The Australian Energy Market Operator (AEMO) has said in a new report that the National Electricity Market (NEM) has seen energy arbitrage revenues for battery energy storage systems (BESS) surge by 97% year-on-year (YoY) to AUS$25.4 million (US$16.39 million).

Detailed within the organisation’s Quarterly Energy Dynamics Q2 2024 report, increases in arbitrage revenues from energy trading were underpinned by a 117% uplift in energy revenues which stood at US$22.6 million for the quarter, including revenue from charging at negative prices, showcasing the increasing volatility the NEM is witnessing in Australia.

This was more than enough to offset a major increase in energy costs of 155%, or AU$10 million, from the same period of 2023, AEMO said.

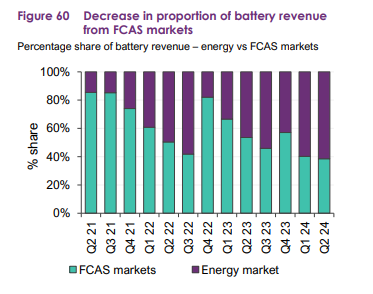

Indeed, energy trading continues to become a larger proportion of the revenue stack for battery storage systems than revenue secured through frequency control ancillary services (FCAS), a type of service controlled by the AEMO designed to secure the security of supply and prevent blackouts and power failures.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Total estimated net revenue for NEM grid-scale batteries this quarter was AUS$41.2 million, an increase of AUS$13.6 million from the AUS$27.7 net revenue earned in Q2 2023.

AEMO’s report revealed that FCAS revenue increased steadily YoY, with an increase of AUS$1.1 million, around 7%. However, this ultimately led to a YoY decrease in the proportion of overall revenue deriving from the FCAS market, with it down 39% in the quarter compared to Q1 and down from 54% in the previous year.

As seen in the graph, Australia’s NEM, which covers the south and east of the country, has become an increasingly volatility-oriented market for BESS owners. Since Q2 2021, when energy market trading stood at less than 20%, it has grown to take up a much greater market share, around 60%.

Research conducted by Rystad Energy last year (October 2023) revealed that, amongst the 39 global electricity markets, NEM was identified as the “most volatile”, with the organisation stating that there was an urgent need for energy storage to mitigate this.

Drivers of the volatility being seen are primarily due to outages at coal power plants, the impacts of natural disasters on transmission infrastructure and the increasing penetration of variable renewable energy on the grid, mainly from solar PV. As such, Rystad concluded that by 2050, balancing the NEM will require 46GW/640GWh of energy storage.

It is worth noting that the volatility seen in the NEM is attracting international companies seeking to ply their trade in Australia. For example, as reported by Energy-Storage.news in 2022, Ireland-headquartered smart energy company GridBeyond entered the market, citing growing electricity supply volatility and the rising demand for distributed energy solutions in Australia as amongst their motivations.

New South Wales leads net revenue margins

From amongst the states connected to the NEM, including Victoria, Queensland, New South Wales (NSW), South Australia and Tasmania, NSW’s BESS assets captured the highest net revenue, around AUS$13.4 million – a 341% increase compared to Q2 2023’s AUS$3 million net revenue margin.

Of this figure, around AUS$11 million came from energy trading and AUS$2.4 million from FCAS markets.

The second-highest increase in net revenue figures came from Queensland, which saw a jump from AUS$4.7 million in Q2 2023 to AUS$10.3 million in this quarter. Most of this revenue, at AUS$6.7 million for the quarter, arose from contingency FCAS revenue.

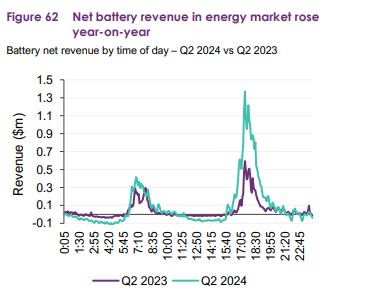

There was also a YoY increase during the morning and evening peaks in this quarter. This increase is driven by the availability of additional batteries and higher spot prices. However, higher energy costs associated with charging offset the increased revenue earned when charging at negative prices (+AUS$0.5 million), resulting in a decrease in net revenue outside peak periods.

Pumped hydro energy storage net revenue sees a vast increase

Alongside battery energy storage, pumped hydro energy storage (PHES) saw quarterly revenues rise by AUS$22.4 million year-on-year, representing a 76% increase.

The increase in spot prices corresponded to that rise, especially due to spot price fluctuations in NSW. Shoalhaven, a 240MW project, saw revenue from prices exceeding AUS$300/MWh, up AUS$14.9 million, around 468%, to reach AUS$18.1 million this quarter. Overall, Shoalhaven’s estimated net revenue was AUS$24.4 million, marking an AUS$17.1 million (235%) increase YoY.