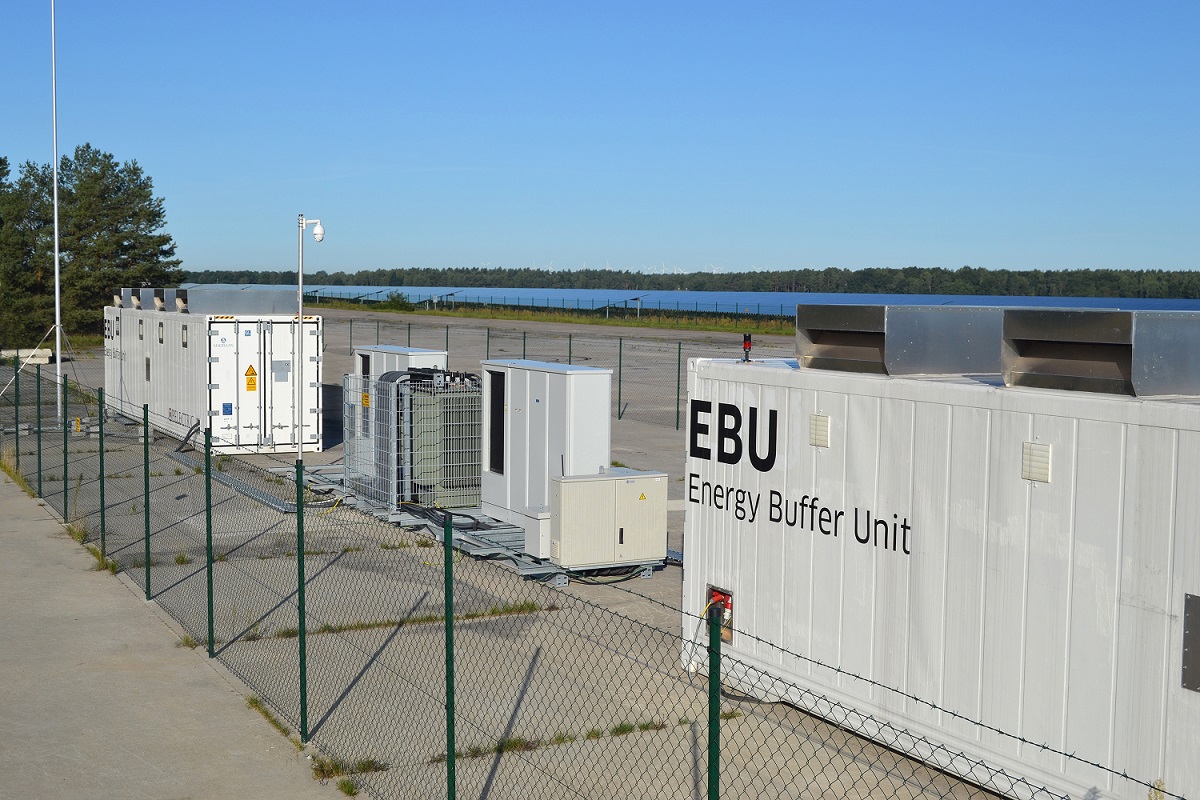

Belectric has developed PV plants on every continent of the globe except Antarctica and is the third largest O&M provider for PV in the world. The company also delivers energy storage system projects and offers a wide range of energy storage solutions including in-house battery systems, turn-key large-scale battery storage as well as scalable container solutions, called the Belectric EBU (Electric Buffer Unit). The company also offers hybrid and off-grid solutions. After being owned by four families since its inception at the beginning of this century, the company was sold to European mega-utility RWE’s majority-owned green energy subsidiary Innogy in August last year. Managing director of Belectric Solar and Battery, Frank Amend, spoke to Energy-Storage.News about the acquisition and where the company sees energy storage (and solar) going.

How has the takeover by innogy changed things for Belectric and what’s the focus of Belectric for the near future?

