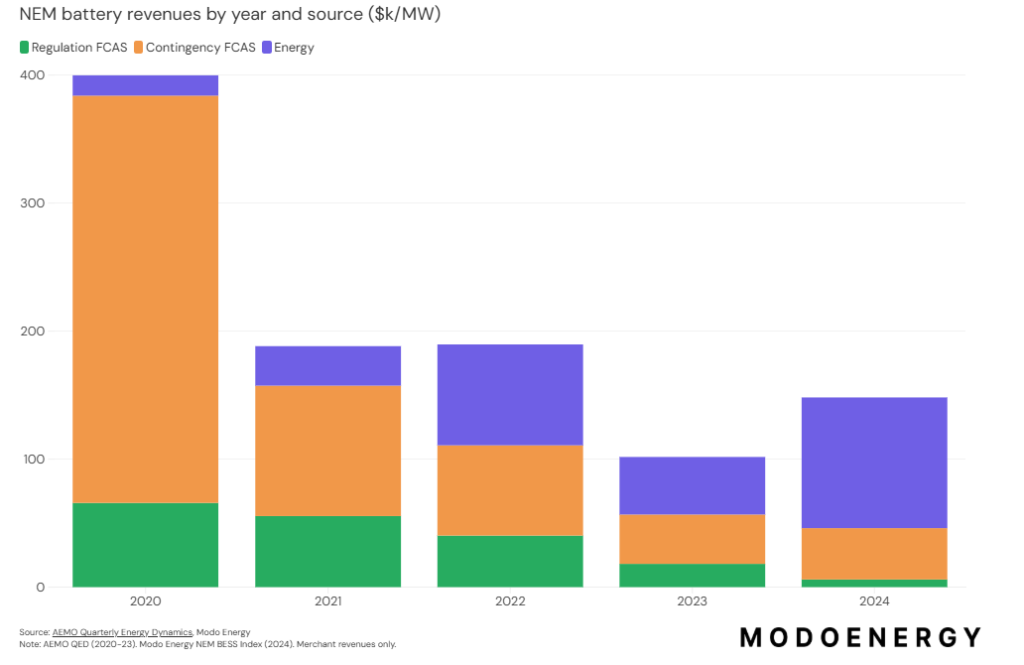

UK-headquartered energy industry data platform Modo Energy has said that battery energy storage systems (BESS) in Australia’s National Electricity Market (NEM) earned an average of AU$148,000/MW (US$92,810/MW) in 2024, a 45% increase year-on-year.

Modo said that these revenue figures followed market trends witnessed across the past several years, where revenues from Frequency Control Ancillary Services (FCAS) markets dropped. This drop was offset by energy trading revenues, which more than doubled to AU$102,000/MW from 2023 to 2024.

The energy industry data platform claims that one of the primary reasons for the fall in FCAS revenues is a collapse in the value obtained from regulation FCAS. Despite this fall, contingency FCAS revenues actually increased slightly due to batteries providing contingency FCAS services at very high prices.

In contrast to a fall in FCAS, revenues from energy reached an all-time high, increasing by 29% compared to the previous record set in 2022. This surge was primarily driven by a rise in extremely high prices, which led to larger price spreads. In 2024, the price spread captured by batteries was 72% higher than in 2023.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Overall, 50% of the net revenues generated by batteries trading energy came from selling power when prices exceeded AU$3,000/MWh. You can find a breakdown of NEM battery revenues by year and source below.

The top performing BESS in the NEM was Genex Power’s 50MW/100MWh Bouldercombe battery in Queensland, which earned AU$336k/MW over the year, 227% above the average. At the opposite end of the spectrum, EnergyAustralia’s 30MW/30MWh Ballarat BESS in Victoria earned AU$48k/MW, 33% of the average.

Wendel Hortop, director of Australia at Modo Energy, exclusively told Energy-Storage.news that one day in particular, 5 August, accounted for 11% of the entire average revenue.

“That was the only day when prices reached well above average at around AU$10,000 up to the cap in all four of the big states,” Hortop said.

Hotrop explained that this increase was due to a combination of very low wind output, relatively low solar output, and a number of coal plant outages – a triple effect that hit the entire NEM.

Longer-duration systems see increased revenue

The top five best-performing BESS assets on the NEM included Bouldercombe, the 25MW/52MWh Lake Bonney BESS in South Australia, TransGrid’s 50MW/75MWh Wallgrove battery in New South Wales, Shell’s 60MW/120MWh Riverina 1 BESS in New South Wales, and the 100MW/150MWh Wandoan South BESS in Queensland.

Each of these systems is also longer in duration than average. Bouldercombe, Lake Bonney, and Riverina 1 are two-hour systems, while Wallgrove and Wandoan South are 1.5-hour duration. In general, the longer a battery’s duration, the higher its revenues in 2024, Modo said.

A rise in revenue for longer-duration systems coincides with previous research conducted by Wood Mackenzie, which said last year that 4-hour battery systems would be more profitable in the future than the typical 1.6-hour duration of projects operating currently.

Wood Mackenzie’s research outlined that a 4-hour battery that starts operations in 2026 is projected to generate an average annual revenue of AU$263,000/MW over its lifetime. Batteries in Queensland are expected to lead at AU$281,000/MW.

Previous research by Modo indicated that the capital expenditure (CAPEX) for 4-hour batteries is expected to decrease by 20% by 2030, making investments in this technology more economically attractive.

Big batteries spur growth on the NEM

This new research by Modo complements its findings within the 2025 NEM Battery Energy Storage Pipeline report, which found that the NEM is expected to see a ninefold increase in BESS capacity in three years, around 16.8GW.

Much of this forecast growth is being spurred on by larger-sized batteries. Modo said that 20 projects with a capacity of 300MW or greater, around 50% of the development pipeline, will be switched on by 2028.

One of the largest of these projects is the 2.8GWh Eraring power station development being pursued on the site of New South Wales’ largest coal-fired power plant. Australian utility Origin Energy is pursuing the project, which has been divided into three stages.

The Eraring BESS is hoped to be fully operational by the end of 2027. Stages one and three will be completed in the final quarter of 2025, followed by stage two in 2027.

Modo also noted that the duration of batteries is expected to be longer in duration, shifting from an average of 1.5 hours to 2.5 hours by the end of 2027.

Despite this potential growth for BESS on the NEM by 2027, Wendel Hortop told ESN Premium recently that there remain “big question marks” over large-scale BESS commissioning schedules in Australia’s NEM.