System integrator Fluence saw revenue of US$475.2 million in the last quarter of 2025, while its net loss grew around 10% to US$62.6 million.

The battery energy storage system (BESS) technology and services firm released its results yesterday (4 February), covering the three months ending 31 December, 2025. That period is Fluence’s Q1 2026 because its financial year runs to 30 September.

Revenue was up 154.4% year-on-year though its GAAP-adjusted gross profit margin halved, from 12.5% in Q1 2025 to 4.9% in Q1 2026 (5.6% adjusted gross profit margin). It said there were additional estimated costs on two projects, totalling US$20 million, which it mostly expects to recover over the year.

Net loss subsequently grew, up around 10% to US$62.6 million, while its EBITDA loss increased by around 5% to US$52.1 million.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The firm’s backlog has reached US$5.5 billion, a record, with US$750 million of orders. It highlighted data centre-related and long-duration energy storage (LDES) projects as key future revenue drivers with around 35GWh of each in the pipeline or as leads.

Fluence is guiding for US$3.2-3.6 billion in revenues and an adjusted EBITDA of approximately US$40-60 million.

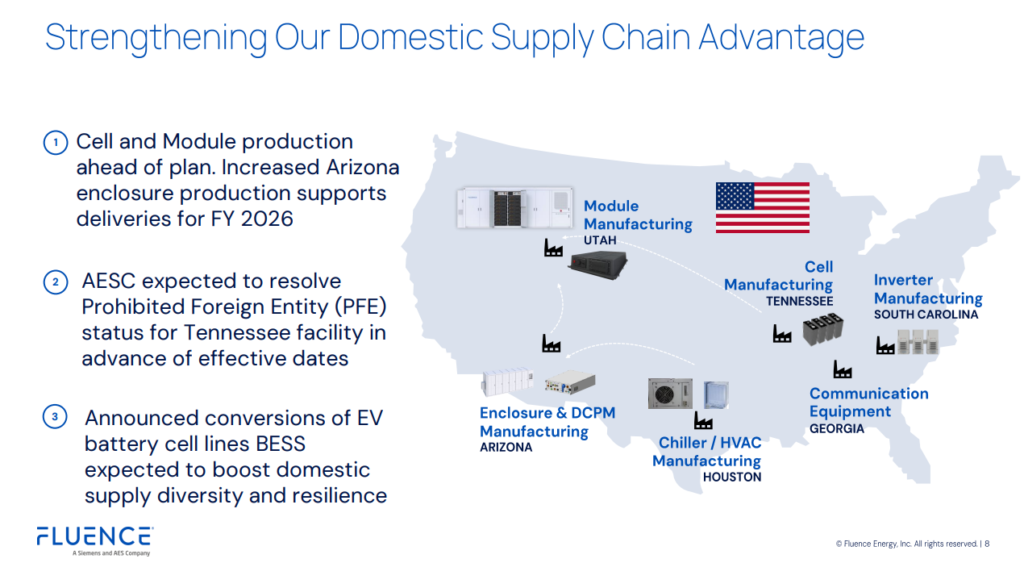

It recently said that the US would be its largest source of revenue, and expected to be able to offer BESS products that are compliant with new FEOC restrictions on tax credits for clean energy projects. Its US domestic manufacturing roadmap was outlined in the earnings presentation slide below.

Major recent contract wins for the company include project orders in Arizona for BrightNight/Cordelio Power and Greenflash, as well as a huge 1GW/4GWh BESS in Germany for LEAG.