People that are sceptical of the ability to decarbonise the energy system are often simply not aware of the solutions that already exist. One major example of this is how the renewable energy and energy storage industries are rapidly adding digital capabilities to control how their resources interact with energy markets.

Smart software and artificial intelligence (AI) can forecast everything from how much electricity will be generated and when it will be generated, to the right strategies for putting that electricity into different market opportunities.

When Advanced Microgrid Solutions (AMS), one of the pioneers of adding digital capabilities to batteries, was acquired by energy storage technology provider and system integrator Fluence in October last year, it cemented a relationship between the two companies going back to 2019.

At the time the acquisition was announced, AMS CEO Seyed Madaeni, who is now Fluence’s chief digital officer, explained in an interview with Energy-Storage.news that AMS had focused on building AI and machine learning capabilities to optimise and operate assets in wholesale electricity markets.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Meanwhile Brett Galura, Fluence’s chief technology officer, told the site that energy storage is “the first truly digital asset that you can put on the electric network”. A lot of what has been learned about digitally controlling energy storage could be applied to the wider electricity system.

Fluence is initially utilising these new-found capabilities in two major markets: the California Independent System Operator (CAISO) wholesale markets and in the National Electricity Market (NEM), which covers much of southern and eastern Australia. In California, Fluence is already working with one of the world’s largest battery storage systems, optimising the 182.5MW / 730MWh Moss Landing Battery Energy Storage System (BESS) for utility Pacific Gas & Electric (PG&E).

In Australia, the company announced earlier this month that it has rapidly expanded on AMS’ existing portfolio of traded assets, adding 1.5GW of NEM assets since October, including around 20% of all solar and wind capacity being traded in the NEM.

Former AMS chief commercial officer Matt Penfold, an Australian based in the US who is now Fluence’s VP of business development for digital spoke with Energy-Storage.news to explain how this rapid expansion happened and what it means for the role of digital platforms like the Fluence Trading Platform in the energy markets of today and tomorrow.

Since the acquisition, Fluence has been able to grow AMS’ portfolio quite rapidly. Is that partly to do with being under the Fluence brand and the opportunities that has brought, or it is more that it’s bringing scale to what you were already doing, as AMS?

As AMS, we pivoted the business from behind-the-meter deployment of commercial and industrial (C&I) batteries to focus instead on optimisation of front-of-the-meter battery and renewable assets via an AI and operations research-type approach. We basically grew the business from an idea to the point of operating about 2.2GW of assets at the time that Fluence acquired us. It took us two or three years to get to that point and we’ve now added 1.5GW of resources to the platform in eight months since the acquisition.

The acquisition has lent us a lot of great resources, team members, a great brand that’s been incredibly helpful in terms of adding credibility to what was previously a small little software company. We’re now affiliated with two of the biggest industrial powerhouses in the electricity sector.

At the end of the day though, customers will only buy the product if it’s useful and adding value. I think the product’s really hit its stride in the last 12 months, particularly for our wind and solar customers, who in markets like Australia are avoiding negative prices and local grid constraints through an optimised bidding approach.

The interesting thing about this technology is that it’s not just applied to batteries, you can also add up to 10% revenue versus a manual trading approach for standalone wind and solar in competitive electricity markets. That’s really testament to the great work that our software team and data science teams have put into building this product, which can really increase the revenues and they’ve added large utility-scale assets quite substantially.

Software is really the key to that decarbonisation that we all hope for, that will occur over the coming years and decades.

There are other optimised bidding and trading platforms out there from some of the other big players in energy storage. Tesla has Autobidder, and Wärtsilä has Intellibidder, to name just two. What are some of the digital technologies and strategies that you use on the Fluence Trading Platform that make it a competitive choice?

At the highest level, our sales pitch would be that our trading software will make you more money than anything else in the market. That is represented by a metric we refer to as ‘percent of perfect’ (PoP) foresight.

The way to think about battery operations in competitive wholesale markets, is that if you look back over a period of time and look at the market prices that materialised, there is a theoretical maximum amount of revenue that a battery can achieve across all of the available market products, energy and ancillary services. Our software will achieve 80% to 90% of perfect in actual live operations. And this is optimising across all those available market products.

Ultimately, that’s what our customers care about and we obsess over refining and improving this metric of PoP. That’s our North Star for improving the algorithm, regardless of what type of asset we’re optimising.

Sitting below that, though, there’s a whole set of web user interfaces and we take cyber security extremely seriously given the sector that we’re operating in. There’s a lot of data that gets aggregated that our customers benefit from seeing and that comes through in our reporting.

So there’s a whole raft of supporting infrastructure there alongside the software, but ultimately, it’s the financial performance that tends to be what our customers care about, as they make these investments of tens or hundreds of millions of dollars in these large infrastructure assets that we’re helping them to optimise.

