France’s electricity transmission system operator, RTE, is exploring options to reduce congestion on the grid at four strategic locations around the country and could award long-term contracts to battery storage systems that can help.

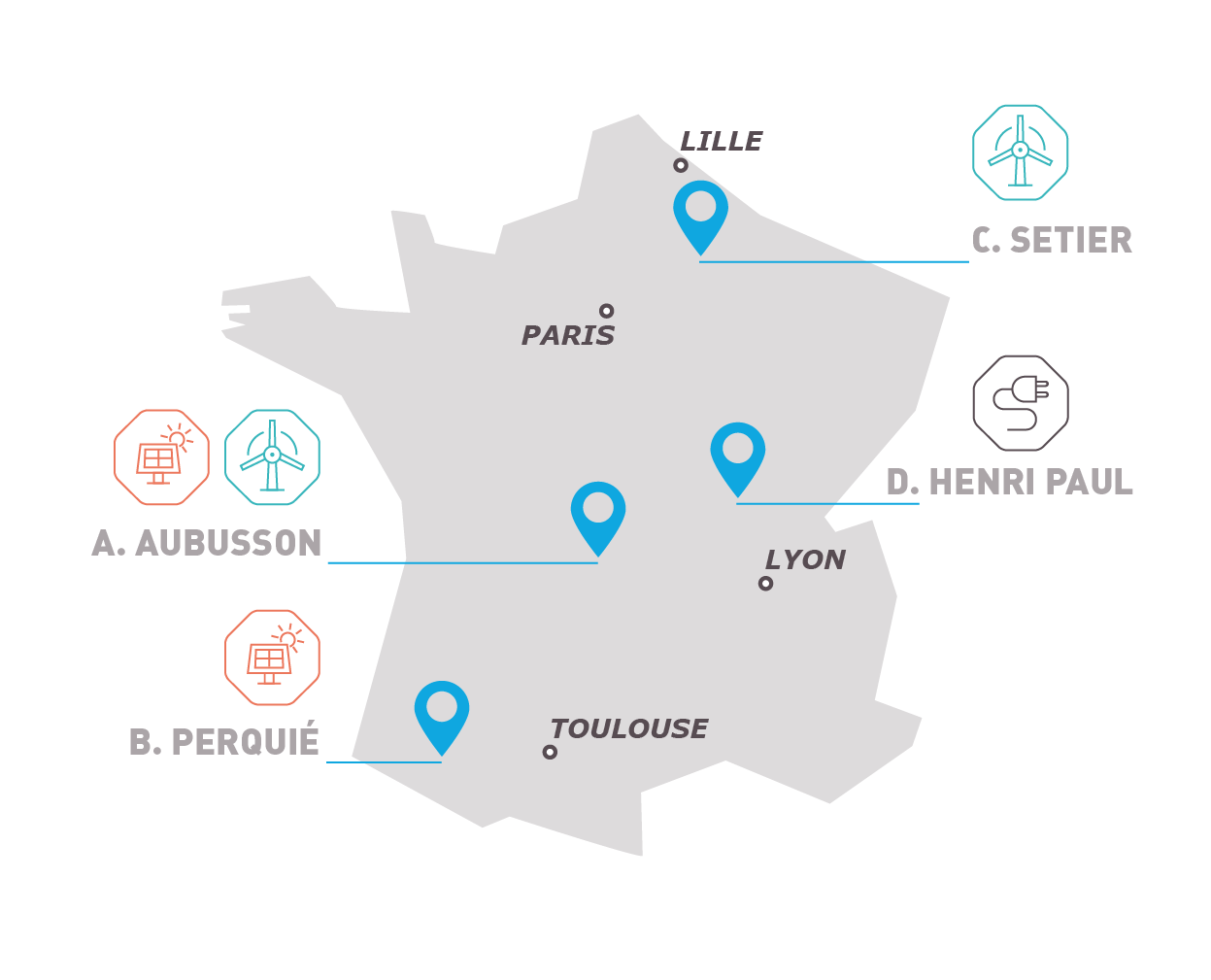

RTE has asked interested parties to respond by 19 February 2021 if they would be able to provide flexibility options that would help ease grid congestion at three substation sites where there is surplus generation of renewable energy and one site where the growth of electric vehicles (EVs) is causing demand for grid power to rise. These options would be “alternative solutions to adaptations of the electricity transmission network,” RTE said.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

