Energy-Storage.news Premium speaks with CEO of optimisation platform provider Ascend Analytics, Dr. Gary Dorris, PhD, about navigating ERCOT’s revenue opportunities and the implementation of RTC+B.

Ascend Analytics operates as a market intelligence consultancy firm and also issues Electric Reliability Council of Texas (ERCOT) market reports quarterly. Ascend’s ERCOT Market Report 5.2 release in June forecasted that market load growth could underperform projections due to practical supply expansion limitations.

Furthermore, the report states that ERCOT faces a ‘weather-dependent knife’s edge’, a precarious balance as demand growth outpaces power supply capacity heading into the late 2020s.

This imbalance will likely trigger more frequent electricity shortages and greater price volatility, according to Ascend’s analysis. These conditions create favourable circumstances for battery energy storage systems (BESS), potentially unlocking substantial revenue opportunities.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The newly introduced Real-Time Co-Optimisation Plus Batteries (RTC+B) modifications have also created significant market changes within ERCOT.

Ascend’s latest ERCOT Market Report Release 5.3 characterises ERCOT’s revenue patterns as resembling a ‘roller coaster,’ though the firm emphasises this volatility as an intentional design characteristic rather than a flaw.

The ERCOT roller coaster

Dorris says, “In our industry, there are a few truisms. Market expectations serve as the best estimates of future outcomes, and this generally holds true. Otherwise, you’re essentially debating the market as a speculator. We are challenging this assumption by highlighting a unique market circumstance where the on-peak and off-peak forwards—these monthly energy blocks—differ.”

He continues, “On-peak typically covers 16 hours a day, five days a week, while off-peak covers the remainder, roughly aligned with daylight hours during summer. We claim this usual principle doesn’t apply here. In our experience, such an approach is extremely rare. Normally, risk management assumes the forward price matches the expected spot price overall. But now, we see an imbalance between buyers and sellers.”

The report states that because ERCOT lacks a capacity market or centralised planning, scarcity conditions are necessary to motivate new entrants but tend to be unstable. Participants should employ hedging strategies to reduce volatility and support the 2026 forecast, which Ascend expects to be more similar to 2024 than what the forward market indicates.

Dorris notes, “It’s a roller coaster because: do you have the weather to support it? Yes or no, depending on the summer. The reserve margin sometimes supports it. Sometimes you have tight conditions, sometimes it’s very clear we’re going to be fat for the next summer, probably two, and that will mean very limited scarcity.”

“To make your payments traditionally, you need scarcity conditions. The roller coaster is when it doesn’t happen. The lows last a year or two or three. In this case, it will likely be for summer ’24, ’25, ’26, and possibly ’27. It’s a four-year low.”

Dorris goes as far as to make a biblical analogy about the market’s dependency on the weather, remarking that it’s like Joseph interpreting Pharaoh’s dreams.

He says that hedging becomes essential to navigating the ‘roller coaster.’

Getting off the roller coaster

Dorris says, “You should consider how solar and storage can capture that risk premium. Similar to the biblical analogy—saving during good years for the bad ones—hedging is a way to secure consistent revenues. If we face a series of bad years or an imbalance, capturing that risk premium through hedging is vital. The only way to do this is by implementing hedging strategies.”

He continues, “However, operators often lack the tools, knowledge, and infrastructure needed for this. Their survival depends on adopting these strategies, as they could otherwise lose about 30% of potential revenue. If they had experienced the last two summers with similar conditions expected this coming summer, their revenue could increase by roughly 30%, excluding the risky period from December to February.”

Ascend further highlights the practices employed by thermal energy project owners, which utilise the physical characteristics of their assets to earn risk premiums in the market, stating that it is essential for the ongoing profitability of renewables and storage. To ensure consistent profits, it’s vital to capitalise on all market opportunities, including engaging in forward market activities or implementing portfolio risk management hedging strategies.

Dorris explains, “If your battery has a two-hour capacity, say 100MW, you might want to lock in and sell 40 or 50 megawatts for nine months of the year, capturing the risk premium, especially during summer.”

“This is crucial because most of the value occurs then, particularly in July and August. For those months, you’re earning approximately US$70 per MWh over 344 hours each.”

He continues, “Combining July and August, that’s about 700 hours of operation at a spread of US$70 per MWh, totalling roughly a US$60 spread per MWh. This is substantial and helps address many issues. In case of a major strike or other event that severely reduces generation and tightens reserve margins, locking in this rate offers a safety net.”

