India’s ambitious drive for renewable energy has accelerated the need for energy storage, but there are many factors to success, writes Charith Konda of the Institute for Energy Economics and Financial Analysis (IEEFA).

Driven by ambitious 2030 renewable energy targets (500GW non-fossil capacity) and growing grid stability needs for variable solar/wind, India is rapidly tendering renewable energy (RE) + storage capacities.

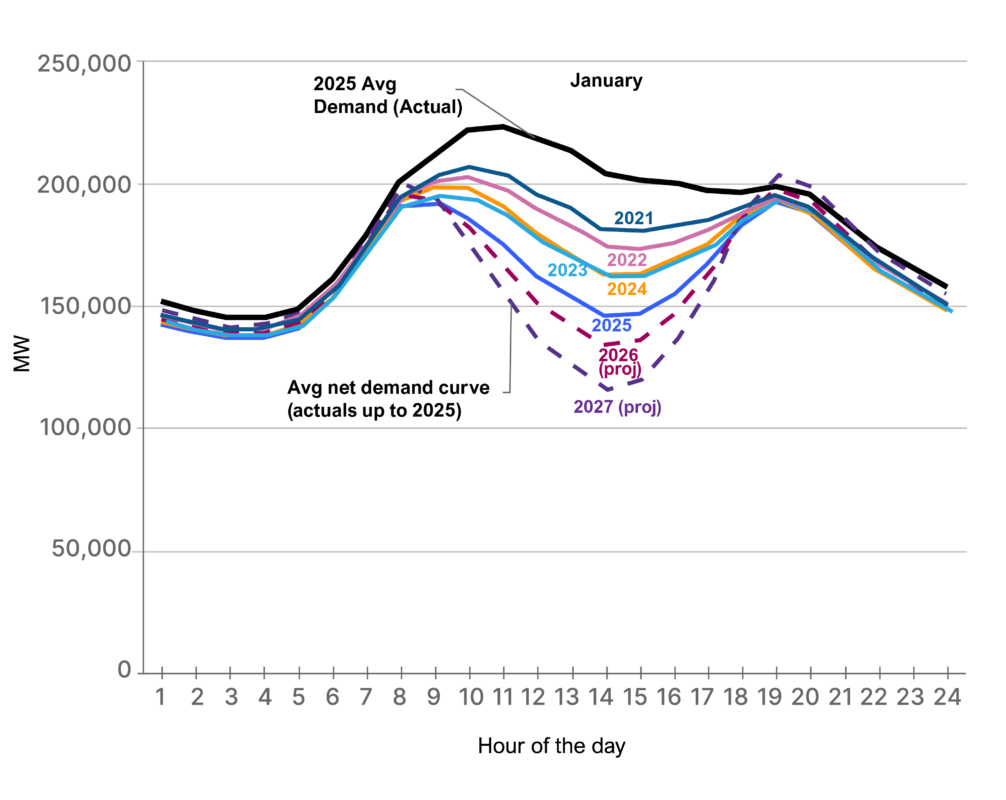

The Central Electricity Authority estimates that 411.4Gigawatt-hour (GWh) energy storage will be needed by 2031-32 – 236.2GWh from battery energy storage systems (BESS) and 175.2GWh from pumped hydro storage plants. The increasing supply of solar power during the day and the sharp drop in the evening, even as electricity demand holds steady, underscores the need for storage systems.

This phenomenon is explained through the “duck curve” in Figure 1. The curve shows how midday peak solar generation significantly reduces net electricity demand (total demand minus solar power generation) and can drive market prices to near zero.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Conversely, as solar tapers off in the evening, the electricity demand to be met from non-solar sources rises steeply. As solar capacity grows, this phenomenon becomes more pronounced (shown by the increasing depth of the curve), highlighting the need for energy storage.

The Government of India is supporting the growth of energy storage capacities with a combination of policies and incentives. On the supply-side, to lower the cost of stored power, the government has introduced a IR91 billion (US$1.09 billion) viability gap funding (VGF) support for 43.2GWh of BESS capacity, a waiver of inter-state transmission charges for BESS projects (co-located with RE plants) commissioned on or before 30 June 2028, and a Production-Linked Incentive (PLI) programme to support the manufacturing of 50GWh Advanced Chemistry Cell (ACC) batteries with a budgeted outlay of IR181 billion.

In addition, the government has issued an advisory to co-locate a minimum of two-hour battery storage with solar projects and also stipulated an energy storage obligation, applicable to entities like distribution utilities, that will gradually increase from 1% in 2023-24 to 4% by 2029-30.

The government has also increased hybrid (solar + storage/solar + wind + storage) tenders. With a rise in preference for firm renewable energy, the share of hybrid tendered capacity has increased from about 12% in 2021 to over 49% in 2024 in the overall renewable energy tenders.

Rapidly evolving contracts and technologies bring new challenges

Regardless of positive developments on the policy and tenders front, the energy storage sector is facing the following challenges:

Aggressive bidding in auctions: Since 2022, India has auctioned approximately 12.8GWh of BESS capacity, with 9GWh offered in 2025 alone by May, for both hybrid and standalone applications. While capacity tenders are rising, financial institutions and developers are concerned about underbidding with prices of BESS dropping significantly in recent auctions.

