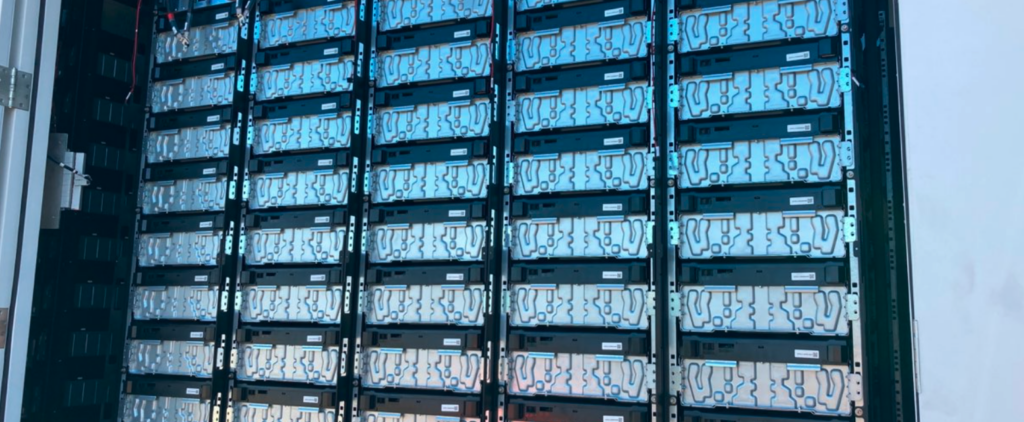

Canadian-headquartered developer-operator Aypa Power announced successful close of a US$398 million financing package for its 250MW/1,000MWh Pediment BESS project in Arizona.

Located in Mesa, the Pediment BESS is expected to become operational in 2026. Investor-owned-utility (IOU) Salt River Project (SRP) has a 20-year tolling agreement with the project.

Announced 11 December, the financing package includes a construction-to-back-leverage loan, tax credit transfer bridge loan, and letters of credit.

French bank Société Générale led the financing group with ING Capital and Bank of America as coordinating lead arrangers. Zions Bancorporation, Royal Bank of Canada and Canadian cooperative financial group Desjardins Group acted as joint lead arrangers. ING Capital also served as green loan coordinator while Zions Bancorporation acted as Administrative Agent.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Aypa Power and SRP also signed an agreement in July, giving SRP full dispatch rights to Aypa’s Signal Butte, a 250MW/1,000MWh BESS project.

SRP has made a streak of deals recently, announcing the 200MW/800MWh Flatland Energy Storage Project in mid-November, and in October, partnering with Danish renewable energy company Ørsted on the 300MW/1,200MWh Eleven Mile Solar Centre.

SRP uses an Integrated System Plan (ISP), rather than a traditional Integrated Resource Plan. The ISP looks to address stakeholder concerns while planning for regulatory and supply chain changes and outlines its roadmap to achieve net zero carbon emissions by 2050.

Aypa Power, previously NRStor C&I, before being acquired by Blackstone Energy Partners in 2020, when the company was renamed, previously focused on the commercial & industrial (C&I) market.

Since its acquisition, the company has focused on utility-scale energy storage deployment and hybrid renewable energy projects, making a series of high-profile deals in the years since.

IOU Southern California Edison (SCE) is seeking regulatory approval of resource adequacy (RA) contracts, the largest of which covers Aypa Power’s 400MW/3,200MWh Euismod lithium-ion BESS (Premium access article).

Aypa Power also negotiated two RA agreements with California IOU Pacific Gas & Electric (PG&E)(Premium access article), in early-November, covering 500MW/2,000MWh of energy storage from two standalone BESS projects located in California.