Fluence’s Matt Grover, director, energy markets, and Sam Markham, growth and commercial strategy, APAC, discuss the growing opportunity for hybrid renewables-plus-storage projects in Australia.

Australia’s National Electricity Market (NEM) is entering a new phase, driven by the rapid expansion of renewable energy and the challenge of integrating these assets into an already constrained grid. In this evolving landscape, hybrid battery energy storage systems (BESS) will become critical enablers of Australia’s clean energy future.

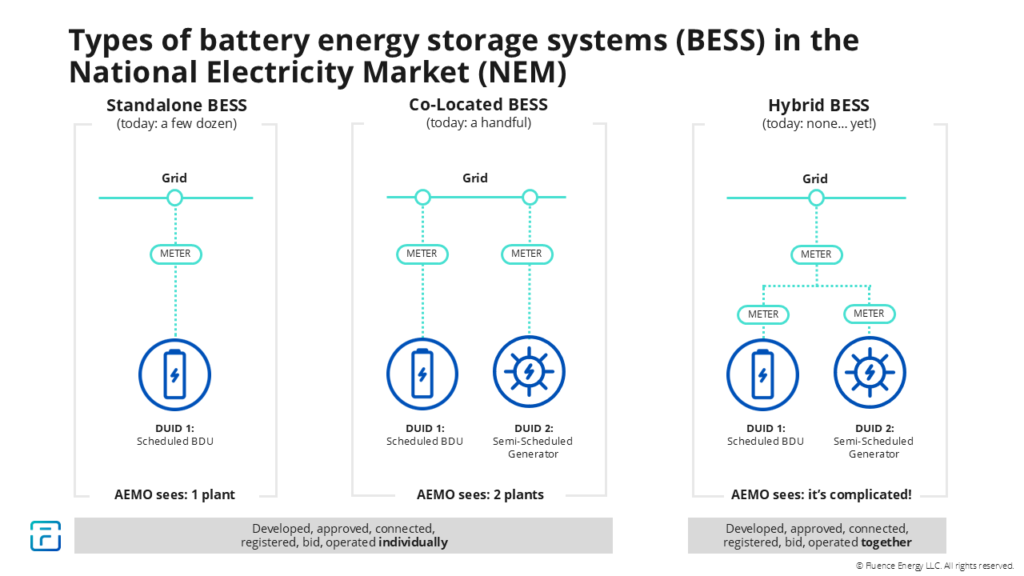

There are currently three main configurations for BESS in the NEM (as shown in the diagram below): standalone batteries, co-located batteries with renewables where the assets may be near one another but each has their own transmission connection, and the emerging hybrid BESS.

Hybrid BESS combines renewable generation, such as wind or solar, with battery storage, operating together behind a single grid connection point. While there are not any operational hybrid BESS assets yet in the NEM, several projects have reached financial close and are under construction.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The opportunity for hybrid BESS lies in tackling a growing problem: the curtailment of energy from renewable assets. As more renewable generation comes online, parts of the grid are experiencing congestion, and negative prices are becoming increasingly common.

These factors force renewable asset owners to curtail output when wind or solar is most abundant. Hybrid BESS can help mitigate these losses by using batteries to store excess generation at key times or to bid strategically into the market, improving overall asset utilisation and economic returns.

However, building a hybrid system is complex. We see five critical considerations for project developers:

