From August 2026, battery storage projects in France will benefit from changes to grid tariffs designed to encourage them to support the grid at specific times of the day.

The country’s energy regulator the Commission de Regulation de l’Energie (CRE) approved its TURPE 7 reforms last month.

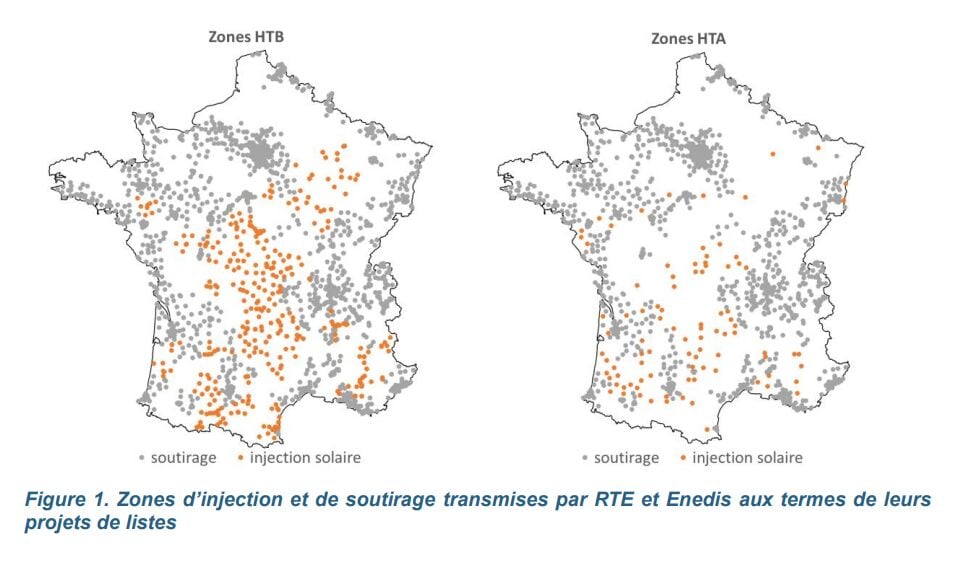

From August 2026, battery storage assets can choose a new ‘injection–withdrawal’ tariff that rewards them for supporting the grid at times of need. Around 3,000 grid zones have been designated as either ‘withdrawal’ (soutirage) or ‘injection’ (injection solaire) zones.

In withdrawal zones, batteries will be paid to discharge during winter peaks (between 8-12am and 5-9pm) and in injection zones they will be rewarded to charge at midday during summer, said Alexandre Cleret, COO of French transport depot decarbonisation solution provider Decade Energy on LinkedIn.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The objective of the reform is to incentivise energy storage resources to adopt practices that reduce local grid peaks, both for injection and withdrawal, the CRE said.

The tariffs will be available to energy storage projects connected at the HTA, HTB 1 and HTB 2 voltage levels. HTA is the medium-voltage distribution level of around 20kV, HTB 1 is the sub-transmission level of 63/90kV and HTB 2 is the regional transmission level of 150/22kV (the next highest is the 400kV HTB3).

There are a total of 396 injection (injection solaire) and 1,588 extraction (soutirage) zones at the HTB level, and 320 injection and 1,121 extraction zones at the HTA level, shown in the map above. Some 1,114 HTB zones and 795 HTA zones were ‘not eligible’ to become a zone, around one-third of the total number of zones within each category.

Industry reaction

The reform follows similar moves in other major European markets. In November 2023, Germany extended a temporary exemption for grid fees for energy storage until August 2029, while the Netherlands introduced flexible grid fees and connection times for storage last year.

Cleret was highly positive about France’s own reform, saying it created a locational price signal that directly links battery behaviour to system value.

“Grid costs move from a fixed penalty to a variable reward tied to flexibility. This is how regulation should evolve: simple, measurable, aligned with physics. France just gave Europe a blueprint for how to make flexibility attractive,” Cleret said.

Assets optimising around these windows could lower their grid fees by 40% and improve their internal rate of return (IRR) by 1-2 percentage points, according to Clean Horizon and Aurora Energy Research.

However, in response to Cleret’s post, some industry executives said that the move may lag market reality, for example if a zone’s injection-withdrawal balance changes. Several pointed out that the change would not be needed if France had a nodal electricity market system (such as in California or Texas).

Another pointed out concerns about intergenerational equity, noting that legacy energy projects have benefited from flat rates (and public financing) while new entrants now face variable costs to connect to a system which does not have flexibility designed in.

France’s largest battery energy storage system (BESS) at 100MW/200MWh was put into commercial operation earlier in August by developer-operator Harmony Energy, which CEO Peter Kavanagh touched on in an interview with ESN Premium shortly after.

That project could benefit from the TURPE 7 reforms if located within two-thirds of the zones included, being connected to the grid at the HTB 1 sub-transmission level via a 63kV connection.