In the leafy suburbs of Melbourne, Australia, energy-transition evangelist Gavin Mooney is making powerful additions to his home. Like 4.2 million other Australian households, Mooney relies on a relatively-large rooftop solar array to power his home; his system, rated at 9.5 kW, covers most of his daytime electricity needs. For transportation, he drives a Tesla Model X. And in October 2025, he installed a piece of technology that could fundamentally change the way he generates and consumes energy.

To make the most out of his solar generation, Mooney has coupled his rooftop PV array with a 32 kWh battery. He initially considered a smaller 16 kWh system, but ultimately chose to “go big” to further reduce his electricity bills. With electricity prices in Australia sitting slightly above the OECD average at AUD0.39 per kWh, the potential savings from generating and storing his own power are significant.

Photo: Gavin Mooney/LinkedIn

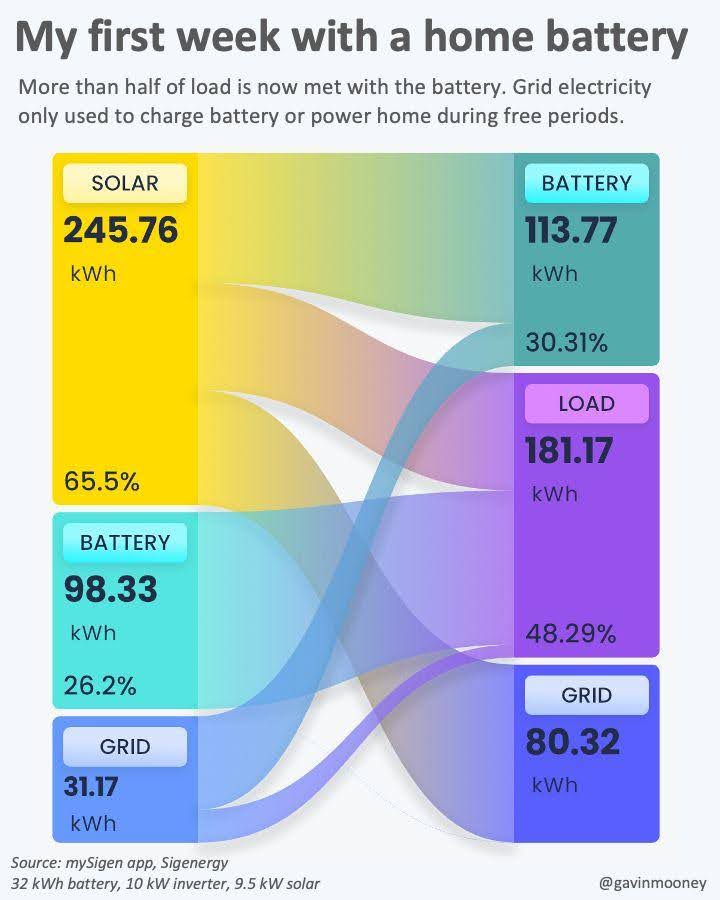

Mooney chose a SigenStor system, attracted to the sense that Sigenergy is a young, innovative company “shaking up the market,” as he puts it. “Their app has this really cool Sankey chart that I really enjoy looking at,” Mooney adds. His purchase comes at a time when Australia is seeing unprecedented growth in residential battery storage, with more than 1,000 installations per day nationwide since July, when the Cheaper Home Batteries subsidy program came into effect.

The battery is installed in Mooney’s garage, storing solar energy generated during the day and supplying it to the household during the evening and morning hours. It also discharges into his EV, substantially reducing both the family’s running costs and their transportation-related carbon emissions.

Beyond benefiting Mooney’s household, the combination of home battery and EV is likely to play a new and valuable role in supporting the broader electricity network: providing backup power, discharging during hours of peak demand, and absorbing abundant daytime solar generation. This last function is becoming increasingly important as residential PV output in Australia frequently drives grid demand close to zero during spring and autumn.

The ability to tap the battery inside an EV for more than mobility is one of the most promising developments in the energy transition. “I think it’ll be fundamental to the energy transition,” Mooney says. “At some point in the future, EVs will be the default vehicle. There’s just going to be so much storage out there that it cannot fail to have a huge impact on the grid.”

The term bidirectional charging captures this capability. In a vehicle-to-home (V2H) setup, an EV’s battery discharges electricity to power a household. In a vehicle-to-grid (V2G) configuration, it can also export energy back into the wider electricity network. And the potential applications are vast.

To meet drivers’ needs, EVs come equipped with large lithium-ion batteries, typically 40–60 kWh for a standard sedan. And fully-electric car uptake is accelerating. Global EV sales are expected to reach 22 million in 2025, representing a 24% market share – according to EV Volumes. This growing fleet of “batteries on wheels” represents a huge, largely untapped resource for powering homes with clean solar energy and helping to stabilize the grid.