In some parts of the world, particularly the UK, we increasingly hear that the growth of energy storage is linked to the availability of merchant revenue opportunities. Moving away from long-term contracts for delivering specific grid services to a more nimble approach that chops and chooses to deliver the services that have the highest value. While this can offer asset operators the chance to maximise their revenues, it can make it more difficult to get things financed, because you obviously don’t have the long term visibility into what the revenues will be over time. Is there a role for things like the Fluence Digital Trading Platform, in enabling new assets, whether that’s through financing, or giving project partners the confidence that the asset will be able to generate revenues?

Generally, we leave that work to industry consultants who are pretty well placed to do that type of revenue forecasting and provide an impartial third-party perspective. But that being said, we do have all the tools needed to take a forward curve and use that to project the hourly or sub-hourly dispatch of the potential battery resource over a 15 or 20 year project lifetime and from there, what we essentially get then is a theoretical maximum revenue projection for the battery. We can then overlay that percent of perfect concept to get to an estimate of the merchant revenues.

A core part of our battery sales efforts is to provide those tools and perspectives to customers. But at the end of the day, in terms of getting finance, we’re invested, or I guess you could say conflicted, in developing those perspectives. So we’ve invested a lot of time in Australia and California and other places, in helping industry consultants get up the learning curve and build the tools themselves to do this type of analysis.

At the end of the day, we think that’s good for the industry if there are impartial third parties who are offering those perspectives to developers and financiers, because I think that’s really central to getting more batteries built and getting that transition in the energy grid that we all hope will happen.

In the Australian market, or rather Australia’s NEM, it sounds like there are a few available opportunities, such as the eight different frequency control ancillary services (FCAS) markets which are pretty lucrative. What are the opportunities like in Australia at the moment, not just for merchant battery storage, but for these smart traded assets in general? We understand there are future opportunities such as fast frequency response (FFR) that the Australian Energy Market Operator (AEMO) is looking to roll out too.

Well, if you take the example of California, there you see maybe half of the revenue required to build a battery coming from capacity market-style products. In California, that’s called Resource Adequacy, essentially a fixed payment that the battery gets for sitting there.

There’s not a lot of that in Australia, which is, I think it’s been challenging for developers and financiers to get their heads around financing batteries. for example, the Hornsdale Power Reserve battery has made AU$105 million (US$81.23 million), since its conception four years ago, give or take a few million.

Around AU$95 million of that came from frequency control ancillary services, so that AU$105 million is the merchant revenues. In addition, that project received a capacity payment from the South Australian government but that was substantially less than the merchant revenues.

Whereas if that battery was in California, 40% – 50% of the revenues would come from Resource Adequacy, which is a fixed payment. You can throw debt against that and it makes it a lot easier to build a battery in a market where you have that type of capacity market structure.

So Australia, being more focused on merchant revenues, there are a few government procurements, a few for distribution-connected batteries. There are some network service agreements that can provide the battery with a fixed payment in exchange for discharging at certain times of day to provide the grid with some support. But by and large, as developers try to get their heads around the business case for batteries, and network support agreements and other capacity payments are pretty few and far between, it’s really that merchant business case, which can be made a bit easier if it’s someone like a AGL or EnergyAustralia, the big (utility genrator-retailers, aka gentailers) thinking about batteries in the context of their portfolio.

That portfolio hedge does provide some extra benefit beyond the merchant revenues but it has been challenging and we’ve only seen five large-scale batteries get built between 2017 and today at the utility-scale in Australia. I think quite a few developers are starting to crack that now and we’re seeing a few more batteries come into the market later this year.

But I think it would be really wonderful if we saw — and I know the Australian Energy Market Commission (AEMC) is working on this — to get some more market products in place to reward batteries for the services that they can provide. Things like fast frequency response, or fast ramping capacity payments that we see in other markets [that are] really incentivising and accelerating the adoption of batteries to support the retirements of conventional resources that are inevitably coming.

The NEM is changing its settlement periods from 30 minutes to five minutes, which is being introduced this October. Will that be a game changer and does it bring the fast-responding capabilities of battery storage into a position of competitive advantage over fossil fuel generators like natural gas, which are much slower to respond to grid and market signals?

We’ve got a whole software change roadmap in place and we’re getting ready, counting down the days until October this year when the change goes live and and all generators and storage bidding into the NEM will now be paid based on the five minute price as opposed to the 30 minute average price, which it’s been using since the NEM’s inception 20 years ago.

A storage resource which can run in a matter of milliseconds, or inverter-based solar resources, are able to move really flexibly. Whereas if you’re running a combined cycle [gas turbine] or a slower moving unit, it’s tougher. You have minimum run times and ramp up times, for which you need to prepare well in advance and have the asset up and running in terms of making unit commitment decisions that can be 12 hours in advance.

That’s obviously not something we need to do with a battery. It’s ready to go in a matter of milliseconds.