For example, prices fell 22.3% from the TERI 20MW Delhi auction in September 2023 to Rs372,978 (US$4,362)/MW/month in the GUVNL Phase 3 250MW auction in March 2024. They further decreased by 41.3% to Rs219,001 (US$2,561)/MW/month in the Rajasthan 500MW auction in November 2024, supported by VGF and expected declines in battery costs.

While a combination of factors, including government incentives and falling battery prices (40% drop in turnkey BESS costs in 2024 from 2023), may be driving down bid prices, a large under-construction pipeline of projects (only 219MWh commissioned so far) is leading to rising concerns over underbidding in the auctions.

Underbidding could result from expectations of an unrealistic fall in battery prices and participation from inexperienced players in the auctions. Aggressive underbidding can jeopardise the successful commissioning of projects.

Delays in PPA signing: BESS projects are typically given 18-24 months for commissioning, from the signing of the power purchase agreement (PPA). However, the signing of the PPA with a distribution utility (offtaker) often gets delayed as they expect further price reductions in a rapidly evolving competitive market. In addition, the complex nature of hybrid project contracts, such as Firm and Dispatchable Renewable Energy (FDRE) contracts, is causing further delays.

In January 2025, the Central Electricity Regulatory Commission cancelled Solar Energy Corporation of India’s 500MW/1,000MWh standalone BESS tender due to significant delays in signing the project agreements. According to an industry estimate, around 40-55GW of renewable energy capacity (both vanilla as well as hybrid) are facing delays in securing PPAs.

Grid connection delays: India’s renewable energy growth is outpacing its transmission infrastructure, leading to curtailments and underutilised capacity, especially in renewable-rich states. The lack of evacuation infrastructure also delays the commissioning of new projects as they await grid connection. While India has launched an ambitious National Electricity Transmission Plan to integrate 500GW of renewables capacity by 2030, building transmission lines and substations is a complex process, taking anywhere from three to six years to complete.

Perceived risks leading to high financing costs: Hybrid and standalone energy storage projects are facing higher financing costs than vanilla RE projects due to high perceived risks. Contract structures (e.g., round-the-clock to FDRE) and use cases (e.g., peak shaving to ancillary services) are still evolving, and many of their aspects remain unclear.

According to analysis by Ember, project commissioning delays and complexities of FDRE contracts, such as exposure to wholesale market fluctuations and penalties for not meeting the required demand fulfilment ratio, add up to 400 basis points to the cost of the capital of these projects.

Furthermore, the lack of battery performance data and uncertainty over future battery replacement expenditure also add to the financing costs.

In addition, uncertainties in battery supply chains are increasing project execution risks. While India continues to keep the import duty on batteries and their components high to encourage domestic manufacturing, local manufacturing is yet to scale. India’s ACC PLI programme, launched in 2021, is yet to disburse any incentives as manufacturers have not been able to meet domestic content requirements.

Policy and regulatory changes could unlock the full potential of BESS

India is witnessing a dynamic period in energy storage deployments, driven by increasing market need, which is supported by strong policy and rising tender activity. However, with only 219MWh of commissioned BESS capacity and a large pipeline of under-construction projects, addressing project execution risks is important. While clear policy direction and falling battery costs are helping to an extent, the following measures can alleviate some of the challenges that remain:

Stricter qualification criteria: RE + storage and standalone storage tenders may include stricter qualification criteria to weed out non-serious bidders. As underbidding by inexperienced and non-serious bidders is an emerging concern that could affect capacity deployment, it is prudent to address this risk by strengthening the design of auctions. This may include superior technical qualifications and prior tie-ups with battery suppliers and engineering, procurement and construction companies.

Minimising post-auction delays: Delays in PPA signing and grid connection can affect the project economics adversely, and may even lead to the cancellation of projects. To address these risks, renewable energy implementing agencies can issue tenders only after sourcing firm commitments from offtakers. Furthermore, capacity deployments in renewable energy parks can be encouraged to reduce grid connection risks and delays. In addition, expediting the development of evacuation infrastructure, especially in renewable-rich regions, will help India achieve its renewable energy and storage targets.

Unlocking additional revenue streams: BESS projects, with their quick response times, are well-suited for providing ancillary services, which are crucial for grid stability and project viability. Their multiple value streams include primary to tertiary ancillary services, capacity deferral, transmission and distribution infrastructure deferral, black start, frequency regulation, and voltage support. However, realising these benefits requires developing specific market frameworks and transparent price discovery mechanisms, as India’s ancillary services market currently relies on thermal plants and lacks clear guidelines on BESS projects.

Contractual innovations: Flexible PPAs that include guaranteed offtake as well as clauses that allow monetisation of excess power generation should be encouraged to increase the viability of BESS projects. Contracts can also incorporate tolling agreements with third-party optimisers who manage BESS operations for daily arbitrage, ancillary market participation and other use cases based on the project configuration. The government can also encourage RE + BESS contracts for Corporate PPAs to expedite energy storage deployment and increase the share of renewable energy.

Unlocking India’s battery storage potential will ultimately depend on resolving execution risks, deepening market reforms, and creating scalable business models. This can be realised with a multi-pronged combination of government policies and incentives.

About the Author

Charith Konda is an energy specialist at the Institute for Energy Economics and Financial Analysis (IEEFA), working on issues related to clean mobility, newer clean energy technologies, and the overall energy transition challenges of the economy. IEEFA examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.