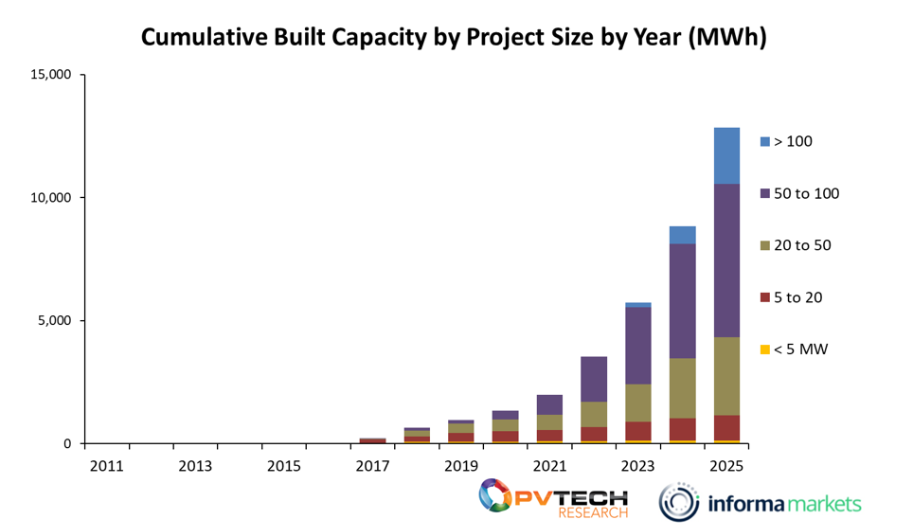

The UK grid-scale battery storage market grew 45% by operational capacity in 2025, with 4GWh coming online during the year, bringing total operational capacity to 12.9GWh.

The Clean Power 2030 Action Plan, released in late 2024, pointed to the urgency of increasing battery storage in the region, which developers are racing to fulfil and reap early benefits from this nascent market. The data showcased in this article comes from Solar Media Market Research’s Battery Storage: UK Pipeline & Completed Assets Database.

Over 4GWh of battery storage was completed in 2025, 30% more than in 2024, making it another record-breaking year in terms of operational capacity added.

However, as expected of a maturing market, the growth rate did fall slightly compared to the 53% seen from 2023 to 2024. There were also fewer sites completed in 2025 compared to the year prior. Larger capacity projects finally saw build-out, with the average size of projects increasing by 48% compared to 2024 to around 95MWh.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

In addition, over 75% of the capacity added in 2025 came from projects exceeding 50MW. Most of the operational projects (61%) are standalone sites, which are also more likely to have a higher capacity than co-located assets.

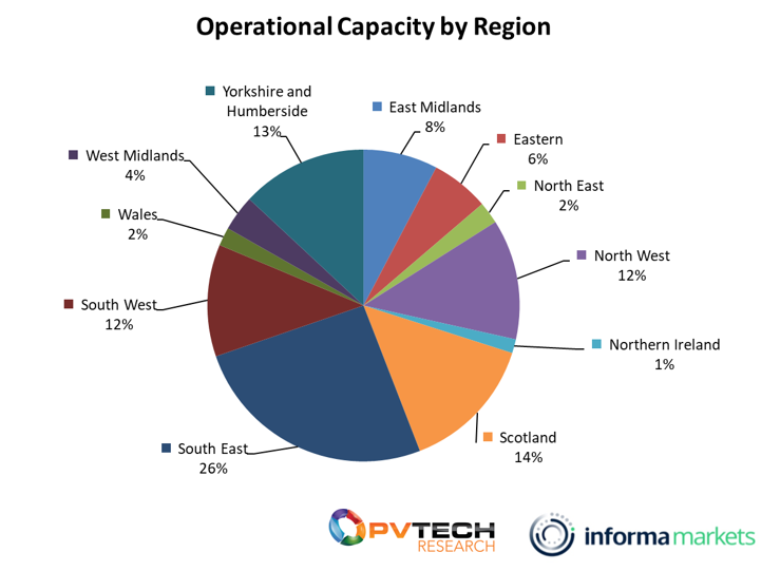

The South East region had the highest capacity come online in 2025 at over 1.4GWh and over 10 sites completed, which brings the cumulative operational capacity to over 3.2GWh.

The turbulent nature of revenue generation for BESS, particularly in the ancillary market, and rapidly changing government incentives mean that the UK battery storage market has yet to settle. However, the global uptick in battery storage interest and the falling price of batteries mean the market remains appealing to both developers and investors.

With numerous large-scale projects planned, the decline in growth rate in 2025 could be attributed to the market shifting into a new stage of larger sites rather than spelling a long-term slump.

The news comes ahead of the Energy Storage Summit EU 2026 in London, UK, on 24-25 February 2026 in London, put on by our publisher Solar Media. ESN Premium subscribers can claim exclusive discounts on ticket prices. See the official website for more details, including agenda and speaker lists.