ESS Inc, US maker of the only flow battery that uses a battery chemistry based on iron and saltwater electrolytes, is making its first incursion into the Brazilian energy storage market.

An investor and developer, Pacto GD, part of the larger Pacto Energia Group of Brazil, has commissioned ESS Inc to install Energy Warehouse, the company’s containerised grid-scale storage battery solution.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

A 50kW / 400kWh test unit will be deployed and integrated with 100kW of PV, allowing for several hours of energy storage and self-consumption of onsite generated electricity. The facility, in the state of Goiás, will reduce or eliminate diesel use at a commercial site during peak demand periods.

The project is set to cost around US$1.3 million, partly funded by the US Trade and Development Agency (USTDA). With the project expected to demonstrate the effectiveness of long duration storage coupled with solar from economic and environmental perspectives, ESS and Pacto GD are planning to take learnings from its development into future projects.

According to ESS, this could mean the pair will deploy distributed generation projects in Brazil which could have anything up to 5MW of PV capacity and 20MWh of energy storage per installation. It follows ESS’ first projects in Europe, announced in March. While Latin America is considered a good fit for both solar and energy storage, uptake has been slow to date. According to some sources in Brazil this is partly to do with high environmental, product certification and safety standards.

Elsewhere in the country, EOS Energy Storage’s novel zinc battery is being tested to its “operational boundaries” by utility Engie. That project involves a 1MW / 4MWh Eos Energy Storage zinc hybrid cathode battery system co-located with a more than 5MW hybrid solar and wind energy project in Tubarão, Brazil.

ESS CEO Craig Evans told Energy-Storage.News that he sees the overall energy storage market shifting towards longer durations of storage for the purpose of renewables integration, particularly when the cost of solar-plus-storage is compared to the high and fluctuating cost of deploying and powering diesel gensets.

“Certainly four hours or greater is where the market is moving. Durations are always getting longer and as renewables get cheaper, integrating with off-grid, microgrid-type markets is starting to gain traction.

“Coupled with renewable energy, as those prices come down, diesel gensets seem less attractive. We’re kind of seeing a reversal of the format, of diesel genesis being the baseload. Diesel is becoming the backup and solar-plus-storage the baseload for those types of grid.”

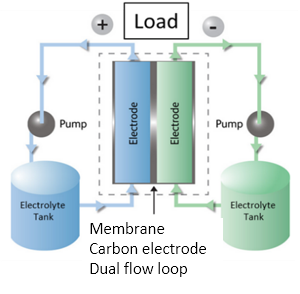

Flow battery manufacturers would argue that their technology is more suited to long duration, can be deeply and frequently cycled without degradation and holds more energy than lithium, which is considered more appropriate to deliver short bursts of high power.