Future battery energy storage projects in the UK have been hit with a major blow after the government published its intention to lower the de-rating factor in Capacity Market auctions by almost 80% for 30 minute duration batteries.

The ruling comes just days after prequalification results were published for the upcoming T-1 2018/19 and T-4 2021/22 auctions, now known to be the first auctions to be affected by the new mechanism rules. The Capacity Market is the mechanism by which generators are paid to ensure there is enough power on the network to provide reliable electricity supplies, especially during the winter months in the UK.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

In July the government Department of Business, Energy and Industrial Strategy (BEIS) bowed to pressure from participants using other technologies, who claimed that batteries participating in the CM had the potential to pose a risk to security of supply owing to the short duration facilities used to bid into auctions.

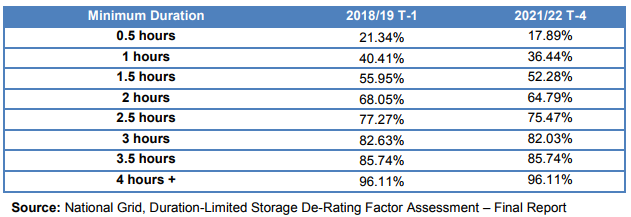

BEIS has now confirmed plans to lower the previously set 96% de-rating factor to as low as 17.89% in the T-4 auctions for half hour duration batteries, with 21.34% set for the T-1. These increase in half hour increments, with only batteries with four hours duration or more qualifying for 96.11% de-rating.

“We are satisfied that it is robust and represents the best basis upon which to de-rate storage in the upcoming auctions,” BEIS’ consultation response states.

While many storage developers considered these changes may prove to be a logical move for the CM, a number who have spoken to Clean Energy News since July’s consultation expected the changes to be phased in gradually.

However, the government has confirmed that it will introduce the changes ahead of January and February’s auctions, which could have severe consequences for the business cases of those projects which were able to secure pre-qualification.

The consultation acknowledges concerns that the proposals have adverse effects on the business case for storage projects, particularly batteries, while appearing to be contrary to the government’s position on storage as set out in its ‘Smart Systems and Flexibility Plan’.

Also addressing worries that the plans would be brought forward ahead of the upcoming auctions, the consultation merely states: “The government has carefully considered these points, but does not share the underlying concerns.”

It claims that after calculating that the mean stress event duration in the UK is around two hours, with some events lasting much longer, the auctions would have secured insufficient capacity to meet the CM’s reliability standard under the previous de-rating regime.

“In relation to the T-4 auction, any shortfall in capacity would need to be re-procured in future CM auctions which would lead to an increase in costs to consumers. In relation to the T-1 auction, there would be no opportunity to replace any shortfall in capacity,” it states.

To remain under these circumstances could, the government contends, create a total additional cost to consumers of between £50 million (US$67.56 million) to £500 million over 15 years, with a central estimate of around £200 million.

With amendments to the CM Rules being laid in Parliament shortly, it is unclear how the sector will respond to the new de-rating factors being introduced, or how they will affect the ~7GW of battery projects which won pre-qualification across the T-1 (2.1GW) AND T-4 (4.8GW) auctions.