Changes to the California Independent System Operator (CAISO) interconnection process have been approved by the Federal Energy Regulatory Commission (FERC) following months of scrutiny by advocacy groups, independent power producers (IPPs) and utilities.

Despite CAISO describing the changes—which will impact prospects for energy storage projects—as “essential” in dealing with “recent dramatically increased levels of requests to interconnect to the CAISO-controlled grid,” it appears that not everyone is happy.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Back-to-Back record-breaking ‘superclusters’

Under current rules, anyone wanting to connect a facility to the CAISO-controlled grid must submit an interconnection request with the California system operator during an annual two-week window (held between 1-5 April), with projects submitted together grouped as a queue cluster.

After this window closes, CAISO identifies the network upgrades required to accommodate the new connections, estimates the associated costs, and allocates these costs amongst developers sharing upgrades.

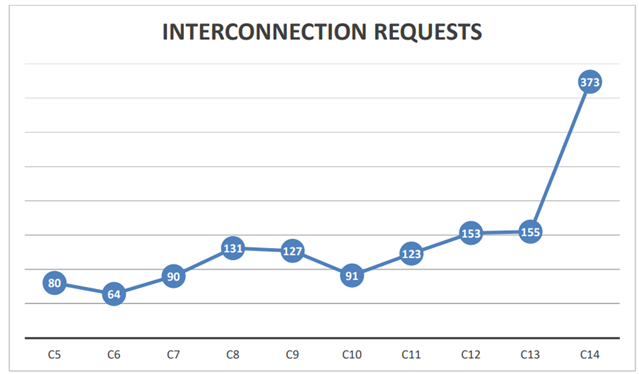

CAISO found this to be an effective strategy for dealing with new interconnection requests until the close of the Cluster 14 window in April 2021, dubbed by the system operator as a ‘supercluster,’ after it witnessed a 241% increase in the number of submissions on the previous year from 155 to 373. As CAISO eloquently described in a proposal issued in May 2021 to deal with increased queue submissions – “cluster 14 speaks for itself”:

In order to complete the grid studies associated with cluster 14, CAISO hoped that by delaying the opening of the cluster 15 window from 2022 to 2023, and also introducing new rules to reduce overall queue volume, this would reduce the size of the next cluster.

However, despite these changes, CAISO still received a record-breaking 541 new interconnection requests during the cluster 15 window in April 2023, representing a 45% increase on even the previous year’s supercluster.

Oversubscribed interconnection queue

In the US, California has led the renewable energy charge over the last decade, with the California Energy Commission (CEC) recently reporting that energy storage capacity on the CAISO grid has grown from 500MW in 2018 to more than 13,300MW energy storage, as reported by Energy-Storage.news.

This remarkable growth can be partially attributed to bills passed by California lawmakers, including Assembly Bill 2514 (AB 2514), the US’ first energy storage target for investor-owned utilities (IOUs) to procure 1.325GW of storage by 2020, as well as requiring all electricity sold in California be 100% carbon-free by 2045.

Although recent renewable energy-related mandates have been effective at driving the deployment of renewable energy in the Golden State, CAISO attributes its recent struggles on the new laws, describing “California’s ambitious decarbonisation goals and the large quantities of renewable energy and zero-carbon resources required to meet them … [resulted in an] unprecedented numbers of interconnection requests from interested resource developers”.

Moreover, CAISO claims that the queue now contains more than three times the capacity expected to achieve the policy objectives established by California state legislation.

CAISO’s Interconnection Process Enhancements Stakeholder Initiative

As previously alluded to, CAISO has taken intermediary steps to rectify the issues with its interconnection process, although seemingly, none of these measures went far enough.

To get to the real heart of the issue and reform its interconnection process, CAISO launched the first phase of its Interconnection Process Enhancements Stakeholder Initiative (IPE Initiative) in February 2023, which was split into three different tracks.

Track 1 set out to address the two recent superclusters, resulting in the extension of deadlines to studies relating to cluster 14, and the immediate pausing of anything relating to cluster 15.

The objective of the second track, recently approved by FERC and the subject of this article, was to instate a series of enhancements to the interconnection process for future clusters.

Track 3 is still underway and will look to introduce a series of further enhancements to the process.

Zonal clusters and additional study criteria

CAISO’s recently approved Track 2 proposal for dealing with interconnection queue clusters introduces two new components to the initial assessment phase: zonal clusters and additional study criteria.

The first portion of the reform attempts to address grid congestion at certain points on the CAISO grid, with the system operator assessing its entire grid prior to the opening of the cluster window and assigning each studied area as a Deliverable Zone or a Merchant Zone. Study areas with at least 50MW of available deliverability prior to the window opening will be tagged as a Deliverable Zone, and areas with less than this tagged as a Merchant Zone.

For submissions into a deliverable zone, interconnection customers are opting to compete for the finite capacity available in this area, meaning that although deliverability isn’t guaranteed, they may receive cash reimbursement for the construction of network upgrades.

For merchant zone submissions, interconnection customers won’t be competing for deliverability, but they will have to self-fund any network upgrades. Essentially, the introduction of merchant zones allows for the construction of network upgrades beyond what CAISO had planned for, without affecting the upgrades in deliverable zones where the new projects are needed most.

The second part of the reform is an attempt from CAISO to reduce the size of the overall cluster to be studied. In Deliverable Zones unable to accommodate all new queue requests, CAISO will introduce a scoring system to rank projects based on indicators relating to commercial interest (30 points), project viability (35 points), and system need (35 points).

Protests from developers

Only a handful of organisations, utilities and advocacy groups accepted CAISO’s new proposal in its entirety, including Southern California Edison (SCE), Pacific Gas & Electric (PG&E), California Public Utilities Commission and California Community Choice Association (CalCCA).

On the other hand, there were a handful of other organisations made up of mostly independent power producers (IPPs) and advocacy groups, who submitted requests with FERC for changes to be made to the proposal before approval.

IPPs Aypa Power and NextEra Energy Resources (NEER) took this a step further and requested FERC to reject the proposal in its entirety.

Although there were several points of contention, a selection of IPPs and advocacy groups appeared to take a particular dislike to CAISO’s scoring of projects based on commercial interest.

Under CAISO’s new scoring criteria, the system operator will incorporate “preliminary non-binding feedback on specific projects from load-serving entities LSEs”, as well as provide an opportunity to commercial offtakers to express interest in certain projects, awarding points to projects who can demonstrate interest from such offtakers.

In its protest filed with FERC, Irving, Texas-based IPP Vistra stated that CAISO had not shown this scoring methodology to be “reliable or even [a] rational basis for evaluating commercial viability”.

Several trade advocacy groups along with Vistra and Calpine also made reference to “self-interested utilities” being granted too much discretion in the process, potentially resulting in “discrimination”.

Calpine summed up these concerns by stating it hoped LSE’s would make a “commercial evaluation while acting as nothing more than a customer buying power in a competitive marketplace, not as a competitor who controls access to the grid or a buyer with significant power over pricing and terms”.

Despite the concerns, FERC rejected these protests and granted approval of CAISO’s new reforms, which it will apply to its paused cluster 15.

Cluster 16 postponement

To enable CAISO to process the previous 14 and 15 clusters, FERC granted the system operator’s March 2024 request to postpone the opening of its 2024 cluster window.

CAISO stated that after applying the new process to cluster 15, it hopes it can use the experience to set a more granular timeline for future clusters.