Key to the rapid success and growth of the energy storage industry in the US, China and other maturing markets has been the presence of a small number of system integrators. IHS Markit association director Julian Jansen examines what it is that system integrators do that makes them so vital to the industry and why the future ahead looks to be one characterised by growth, competition and consolidation.

The global energy storage industry continues to rapidly expand, creating opportunities for new entrants and incumbents alike. As the market grows, many system integrators are evolving their business model to create a stronger competitive footing. To capitalise in the long-term, different stakeholders focus on growing share as the market accelerates. While this creates price pressure for incumbents, both upstream component suppliers and downstream developers are also looking at ways to diversify and protect their own margins. With the influx of capital to the industry, this creates the perfect platform for diverging competitive scenarios and a fascinating position to explore how the industry could develop.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Rapid growth, influx of capital set scene for an evolving competitive landscape

IHS Markit projects a tripling in annual grid-connected energy storage installations from 2020 to 2025, reaching 15.1GW/47.8GWh. At the same time, annual hardware revenues (battery modules, PCS and balance of plant) of US$4.2 billion in 2020 will rise to US$9.5 billion in 2025. This rapid acceleration is happening – despite a continuous decline in hardware prices – both for lithium-ion (Li-ion) batteries and balance of plant. This growth is accelerating competition across the industry and is driving the creation of a more global supplier landscape.

Despite some recent market consolidation, the industry is attracting significant investment. Targeting this market – and in particularly focusing on the role of system integrators – battery and component manufacturers, and increasingly major energy companies and technology conglomerates are joining incumbents in a highly competitive market. At the same time an influx of capital from investors looking to diversify into clean technology industries, is facilitating incumbents and new entrants to compete for market share through the industry’s next phase of rapid growth.

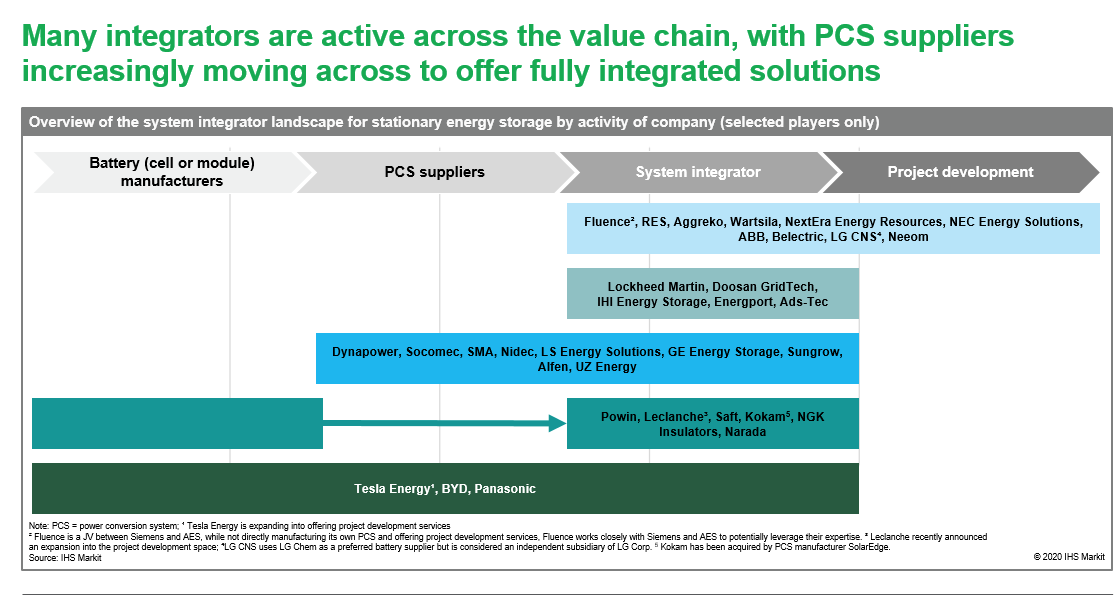

The competitive landscape is diversifying. With significant project pipelines dwarfing the existing installed base, energy storage inverter (power conversion system – PCS) manufacturers are expanding their presence targeting solar plus storage applications and existing integrators are challenging the incumbents. As Figure 1 highlights, there are many players active across individual or multiple segments of the value chain, with especially inverter (PCS) manufacturers moving across to offer fully integrated solutions.

There also remains a large degree of regional diversity in the market. As the energy storage market initially grew in selected regional pockets – California, PJM, the United Kingdom, Germany, South Korea, Japan, and mainland China – many local technology firms and new entrants targeted the segment. Following a first phase of acquisitions around 2017 and the development of new regional markets, an increasing number of global players is emerging. However, some markets such as Germany, South Korea and mainland China remain dominated by local players.