Innogy has a sizeable renewables portfolio. However, innogy was still lagging behind in the field of utility-scale photovoltaic power plants. Together we now close this gap. With Belectric there was a very good fit in terms of strategy, personalities and aspirations. Belectric convinced innogy with an impressive track record and a great team. In the past, Belectric was able to expand successfully to new markets in Asia, Middle East and the Americas. A lot of other companies have struggled with this expansion. Going forward we would like to grow beyond the scale of what a medium-sized company can do on its own. So we at Belectric needed to have a stronger balance sheet, this is where innogy is coming in. Innogy has ambitious plans to develop, build and operate utility-scale photovoltaic power plants with Belectric as EPC (engineering, procurement, construction) and O&M (operations and maintenance) provider. At the same time, Belectric will continue to build out these services for third parties. From Belectric’s perspective we have gained a great new EPC customer and partner with innogy that has ambitious plans to grow in the field of solar PV.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

So was it the technologies of Belectric, the company’s expertise, or a combination of both that convinced innogy?

It’s the whole package. With over 285 PV power plants in many different regions of the world Belectric is one of the most experienced PV companies. Our experts bring strengths to the new partnership that complement innogy’s know-how in project development, project and asset management in the field of renewables. Belectric is very strong on technology so it’s not just another PV box shipper that is ordering some PV panels, putting it together and hoping for the best. Belectric builds highly reliable PV parks delivering high performance ratings. We also know how to play the logistics chain. If you want to enter into new countries, you need to combine international logistics, local content, and investors which like the particular risk profile of that country. Our technical expertise and the wide network we have in the industry on a global scale, was attractive to innogy.

A few people said at the recent Energy Storage Europe show in Dusseldorf that one of the most exciting markets for energy storage at the moment is the UK, along with Germany and Italy.

The UK is of great interest. I think when you look at grid infrastructure, it seems the UK – as a comparatively large country – is a little underinvested. You have places for example in Wales where only a few people live at the very ends of the grid connections. In terms of putting batteries into the grid, there’s an opportunity. But also the UK in general is very committed in pursuing their renewable targets so there is a strong commitment in phasing out coal; we have had summer days when no coal plants were running. The grid operator faces new challenges in ensuring reliable and safe grid operations. Belectric has participated in the EFR (enhanced frequency response) tenders and is contributing to research projects of National Grid that look at the power system with less and less thermal generation capacity.

Today most frequency and reserve services are tailored to a thermal generation portfolio. Fast response frequency services reflect the dynamics of pump hydro stations, the medium response services match the dynamics of CCGTs (combined cycle gas turbines), whereas the slower response services can also be fulfilled by stations with slower ramp rates. National Grid is asking the obvious question – why these services allow 30 seconds before the fast frequency response needs to be up and running.

Why wait 30 seconds? Why not just say, I’ve detected there’s a problem and I can instantly instruct my batteries to do some mitigating efforts on the grid. You do not have to wait until the plant has actually disconnected from the grid and you might have lost a considerable amount of capacity, only to then ramp up with everything you have to balance the grid again. You can be much smarter about it. If you see there is a wobble with a large power station you can instantly kick in with the batteries to smooth it out, and this is something for which batteries are of great use for. I think the UK is quite advanced in their thinking on this. National Grid is pushing some very interesting ideas that will likely become templates for other countries as well.

The EFR tender in particular is all batteries that won the 200MW of contracts and they will mostly be lithium-ion. Do you have a view on the competition between battery chemistries?

It’s very dependent on the primary use cases the customers have in mind. Is it power and energy which is in focus? Belectric has systems in the field with a number of technologies addressing different customer requirements. Belectric is not dogmatic on prescribing lithium-ion [batteries], which are great for certain applications, but not for all. For the UK frequency response market batteries with high c rates, lithium-ion is the technology of the day. For other applications where you need more energy and less capacity we use different technologies, so I’m very easy on that. Belectric is not a cell manufacturer after all!