RTC+B and market saturation

Speaking with ESN Premium last month, Michael Kirschner, managing director US for optimiser Habitat Energy said that RTC+B is “Effectively a full reset of the system. They’re updating all their code. All of history is effectively, I don’t want to say scrapped, but I’m old enough to remember when ERCOT went through the switch to LMPs back in 2008 or 2009, and COVID. Both of those events created a singularity in some sense, where on the other side of it, you can’t use history as a guide.”

RTC implements a new process in which energy and Ancillary Services (AS) are dispatched interchangeably within the Real-Time Market, as per ERCOT. Prior to RTC, ERCOT obtained AS in the Day-Ahead Market and seldom reallocated them among resources during the Real-Time Market.

This change is very important for BESS in ERCOT, as it mainly earns revenue from ancillary services. It will now be dispatched based on location every five minutes, moving away from a system-wide method. Additionally, the Plus Batteries (+B) reform will now consider BESS as individual units instead of combining generation and load.

Ascend noted in a presentation on its ERCOT report that, “Ancillary service markets are already saturated, and RTC+B will only decrease opportunity costs and increase supply for everything except non-spin.”

Dorris notes of this line, “Saturation occurs when supply exceeds demand, leading to economic indifference between serving ancillary service markets and energy markets. This means the opportunity cost of providing ancillary services is equal to the value of energy arbitrage. At any moment or over time, you’re indifferent—alternating between energy and ancillary services because the market is saturated.”

He continues, “Regarding the opportunity exception for non-spin, we currently see a chance for non-spin to generate additional value due to the current rollout of the programme. This situation will persist until they implement a rule change, which is likely in the future. For now, there is a slight reduction in ancillary opportunities for storage, shifting some focus towards energy arbitrage, except for those involved in non-spin. Overall, you may perform slightly better than before.”

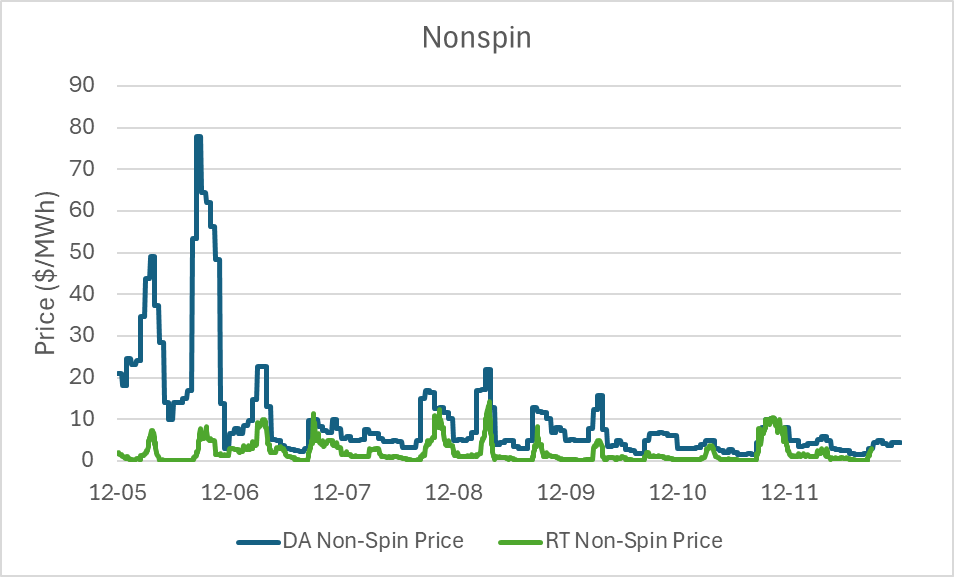

RTC+B was implemented on 5 December. IPP Eolian CEO and Founer, Aaron Zubaty shared in a post on the social networking site LinkedIn, that on 4 December, many energy storage assets did not bid into the ancillary markets for the following day, not seeing the risks as being worth the revenue.

This caused the costs of ancillary market products to rise, with many hours seeing expenses more than five times, or 500%, higher than before. Despite some outliers, the market seemed to normalise in the morning.

Dorris says this result is consistent with Ascend’s forecast expectations, noting that, “The day 1 disequilibrium event produced a day-ahead (DA) ancillary price spike relative to history that was not manifest in the real-time (RT) markets for Day 1 and subsequent DA ancillary prices.”

He continues, “DA carries a consistent adaptive period risk premium over RT ancillaries for the first week. This risk premium is expected to abate over time with an overall decrease in ancillary service costs. Overall, we expect storage revenues to be relatively constant over time, with ancillary service prices slightly lower.”

The Energy Storage Summit USA will be held from 24-25 March 2026, in Dallas, TX. It features keynote speeches and panel discussions on topics like FEOC challenges, power demand forecasting, and managing the BESS supply chain. For complete information, visit the Energy Storage Summit USA website.