website for more details.