India’s government has added an Energy Storage Obligation alongside its Renewable Purchase Obligation for the first time.

Meanwhile, a government thinktank has predicted around 180GWh of demand for batteries for stationary energy storage systems (ESS) by 2030.

Last week, the country’s Ministry of Power issued an order revising the tariff policy around Renewable Purchase Obligations (RPO), through which entities such as electricity distribution licensees must ensure a minimum of energy consumed comes from renewable sources.

Earlier this year, Power Minister RK Singh said energy storage would be included in the policy. The new order sets a trajectory to the years 2029-2030.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Along with stipulating certain parameters for energy storage’s eligibility, the government has determined that large-scale pumped hydro energy storage (PHES) over 25MW be classified as part of the RPO under a separate Hydro Purchase Obligation.

By 2029-2030, combined wind, hydro and other renewable energy purchase obligations will reach a combined 43.33%, comprising 6.94% wind, 2.82% hydro and 33.57% other renewable.

The Energy Storage Obligation (ESO) specifies that the percentage of total energy consumed from solar and/or wind, with or through energy storage should be set at 1% in the 2023-2024 timeframe and gradually rise to 4% by 2029-2030, as in the table below.

Energy Storage Obligation will be fulfilled when at least 85% of energy procured and stored on an annual basis comes from renewable energy sources.

| Financial Year | Storage percentage of consumption (on an energy basis) |

| 2023-2024 | 1.0% |

| 2024-2025 | 1.5% |

| 2025-2026 | 2.0% |

| 2026-2027 | 2.5% |

| 2027-2028 | 3.0% |

| 2028-2029 | 3.5% |

| 2029-2030 | 4.0% |

Read the Ministry of Power’s order on the RPO and ESO trajectory to 2029-2030, here.

Government thinktank estimates 182.9GWh cumulative ESS battery demand 2021-2030

The order is the latest step in market-seeding activities by the government of India, which is targeting a total of 500MW generation capacity from non-fossil fuel sources by 2030, including 450GW of wind and solar PV, and has already exceeded 150GW.

The national Central Electricity Authority has previously determined that this will require about 28GW/108GWh of energy storage to integrate into electricity networks.

However, industry group India Energy Storage Alliance (IESA) has modelled a need for 160GWh or more of storage by that time, and a new report from government tech and innovation Niti Aayog forecasts that it could be even higher.

Last week British politician and COP26 president Alok Sharma met with Niti Aayog CEO Parameswayan Iyer and its vice chairman Suman Bery to discuss collaboration between the UK and India on electric mobility as well as reuse and recycling in the battery market.

The think tank has produced a report in partnership with the UK government on the prospects for advanced chemistry cell (ACC) battery recycling and reuse in India. India is currently supporting private entities from home and abroad to set up 50GWh of annual ACC manufacturing capacity by 2025 and is hotly anticipating much more will come online.

While the report therefore focuses on various aspects of the battery industry ecosystem, it begins with an estimated forecast of demand for batteries across all sectors to 2030.

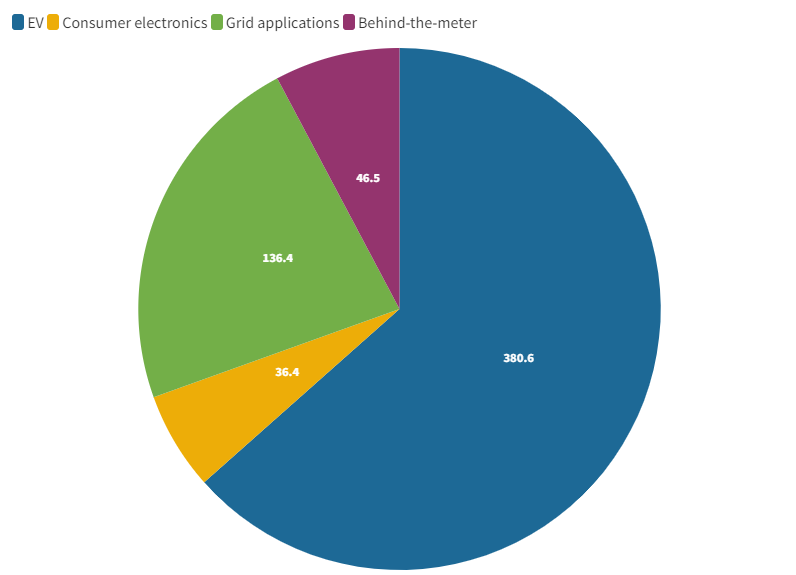

It predicts a total cumulative potential demand between 2021 and 2030 of 600GWh: electric vehicles (EVs) of various kinds take the biggest share at 380.6GWh, while grid applications total 136.4GWh, behind-the-meter applications 46.5GWh, while consumer electronics demand for batteries is forecast at about 36.4GWh.

Read the full report: ‘Advanced chemistry cell battery reuse and recycling market in India,’ here.