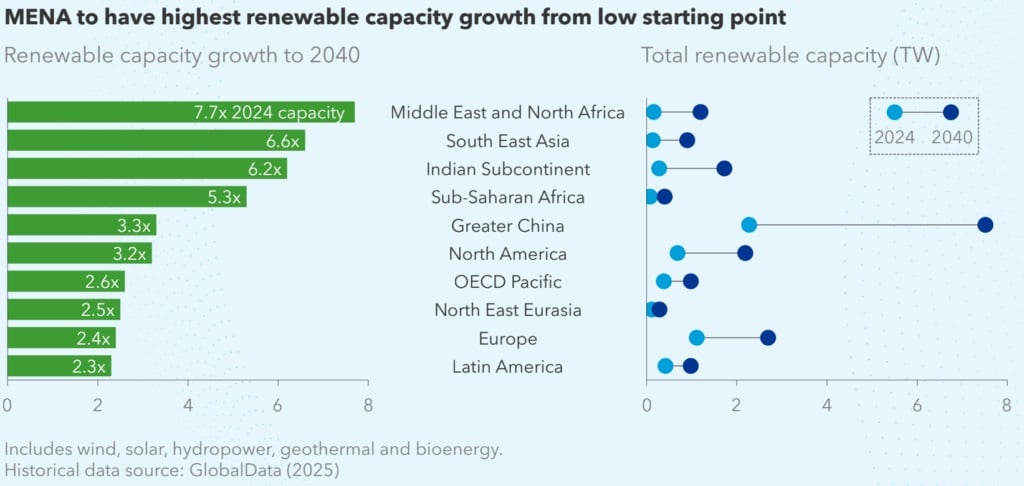

DNV has forecast that the Middle East and North Africa (MENA) region will add 860GW of new solar PV by 2040, while renewables will also be among the drivers for tenfold growth in energy storage capacity by 2030.

This represents a 12-fold increase in new solar PV capacity, including capacity co-located with energy storage, from 2024 levels.

In its report, Rise of Renewables in the Gulf Region, DNV highlighted that despite the growth in solar PV and wind generation, it would not displace gas-fired power until 2040, due to electricity demand growth exceeding the installed renewable energy capacity. DNV forecasts that electricity demand in the MENA region will triple by 2060.

If in the coming decade this demand growth will primarily come from buildings and desalination, from 2040 to 2060 the demand growth will be driven by the switch to electric vehicles, an increase in AI data centres and green hydrogen production.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“The Gulf is moving from discussion to deployment,” said Jan Zschommler, Market Area Manager for Middle East & Africa, Energy Systems at DNV.

“Utility-scale solar, wind, and storage projects are now being built at a pace that changes the regional power mix. Our modelling shows that renewables growth will exceed demand growth after 2040. That is when the transition in the region’s power mix starts to accelerate,” added Zschommler.

Moreover, solar PV continues to be the leading renewable technology in the region, with installed capacity forecast to increase from 76GW in 2024 to 340GW in 2029.

A further 2.2TW of additional solar PV and wind would be installed between 2040 and 2060. Energy storage is also forecast to grow rapidly in the coming decades. Currently, the MENA region has 36GWh of energy storage capacity installed, which DNV expects will grow 10-fold by 2030, 100-fold by 2045 and reach 9.5TWh by 2060. This would mean that the MENA region would have 12% of the global energy storage capacity installed in 2060, up from the 1.4% currently.

“The rapid rise of renewables in the Gulf, and MENA more broadly, is not replacing hydrocarbons overnight, but it is reshaping the power system,” said Ditlev Engel, Energy Systems CEO at DNV.

Engel added: “GCC countries are building some of the world’s largest solar and storage projects while still supplying global oil and gas markets. This development is driven mainly by economics. Renewables now provide low-cost electricity, and clean power is becoming necessary for competitive industry and future hydrogen production.”

The report further notes that the co-location or hybridisation of solar PV with battery energy storage system (BESS) technologies will lead growth in deployments in the energy storage space, overtaking pumped hydro energy storage (PHES) as the dominant technology in the region.

By the end of this year, Li-ion is forecast to represent 70% of all storage capacity installed. In the coming decades, the share of Li-ion will drop as long-duration storage capacity comes online and standalone Li-ion and vehicle-to-grid storage increase, reaching a combined 45% of storage by 2060.

The co-location of solar PV with energy storage has been on the rise in the region in the past few years, with several gigawatt-scale projects announced recently. Interest in solar-plus-storage is expected to increase as developers seek round-the-clock supply and greater system flexibility, wrote DNV.

The world’s biggest solar-plus-storage project so far announced is being built in the United Arab Emirates (UAE), a US$5.9 billion project which will combine 5.2GW of solar PV with 19GWh of battery storage capacity. As detailed in DNV’s report, the project will enable the round-the-clock delivery of 1GW of clean energy to the grid. It is being developed by UAE state-owned renewables developer Masdar, and is already under construction with an expected completion date next year.

This week alone, our colleagues at PV Tech covered a new development from one of many gigawatt-scale solar-plus-storage projects. Norwegian independent power producer (IPP) Scatec signed a power purchase agreement for 1.95GW solar PV and 3.9GWh BESS in Egypt. This is one of several solar-plus-storage projects the IPP is currently developing in the country, including the 1.1GW/200MWh Obelisk project.

Other countries in the region also have seen their fair share of large-scale solar-plus-storage projects, such is the case in Saudi Arabia, where local developer ACWA Power recently signed a joint development agreement with Bahraini state-owned energy company Bapco Energies to build a 2.8GW solar PV plant co-located with BESS.

Private and state entities in Egypt and Saudi Arabia are also facilitating large-scale standalone energy storage projects, although perhaps due to DNV’s explicit focus on renewable energy applications, these are not covered in the report in depth.

For example, Scatec’s recent 3.9GWh BESS deal with Egypt’s electricity utility and transmission operator EETC covered the output from two standalone BESS projects, although Scatec declined to provide further project details in response to an enquiry from Energy-Storage.news.

In Saudi Arabia, some of the world’s largest BESS projects were recently inaugurated, totalling 7.8GWh of capacity across three sites in Najran, Khamis Mushait, and Madaya, with BESS technology provided by China’s Sungrow, working with local EPC Algihaz. At the beginning of 2025, a subsidiary of Power Construction Corporation of China (PowerChina) brought online a 500MW/2,000MWh project, Bisha BESS.

This came shortly after the government of Saudi Arabia revealed the bidders in an 8GWh BESS procurement in early January last year, while other notable developments include a 12.5GWh BESS supply deal between TSO Saudi Electricity Company (SEC) and BYD, and Hithium receiving another SEC order for 4GWh.

MENA has been less impacted by grid bottlenecks than many other global markets, both in terms of grid expansion and in project connection, according to the DNV report. DNV forecasts that by 2035, installed solar PV capacity will not be affected by grid bottlenecks, whereas compared with Europe, this will result in a 16% reduction in solar capacity. DNV does warn that by 2035 grid could become a bottleneck if expansions and upgrades do not match the growth of renewables.

This story first appeared on PV Tech.

Additional reporting for Energy-Storage.news by Andy Colthorpe.

Our publisher Solar Media, part of Informa Markets, will hold its inaugural Energy Storage Summit Middle East in Dubai, UAE, on 7-9 April, 2026. It will be co-located with Informa Markets’ Middle East Energy Show. ESN Premium subscribers can get an exclusive discount on ticket prices. See the event website for more information and tickets.