Coupling configurations matter

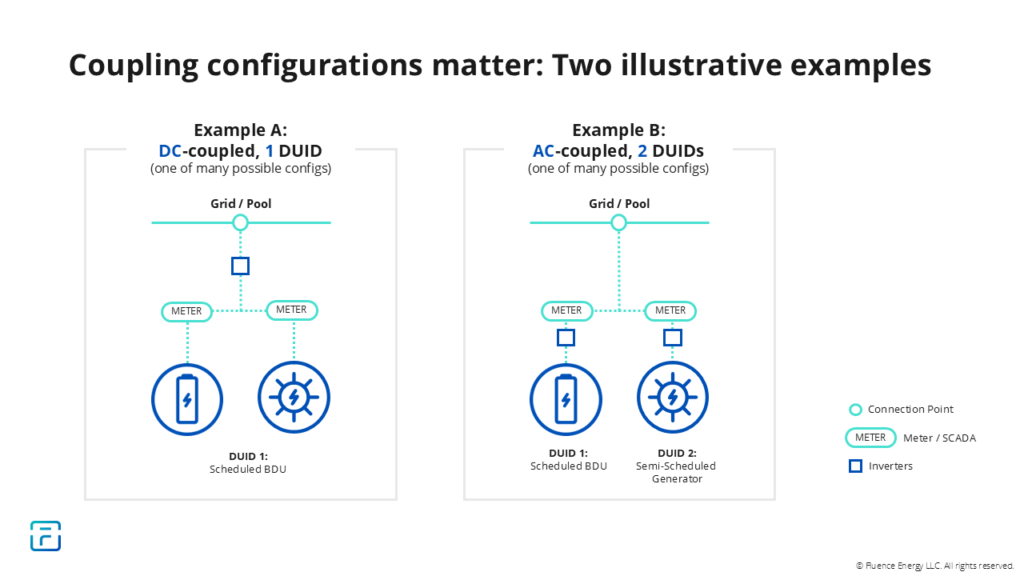

Choosing between AC and DC coupling affects capital expenditure, energy losses, and retrofit potential. DC-coupling can be effective for developing a greenfield site (although considering DC-DC converters is still important). It may reduce energy conversion losses and better capture renewable oversupply. However, DC-coupling is harder to retrofit and may increase engineering and operational complexity.

AC-coupling could be a more effective option when considering retrofitting a BESS to fit an existing plant and when leveraging specialist expertise by developing assets independently. However, AC-coupling may experience greater energy losses when charging BESS from variable renewable energy (relative to DC-coupling).

The choices between AC versus DC coupling, and one or two dispatchable unit identifiers (DUIDs), present multiple possible configurations. We have set out two combinations we expect to be commonly considered by developers.

While historically, the choices in hardware and operations have been distinct, the greater flexibility offered by hybrid BESS means that both the physical plant configuration and its future revenue streams should be considered simultaneously.

Flexibility vs simplicity trade-offs

For particular hybrid configurations, developers face a choice between registering as a single DUID, which simplifies operations but limits the ability to optimise assets separately, or as multiple DUIDs, which offers more market flexibility but compliance complexity.

Grid connection challenges

A key benefit of hybrid BESS is that it places multiple assets behind the same connection point and can utilise a single Generator Performance Standard (GPS) process, rather than separate studies for each asset. However, a drawback to keep in mind is that unless the GPS process is done simultaneously for both assets (under NER 5.3.4A), then an additional GPS approval will need to take place when adding a BESS later (under NER 5.3.9).

Yet, the current design for hybrid systems, particularly for DC-coupled projects, can make grid modelling and approvals more demanding.

Integrated forecasting and bidding systems

Hybrid systems must handle new layers of complexity: forecasting renewable availability, adjusting to headroom changes, and responding to new market signals like Aggregate Dispatch Conformance status, which can change every five minutes.

Early integration of advanced bidding software is now critical to ensure hybrid systems perform as intended while maximising revenue and maintaining compliance.

Integrated hardware and software can reduce risks

While there is significant upside to a hybrid BESS, there is additional risk and complexity to manage. A hybrid BESS with multiple assets behind the same connection point requires more sophisticated tools to manage active and reactive power, and the overall stability and efficiency of the system. For something like a solar BESS hybrid, it’s critical to have:

- a power plant controller (or energy management system) that is capable of managing multiple assets at the same time

- a bidding platform that is sophisticated enough to use highly variable solar forecasts and spot market price forecasts to deliver the most profitable mix of generation and charging to suit developers’ business cases.

For the energy industry, the message is clear: hybrid BESS hold significant promise to unlock renewable potential and improve project economics. These decisions go beyond technology alone. Commercial models, operational flexibility, and how quickly hybrid projects can move from concept to operation all need to be considered.

Importantly, hybrid systems also highlight the need for thoughtful partner selection and early engagement among developers, technology providers, system operators, and market bodies to align design, regulation, and revenue strategies.

As the energy transition accelerates, it is essential to leverage proven technology and software to navigate Australia’s unique regulatory and market environment. Hybrid BESS are set to play a central role in balancing the grid and delivering reliable, affordable, and clean power to Australian homes and businesses.

About the Authors

Matt Grover is director, energy markets at Fluence. Matt’s team works to develop and deliver Fluence Mosaic, the company’s algorithmic optimisation & bidding software offering, which is the most trusted in the NEM.

Grover has more than 12 years of experience in NEM wholesale market operations and trading, across both the supply and demand sides of the market. Prior to Fluence, Matt held regulatory and market development-focused roles with software startup AMS and demand response aggregator Enel X.

Sam Markham is a growth and commercial strategy manager at Fluence, focusing on emerging policy issues and market opportunities for energy storage within Asia Pacific. Sam has extensive wholesale electricity market design, policy development, and regulatory market monitoring experience in government rule-making and regulator roles.

In previous roles, Markham led a team of modelling and economic experts to advise governments on reform opportunities to tackle key economic issues in the NEM, such as addressing future investment challenges in the NEM, improving resilience to financial crises, and incentivising demand-side participation in wholesale operations.