So not only the batteries’ ability to respond but also the software platform’s ability to make automated bidding decisions quickly seems valuable. What are some of the other dynamics that could drive adoption of these digital capabilities in tandem with clean energy technologies in Australia?

There’s increasing potential to avoid the impact of negative pricing, which happens as decarbonisation accelerates and there’s an abundance of renewable energy on the grid at certain times of the day. In South Australia, five years ago negative pricing was relatively unheard of. This past summer, the energy price was negative 20% of the time! It’s more pronounced in South Australia, but we are also seeing negative pricing events across the entire NEM in states like Victoria and Queensland in particular.

If you’re operating a conventional power plant, and paying to generate in all those negative price times, it becomes very challenging, versus if you have a battery and get paid to charge that’s a pretty substantial advantage you have as to owning a flexible asset. So, times are changing and storage and algorithmic trading seems like a healthy way to adapt to that change.

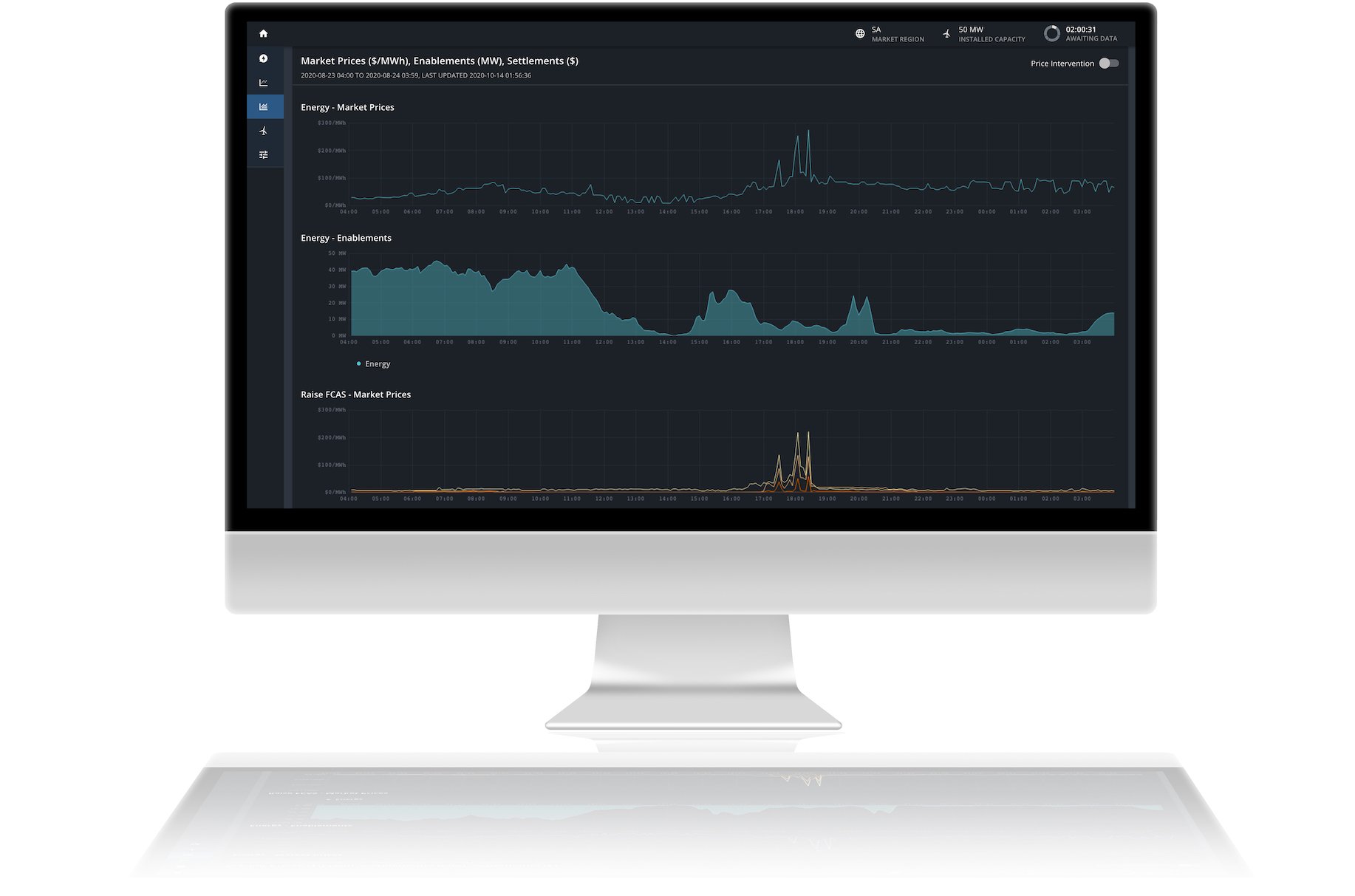

Cover image: Sample screenshot of the Fluence Trading Platform. Image: Fluence.