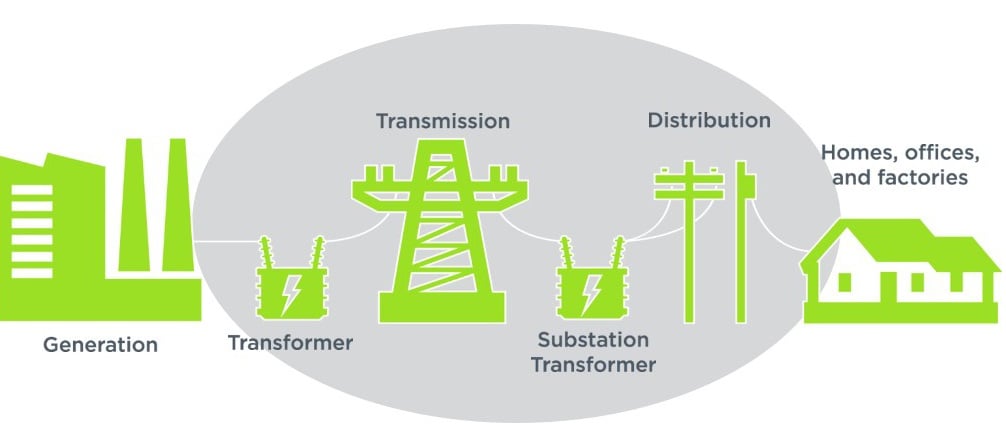

In part 2 of a technical paper first published in PV Tech Power Vol.13, Alex Eller of Navigant Research continues his look at how one of the most significant expenses for electric utilities, maintaining and upgrading transmission and distribution (T&D) networks, could be undercut using non-wires alternatives – including energy storage.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Risk aversion hinders widespread adoption

Despite the advantages and growing popularity of NWA (non-wires alternatives) programmes, significant barriers remain to more widespread adoption. As with many new electrical grid technologies, the level of confidence utilities have in the new programmes is crucial. Although early results have been promising, many utilities do not yet have enough faith in NWA programmes to overcome the traditional preference and expertise with T&D investments. This lack of faith is the result of both an institutional resistance to change within many organisations and the fact that prevailing rate recovery mechanisms for utilities typically do not encourage alternatives and innovation. If there is no regulatory pressure in place, there are few reasons why a utility would pursue an NWA. There is a higher perceived risk associated with these types of short measure life projects compared to a traditional equipment upgrade that is built to last 20 years or more. In addition, a T&D upgrade aligns with the historical experience of a utility. Thus, they may be more comfortable implementing a poles and wires upgrade.

Much of the hesitation to embrace NWAs stems from the challenges with engaging customers and being able to effectively guarantee a necessary amount of load reduction. Investments in energy efficiency, DR and solar PV have proven effective at reducing load in select areas; however, they do not guarantee the level of reliability and control that utilities demand. Although customers may typically respond to a DR signal to reduce demand, they often can override that signal and continue their normal operations. Due to this inherent unreliability, new technologies such as distributed generation and energy storage have emerged as more expensive but advantageous components of an NWA portfolio.

The increasing popularity of energy storage in NWA programmes and as a single-technology alternative to conventional T&D investments stems from the reliability and flexibility of storage systems on the grid. Utilities prefer direct control over critical assets that are used to serve peak demand and ensure the capacity of grid infrastructure is not exceeded. As a result, energy storage is typically seen as a more reliable form of load reduction compared to NWAs composed of customer-side DER. Centralised, utility-scale energy storage systems (ESSs) in particular fit more with traditional utility investment models and technical expertise. ESSs provide added flexibility with the variety of services they can provide when not needed to support T&D infrastructure, including frequency regulation, voltage support, spinning reserves, outage mitigation and effectively integrating renewable generation.

Another advantage of energy storage is that the technology can be sized appropriately to meet grid needs and can be sited in numerous locations to deliver maximum benefits—either in front of customers’ meters on the T&D grid or behind-the-meter (BTM).

Transmission-level ESSs designed to relieve congestion have been relatively rare to date due to the large storage capacity required to alleviate these issues. Distribution-level ESSs have been the most common type of T&D deferral projects to date. These systems are frequently built at substations or specific points of congestion on the distribution grid to defer investments and improve reliability by isolating outages. Many distribution-level systems have been relatively small pilot projects initially, but utilise modular designs allowing for storage capacity to be expanded over time.

BTM energy storage to defer T&D investments is more complex and dynamic than transmission or distribution-level systems, although it has the potential to be far more disruptive to the industry. BTM energy storage for T&D deferral includes systems located in both C&I and residential buildings that utilise advanced software and virtual aggregation to provide targeted congestion relief for grid operators. The primary advantages of BTM storage providing T&D deferral are potentially lower costs to utilities and the ability to offer more visibility and control at the edges of the grid.

BTM storage for these applications is currently a nascent market, with several key challenges including:

• Relatively high upfront costs for customer acquisition in some situations

• Small amount of storage capacity per system

• Concerns regarding the reliability of load reduction with customer or third-party owned systems.

Momentum evident, despite barriers

As with NWA programmes in general, there are several barriers standing in the way of energy storage being widely used to defer T&D investments. Despite recent advances, the technology and market remain quite new and immature, resulting in a conservative approach from often risk-averse utilities. Fully understanding and analysing the value of these energy storage projects is also challenging as the complex nature of the technology –including its ability to provide multiple services at different times – is not captured in many grid modelling and simulation systems. Furthermore, there is a major variation in the costs to upgrade T&D infrastructure. Energy storage and NWAs are typically only a cost-effective alternative when T&D projects face high costs due to challenging terrain, population density, real estate costs, weather constraints and other issues.

While barriers to widespread growth remain, both NWAs and storage-specific projects to defer T&D investments are gaining significant momentum with a variety of new projects being developed around the world. In addition to the NWA projects already discussed, energy storage projects for T&D deferral are growing in popularity and have recently been announced in Arizona, California, Massachusetts and Australia. These new projects are utilising several different business models to match the necessary technical and financial solutions with a customer’s needs and available resources. The innovations happening in this market are helping drive the overall transition to a more intelligent, dynamic and distributed energy system the promises to improve efficiency, empower customers, and reduce environmental impact.

Read Part 1. of this technical paper on the site here.