Mini-grids offer a quick route to electrification in parts of the world where grid extensions are unfeasible. Baptiste Possémé, senior consultant at renewable energy market research and consultancy firm Infinergia, looks at the some of the technological and regulatory trends influencing the deployment of mini-grids in Africa and Asia. This article first appeared in Volume 22 of Solar Media's quarterly journal, PV Tech Power.

Strong developments have been seen in recent years in terms of global access to electricity as 800 million people gained access to electricity since 2010. However, 860 million people still lack access to electricity at the end of 2018 [1]. And 98% of them live in Africa and Asia.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Three main solutions exist to provide sustainable power to those populations: grid extension, solar home systems and mini-grids. The economical choice between those solutions is mainly a matter of distance to the grid, density of population and level of service.

Grid extension is the most classical answer but has several issues. It can be extremely expensive for remote communities and doesn’t necessarily offer a good quality of service (case of “bad-grid”).

Individual electricity generation systems such as solar lamps or solar home systems (SHS) are a very efficient way of providing a basic quality of service to regions with a low population density. SHS manufacturers and distributors such as BBOXX, Mobisol, Fenix International, Total or Schneider Electric have experienced a significant growth over the last years. However, those solutions usually power low power appliances and are usually used as transitional solutions.

Mini-grids, local and isolated networks, have started to gain momentum in the last five to 10 years. They can offer a lower cost than solar home systems in cases where population is dense enough and a similar quality of service than grid extension.

At Infinergia, we focused on 31 African and Asian countries where mini-grids are relevant for regulatory, historic or economic reasons. We also analysed the upstream mini-grid industry (component manufacturers and integrators), the regulatory frameworks of those countries and the associated projects.

Upstream industry’s main trends: technological innovation and containerisation

Mini-grids/Micro-grids/Nano-grids?

Vocabulary can be tricky, and it is difficult to find two definitions of mini-grids that are similar. Based on REN21, UNFCCC and ARE’s definitions, we choose to define a mini-grid as one or several decentralised energy generation sources with a combined peak power between 10kW and 10MW connected to multiple customers through a local network. Those systems are completely isolated from the main grid. If they are not, we call such a system a micro-grid. If the peak power is smaller (<10kW), we call it a nano-grid.

Most of those installations produce and distribute electricity at a community level (usually a village) but can also be used for commercial, industrial, military or agricultural applications.

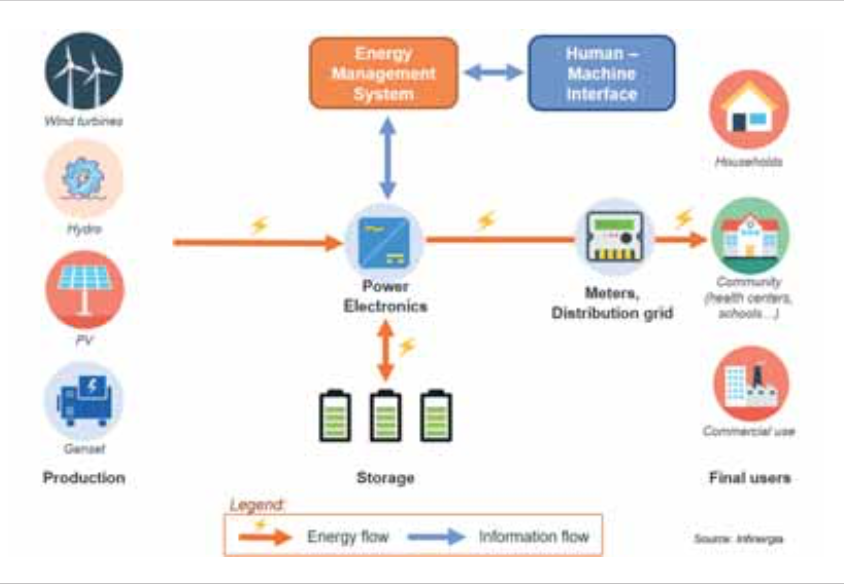

Even though the first mini-grids were solely based on diesel or hydraulic power, the drop in photovoltaic prices over the last 10 years has favoured the development of PV-based mini-grids. Now, the typical installation includes PV panels, batteries, a back-up diesel generator, an energy management system (EMS) and, of course inverters, meters and a local grid as illustrated in Figure 1 below.

Batteries: a key component for the total cost of the mini-grid

In a typical PV-based mini-grid the battery is the key component in terms of both CAPEX and OPEX. Concerning village electrification, the first requirement is reliability. The complexity of having a technician on site means most EPC choose a proven and low-cost technology. Therefore, for small to medium systems (e.g. less than one megawatt), lead-acid batteries are still the most commonly used technology today. They offer a lower cost per nominal kWh, are known and mainstream on the market and, as such, easier to maintain or to find spare parts. However, their high sensitivity to temperature and low depth-of-discharge plus low lifetime often make them the weak link of the system.

The harshness of most off-grid environments gives opportunities for innovation. Lithium batteries are more and more used for mini-grids and new storage technologies have been trialled over the last years (e.g. flow batteries, zinc-air, sodium-nickel, sodium-ion…) with varying success rates. According to several interviewed mini-grid developers and EPCs, there is still a need for a more reliable technology that could lower the systems’ total cost of ownership, even if only a handful of developers are willing to take the risk.

