Another 500MW of energy storage procurement targets have been bestowed onto California’s three main investor-owned utilities by the state’s Public Utilities’ Commission (PUC), on top of an existing 1.325GW mandate.

Under the state’s pre-existing AB2514 mandate, utilities Southern California Edison (SCE), San Diego Gas & Electric (SDG&E) and Pacific Gas & Electric (PG&E) must procure the 1.325GW of energy storage by 2024 in four biennial solicitations. Different targets are set at customer, distribution and transmission level.

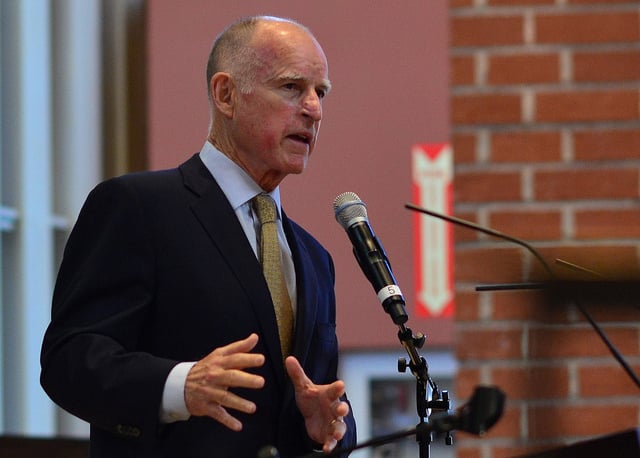

Last week the PUC reaffirmed that utilities must put in place their proposals and proposed investments to deploy 500MW of additional distributed energy storage – defined as behind-the-meter or distribution-connected resources – under the Assembly Bill AB2868, which was originally signed by state Governor Jerry Brown in September 2016.

California’s PUC has assigned each of the three utilities a 166.66MW target to make up the full 500MW. As with previous targets this excludes the use of vehicle-to-grid (V2G), power-to-gas (P2G) and large-scale pumped hydro over 50MW. The utilities must hold a series of workshops and stakeholder engagement events during this year to define their proposals and plans to implement the ruling.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The PUC’s rulemaking decisions came in part from working with the California Energy Storage Roadmap, a document developed by the transmission network operator California Independent System Operator (CAISO), California Energy Commission and the CPUC itself. The roadmap identifies pathways and barriers to adoption of energy storage in the state and lays out recommended actions going forward.

Nearly 500MW procured so far

As of February this year, the three IOUs had already procured 478.5MW of the total 1.325GW AB2514 mandated target. This is split across 192.63MW of customer-sited energy storage (190.14MW of which has been deployed by SCE), 95.87MW of distribution level storage and 190MW of transmission line-connected storage. All deployments must come from competitive solicitations.

While adopting AB2868, three additional Assembly Bills were also signed at the same time in 2016 by Jerry Brown to support the state’s energy storage ambitions. These variously will create an independent body to resolve interconnection disputes, support long duration bulk energy storage and expand funding incentives for customer-sited storage.

Alongside the 1.325GW mandated to IOUs, California’s smaller publicly owned utilities, of which there are 30, are encouraged to set voluntary procurement targets which must be re-established every three years.

A global leader

According to a recent case study of California’s mandate-driven energy storage industry, produced by lobbying organisation The Climate Group, the state is a “global leader in the development and deployment of energy storage”. California has 4.2GW of already installed storage capacity, although 96% of that is pumped hydro. Climate Group said that this nonetheless falls well short to meet the 13GW daily peak electricity demand the state experiences.

Climate Group said the rapid growth of renewables in the state – from 3GWh of PV in 2008 to 12,571GWh in 2015 meant the significant imbalance between peak demand and renewable energy production needed mitigation. Meanwhile the state’s infrastructure has been shown to be less than impervious to failure – the Aliso Canyon gas leak of 2015 required a concerted response to capacity shortfall fears, a response which was largely provided by the quick-fire deployment of some 250MWh of energy storage. Ambitious decarbonisation targets and the retirement of thermal and nuclear plants in the state have also created further drivers for renewables and energy storage.

Climate Group said the AB2514 mandate took three years to implement, from September 2010 to October 2013. The three IOUs must cover the costs of their proposed projects through a variety of mechanisms, from transmission and distribution rates to generation charges.

California is both supporting the uptake of energy storage and providing market security to investors and suppliers, Climate Group argued. Replicating California’s success could be a question of funding R&D in energy storage in a similarly aggressive way – California spends around US$100 per year in research and development on electricity generation and another US$100 million on alternative and renewable fuels and advanced transport tech – as well as copying the state’s widespread rollout of residential and commercial smart meters which allow for accurate and up to date tracking of load profile and other metrics.

Also likely to bolster California’s reputation as the US’ most energy storage-friendly state is the reopening of the SGIP at the beginning of this month, offering up to almost US$300 million through the scheme’s lifetime.