In other words, threes sites have “energy in excess” while the fourth is lacking energy, Corentin Baschet, head of maarket analysis at consultancy Clean Horizon told Energy-Storage.news. While the call for expressions of interest is not yet a defined opportunity such as a tender, the idea RTE is exploring is that by paying for flexibility resources to ease transmission constraints, the grid operator could save money and time that it would have to otherwise invest in transmission infrastructure upgrades.

RTE has made public the amount of power that is either lacking or in excess, ranging from 14MW to 90MW, the amount of energy in megawatt-hours ranging from 8,300MWh to 20,000MWh in excess and then 325MWh lacking in the outlying case and then the number of hours each year that the constraint applies for, from 30 hours per year in the case of the EV demand centre to more than 800 hours per year for the most extreme case of solar or wind overproduction.

While it seems very likely that RTE will be willing to pay for these flexibility options, as yet, it is not clear what form the payment will take and the decisions around this may be months away, Baschet said. It is “very difficult to say” whether they could be capacity payments, availability payments or some other structure, but in any case it is likely these would be long-term additional revenues that battery storage providers could apply to their project’s business case, the analyst said.

Bankable, multi-year contracts for helping keep the cost of electricity down

“RTE would be ready to invest to pay a contract with a bit of [a] long term view for this, because they have a good idea of how demand and generation will grow at these nodes of the grid. So they could agree to give a multi-year contract to storage sites that are close to these locations,” Corentin Baschet said.

As the payments would likely only apply for those limited periods of the year when the flexibility is needed, it is “very unlikely” that these contracts would form a main revenue source for an energy storage system, so energy storage systems would need to consider it another potentially stackable form of revenue alongside other opportunities. Also important to note is that the flexibility provided must be very local to the substations where the congestion is taking place, Baschet said. The “interesting elements” of this search for flexibility by the grid operator are however that the contracts would be bankable and multi-year.

As to whether this type of local flexibility solution – which RTE is only examining for the four specific “zones” at present – could become more widespread, Clean Horizon’s Baschet said it is likely. RTE has launched a pilot project called Project RINGO which uses large-scale battery systems at three strategic locations as ‘virtual transmission lines’ to ease congestion on the network, the transmission operator is unlikely to want to invest capex directly to add flexibility everywhere around the country where there is a less extreme need.

It is however “very difficult to estimate” right now how soon or how widespread this type of opportunity might become, according to the analyst. Transparency of the grid and its congestion issues is not as good in France as it is in the UK, to give one example. Distribution network operators (DNOs) in the UK offer ‘heat maps’ of the grid. Just by looking at one of these maps, you can tell the congestion is and then developers can participate in local flexibility tenders.

It will still take a “lot of work” for either RTE or its distribution system equivalent in France, Enedis, to get to that level of transparency, but it should eventually in place. France’s regulator has said that if flexibility investments can be cheaper than investing in new transmission assets and would reduce the overall cost of electricity, they should be considered instead.

“In the end, if you manage to build less infrastructure, it's less cost for the transmission system operator. Therefore, it's less taxes on the electricity for the end user,” Baschet said.

A transparent system such as the one used in the UK “would be ideal,” because it would “help developers better understand how the grid is constrained and what the grid needs”. With approximately 400MW of battery storage at different stages of development for mainland France at the moment, it could be of value to both network operator and asset owner/investor to know where these battery systems could be sited to also help manage the congestion of the grid.