The concept seems obvious: if the batteries already exist, why not use them more fully? But enabling V2G and V2H requires specific technologies and regulations. Chargers must support bidirectional power flow, and the vehicle must include communication protocols that allow external control – usually managed via an onboard hybrid inverter.

To evaluate the real-world benefits of bidirectional charging, several promising trials have been launched in regions with high solar penetration. In the Nordics, the city of Hudiksvall, Sweden – approximately 300 km north of Stockholm – is hosting a pilot with Volkswagen and the utility Vattenfall. The trial will deploy 200 Volkswagen ID vehicles paired with an equal number of bidirectional chargers. Both private households and commercial customers are participating, and proponents plan to scale up quickly if the results are encouraging.

In July, another major initiative, the “Utrecht Energized” project, was launched in the Netherlands. It includes 50 Renault 5 E-Tech EVs and 50 bidirectional chargers, with the vehicles joining the fleet of ride-sharing provider MyWheels. According to the European Commission, Utrecht is an ideal testbed: roughly 35% of the city’s rooftops already host solar PV installations.

Photo: European Commission

The early results are extremely encouraging. In the first five months, grid operator Stedin reported that evening peak demand fell by 300 kW, driven by MyWheels’ cars discharging around 18:00 each day. Project partners note that the EVs collectively supplied more than 65,000 kWh during this period – an average of 1,300 kWh per car, or 118 hours of discharge per vehicle.

Buoyed by these outcomes, the program will expand its fleet to 170 EVs, with the goal of cutting evening peak demand by 1 MW. A further expansion to 500 vehicles is planned for 2026.

The potential of V2G also extends well beyond urban centers. In the remote north-west Australian town of Exmouth, the regional utility Western Power conducted a trial in which a group of customers were provided with Nissan Leafs at no cost – to trial the impact they can have in V2G operation.

The project used a Distributed Energy Resource Management System (DERMS) platform to monitor and control EV charging and discharging, rooftop solar, and home batteries. Developed and tested by Horizon Power, DERMS was designed to help the utility manage rising levels of distributed solar and storage, and now EVs across the utility’s customer base.

The trial’s goal was to operate the EVs as grid assets without inconveniencing owners – and on that front, Horizon Power considers it a success.

“The trial’s been a great validation of what is a far more strategic plan for us looking into the future as we start to see EVs become more prevalent, especially in the small systems that we manage across the state,” said Ray Achemedei, executive general manager of technology and digital transformation at Horizon Power, in an interview with the Australian Broadcasting Corporation. Participants also responded positively, noting that the experience had changed their perception of EVs in remote regions where charging stations can be scarce.

Independent analyses are also highlighting the significant impact bidirectional charging could have. A 2024 Siemens study found that private and commercial EVs in Munich could together provide 200 MW of capacity toward the city’s summer peak demand of 1,000 MW. By doing so, the intelligently-operated EVs could help displace gas-peaker plants, reduce electricity costs, increase demand-side flexibility, lower climate emissions, and minimize renewable curtailment.

A pan-European study by EY, published in 2025, projects even larger benefits. By 2030, EVs across Europe could supply 4% of the continent’s annual electricity needs, equating to 114 TWh – enough to power 30 million homes. By 2040, that contribution could rise to 10%.

For consumers, EY identifies substantial financial advantages. By avoiding peak tariffs and supplying surplus energy to the home or grid, owners of compact EVs in the UK could reduce total ownership costs by up to 19% (€1,230 per year). In Germany, Sweden and Spain, savings of up to 14% are possible.

Larger family cars could realize yearly savings of 15% (€1,200) in France, rising to 23% (€1,800) in Germany. For SUVs, the benefits are even greater: UK drivers could save as much as 26% annually, while drivers in Germany could achieve savings of 29% (€3,000).

Individual households are beginning to see the tangible benefits of V2H. In the historic Bavarian town of Rothenburg ob der Tauber, one solar installer has put the concept into practice – and the results speak for themselves.

Oliver Hille of Baumann Solartechnik is a well-established solar professional. His company has been installing rooftop PV systems since 2011, serving residential, small industrial and agricultural clients. In 2025, Hille decided to test the effectiveness of V2H in his own home, and the outcome has been remarkable.