Energy management system: the system’s brain

The hybridisation of power sources (diesel genset, PV, batteries, hydro…) adds complexity to the system that must be managed by a local intelligence, an EMS that consists of a software and hardware control solution. Those systems vary broadly from controllers to local computers with forecasting and advanced optimisation algorithms. More intelligence is not always better. The mini-grid designer must find a compromise between efficient management of resources, a low cost and high resilience. For most projects, experience is key to determining the most relevant EMS for a given project.

Integration: the path to standardisation

Most mini-grids today are custom-made. Once the project is financed and the community’s needs have been established, an EPC is chosen to design the most relevant system. A specific room is then built to host the inverters and the batteries. Every component is assembled on-site by the local workforce.

While achieving a very low CAPEX, such solutions often have a significant failure rate. For instance, only 25% to 35% of the mini-grids installed in Senegal between 1996 and 2011 are still functional today [2].

New solutions have emerged over recent years to tackle this issue, such as containerised standardised systems in which every component is pre-assembled at factory (even the solar panels are bundled with a folding/unfolding system) and the container just needs to be transported on-site and unfolded. Those systems secure most of the hidden costs that often appear in custom-made projects (e.g. pieces missing, theft, the supply of various components, low quality of installation…).

On the other hand, they need a production scale effect to reduce their CAPEX. By analysing the main integrators’ projects (e.g. Redavia, Schneider Electric, Winch Energy, Africa Greentec…), we have identified 30 of such projects installed (not only rural electrification) representing 119 installed containers globally by end 2019 [3].

The regulatory framework for mini-grids is strengthening

At Infinergia, we have developed an indicator to compare the development stage of the mini-grid market over 30 countries. By analysing the regulatory framework [3], the announced and existing projects, the countries’ economic status and the local presence of mini-grid actors, we can compare, year after year, those countries’ evolution.

Mini-grids have grown in 2019 in Africa

Eight African countries (including Ethiopia, Kenya, and Nigeria) have reached a higher maturity stage [4]. Over 75 public tenders for mini-grid projects have been published in the last two years, new regulations framing the development of mini-grids were released (e.g. tariffs, subsidies, private operators licenses, possibility to connect the mini-grid to the main grid…). National targets for rural electrification have been defined and include the development of mini-grids (e.g. in Ethiopia and Nigeria). International funding to promote the development of off-grid solutions has been increased (e.g. FEI OGEF, International Solar Alliance, World Bank…).

Regulatory changes less visible in Asia

India still has the highest potential for mini-grids globally but lacks a better framework to move forward. For instance, a draft mini-grid policy was edited in 2016 but has not evolved since then. Myanmar, the Asian country with the lowest electrification rate, is considered by many as the most promising Asian country for mini-grids in the short term but still requires a more established framework to allow a full-scale development of its potential.

Projects: market potential but with high uncertainties

We have identified over 400 announcements, tenders, national or private targets, projects and installations, globally that represent altogether a potential for around 63,000 mini-grids by 2026 globally [4]. In order to characterise the level of certainty of those projects, we have decided to distinguish three main categories:

- Installed projects have been identified as such and should remain so in the next years. It should be noted that depending on the countries and developers, an unquantified part of those projects might encounter technical failures.

- Currently planned or in construction projects have been financed, tendered and most of the time awarded to an EPC. They have a very high probability of ending up installed (even though delays may occur compared to the announced commissioning date).

- National or companies’ targets are engagements (usually not completely financed) that have been made by companies or countries to develop a certain number of mini-grids, usually with no precise location identified. They show ambition but should be considered cautiously.

Considering those categories, two scenarios can be defined: a realistic (even a little pessimistic) one in which over 9,000 mini-grids would be installed globally (compared to 3,200 today), and an optimistic one where 60,000 new mini-grids could be built by 2026.

It is important to consider that only three countries (India, Nigeria and Myanmar) account for 95% of the national and companies’ targets. Their capability to translate those announcements into real projects will be key for the development of the market.

A strong future with short-term uncertainties

Even taking only into account our realistic scenario, we can estimate that the mini-grid market should at least experience a 20% CAGR over the next six years. The growth of this market is not limited by its potential or by companies’ and countries’ willingness to develop those systems but rather by technical and financial issues.

The business model for privately operated mini-grids has not been proven yet and most of the projects rely on national or international subsidies. They are therefore strongly impacted by political instability and international programmes. In 2019 for instance, 236 new projects have been identified as commissioned while 1,260 new ones have been planned.

Furthermore, the harsh environment for most mini-grids raises a need for more reliable solutions that can lower the project’s maintenance without increasing its CAPEX. New component technologies (e.g. batteries, EMS..) and new integration models (e.g. containerised standardised mini-grids) are the main drivers to solve those issues today.

References

[1] IEA. (2020, January). IEA. Récupéré sur https://www.iea.org/reports/sdg7-data-and-projections/access-to-electricity

[2] USAID. (2019, October). Off-Grid Solar Market Assessment – Senegal. Récupéré sur usaid.gov: https://www.usaid.gov/sites/default/files/documents/1860/PAOP-Senegal-MarketAssessment-Final_508.pdf

[3] ESMAP. (2020, January). Framework for minigrids. Récupéré sur RISE: https://rise.esmap.org/pillar/electricity-access/indicator/framework-minigrids

[4] Infinergia. (2020, January). Mini-grids for village electrification: Industry and African & Asian markets. Retrieved from www.infinergia.com: https://www.infinergia.com/en/mini-grid-market-report

Cover Image: Solar mini-grid developer Powerhive has been delivering projects into the “energy access space” since 2011. Image: Powerhive.

This article first appeared in Volume 22 of Solar Media's quarterly journal, PV Tech Power. You can download the whole 104-page book free of charge here, from the PV Tech Store.