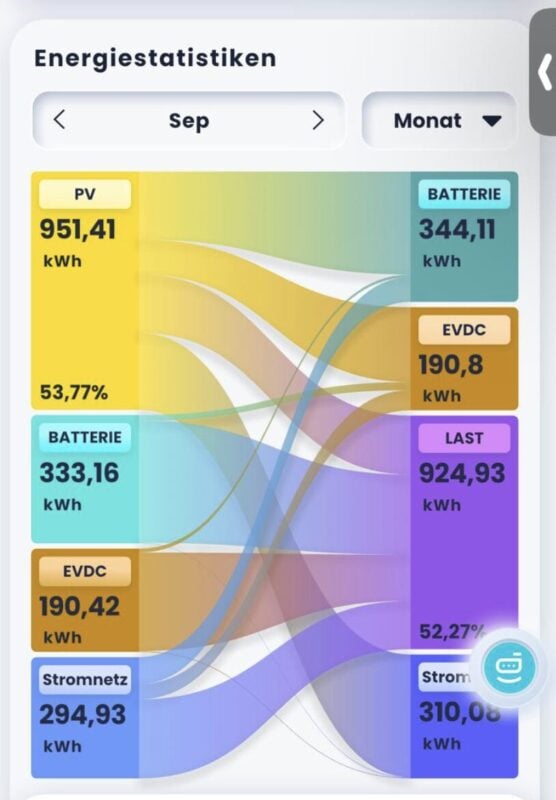

Hille retrofitted a 25 kW EV DC charger to work alongside his existing SigenStor home battery. Today, more than half of his household electricity needs are met through a combination of rooftop solar, the SigenStor battery, and discharging his Kia EV6 via the DC charger. Nearly 54% of his solar generation is now consumed on-site – either powering the home directly or charging the EV and battery.

“You can see how Oliver charged 190 kWh into the car and discharged it back to the house. And it’s a big number,” says Sven Albersmeier-Braun, VP Sales Central Europe for Sigenergy. Albersmeier-Braun introduced both the SigenStor system and the EV-DC charging solution to Hille, and has seen first-hand how these technologies are benefiting not only Hille’s household but also his customers in southern Germany.

“For me this is the next big thing. In Germany, the legislation is now in place, e-mobility is coming, dynamic tariffs are becoming more common, and for people who are interested in solar, they think more about EVs, and they will make use of them – because the EV has such a big battery,” says Albersmeier-Braun.

A major turning point came in November 2025, when the German Parliament ended the de-facto double taxation of V2G applications. Previously, electricity charged into a vehicle and later discharged back to the grid was taxed and subject to grid fees in both directions. Under the new rules, EVs participating in V2G are treated the same as stationary batteries.

“Double taxation is super significant as it is at least €0.20/kWh and then €0.40/kWh if you charge and discharge,” notes Albersmeier-Braun.

Despite recent progress in Germany, significant regulatory hurdles still stand in the way of the widespread adoption of bidirectional charging. These challenges vary widely between countries, creating a complex landscape for equipment suppliers to navigate. Potential barriers include electricity market rules, technical requirements for V2G-capable chargers and vehicles, tariff and tax structures, and grid code compliance for V2G operations.

While the regulatory landscape is complex, targeted reforms can unlock progress – as demonstrated by Germany’s removal of “double taxation.” Yet regulatory clarity alone is not enough. For mass adoption to take hold, consumers must also be convinced that bidirectional charging offers a clear and hassle-free financial benefit.

“There is still some uncertainty and that’s really around things like business models for V2G, battery aging and warranties,” says Gautham Ram, an associate professor at Delft University of Technology and EV-charging expert. “These can either completely kill this sudden mass-deployment phase, but also can facilitate it.”

Rau adds that how vehicle owners interact with V2G or V2H functionality will play a decisive role. “The whole user part becomes very important – the user experience, interoperability and seamlessness.”

When it comes to battery aging and warranties, EV manufacturers are in the driver’s seat. A common concern is that frequent cycling of an EV battery for bidirectional charging will accelerate degradation – potentially leaving owners without warranty coverage. Some automakers have begun addressing this uncertainty. Volkswagen, for example, has introduced explicit V2G provisions in its warranty terms.

In 2025, Volkswagen specified that each model in the VW ID range includes an approved amount of bidirectional energy throughput. For a vehicle with a 77 kWh battery, up to 10,000 kWh of V2G or V2H discharge is permitted. However, this equates to only around 150 full cycles over the vehicle’s lifetime – a relatively limited allowance.

Warranties are not the only area where automakers appear cautious. While the ISO 15118-20 standard for vehicle-to-charger communication is becoming increasingly important for bidirectional charging, some EV makers have been slow to adopt it, and others are developing proprietary protocols that limit interoperability. These decisions signal that many carmakers still prioritize the driving experience over the vehicle’s role as a stationary energy asset.

In this context, DC charging offers clear advantages. Because DC systems do not require enhanced on-board chargers, automakers can avoid adding complex power electronics to the vehicle itself. Paired with the inherently faster charging and discharging rates of DC infrastructure, this lowers technical barriers for V2G adoption.

Photo: Provided

Not everyone sees warranties as a major roadblock. Veteran clean-technology investor and analyst Gerard Reid argues that battery management systems (BMS) can be programmed to minimize degradation risks – for example, by limiting charge and discharge to 80%.

“We’ve got a huge amount of knowledge in and around what to do and not to do with batteries and all to do with BMS,” says Reid. “And that’s the difference from a few years ago. I’ve been looking at V2G for a decade and, obviously, it’s been incredibly slow to get to market. But car makers are looking at what services they can offer on top of just selling a car and that’s the game changer.”

Reid adds that policy momentum is finally aligning: “You now have a regulatory environment that supports, plus you have the hardware. These are very exciting times.”