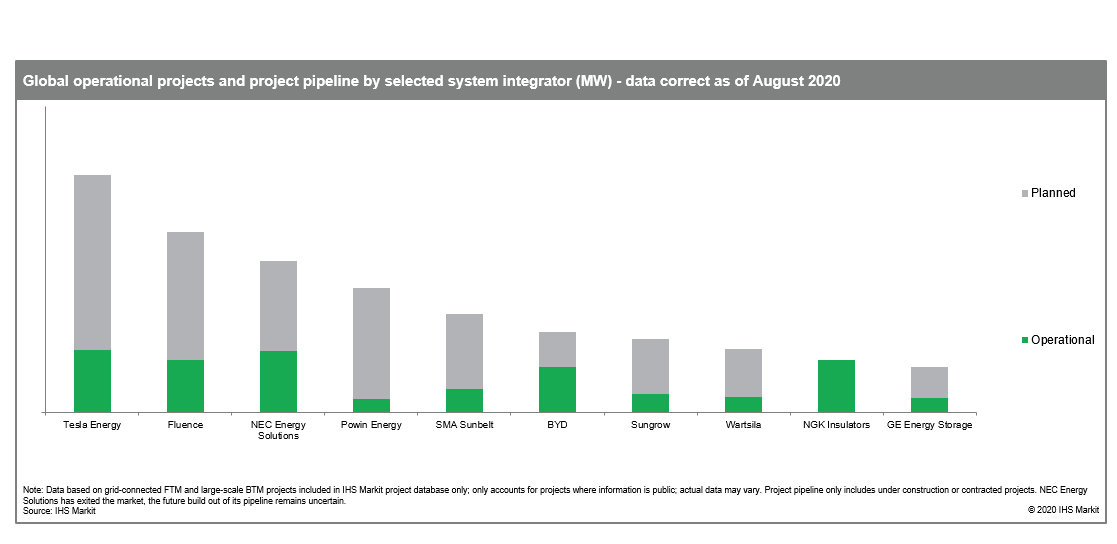

The system integrator landscape remains diverse, but market share is becoming more concentrated and signs of consolidation are appearing

Globally, Tesla Energy, NEC Energy Solutions, and Fluence have historically been the leading system integrators. In the future, the system integrator landscape will further diversify, primarily driven by energy storage inverter manufacturers expanding their presence, targeting solar-plus-storage applications and existing players such as Wartsila and Powin Energy targeting strategic opportunities to drive expansion. At the same time, there will also be consolidation—as illustrated by the recent market exit by NEC Energy Solutions— particularly challenging smaller, regional players. Major system integrators are globalising and can offer more cost-effective solutions based on the scale of their operations. Figure 2 outlines the current installed base and contracted project pipeline by select system integrators (correct as of August 2020, as tracked in the IHS Markit Global Energy Storage Project Database).

Regional diversity remains significant

In the United States, prior to its exit NEC Energy Solutions was the market leader. Pressure to stay price competitive has led to a recent announcement that its parent company is exiting the market, while honouring existing project commitments. Since then, Tesla Energy, Fluence, Powin Energy and Wartsila remain the strongest competitors in the United States, with rapidly expanding project pipelines.

Smaller suppliers such as GE Energy Storage, Doosan GridTech, IHI Terrasun, Energport or RES are increasingly focusing on perceived higher value, smaller volume projects or targeting specific market niches. Inverter manufacturers such as Sungrow are increasingly targeting the United States market because of the significant pipeline of solar-plus-storage projects, which play into the experience gained and distribution channels established in the solar industry.

As the market is highly price sensitive, most integrators have launched lithium iron phosphate (LFP)-based products in the United States.

In the mainland Chinese market, the upstream supply chain in the energy storage market is highly diverse while the downstream system integrator landscape is more consolidated. A large base of battery manufacturers – especially for LFP batteries – as well as inverter manufacturers, lead to a highly diversified supply chain with many players looking to capitalise from a growing stationary energy storage market. Most recently, UZ Energy and Sungrow have been the most aggressive in expanding their project pipelines, especially as the solar-plus-storage market accelerates. Tier 2 inverter and battery manufacturers are also pushing into the market with very low-cost systems using LFP batteries. Overall, low prices and the strong links between grid companies and local suppliers create an environment that limits the opportunities for international players enter the Chinese market.

EXPLAINED: What is a system integrator?

- A system integrator is a company that specialises in combining component subsystems and ensuring that these subsystems function together as a whole.

- In the energy storage industry, a system integrator supplies the full battery energy storage system (BESS). As such it is usually responsible for procuring individual components, primarily the battery modules / racks, power conversion system (PCS) and other balance of plant; assembling the system; providing a wrap on warranties; integrating the controls and energy management system (EMS); often providing project design and engineering expertise; and providing operation, monitoring and maintenance services.

- As the industry continues to evolve, many system integrators vary in the degree of both upstream and downstream integration, with specific responsibilities often varying by contract and customer requirements.

Cover Image: Despite a market leading position, NEC Energy Solutions has exited the industry. Image: NEC.

Energy-Storage.news' publisher Solar Media is hosting the 2021 edition of the annual Energy Storage Summit in a new, exciting format from 23-24 February and 2-3 March, 2021. See the website for more details.

This is the opening extract of an article which appears in full in the latest edition of our quarterly technical journal, PV Tech Power (Vol.25), in 'Storage & Smart Power', the dedicated section contributed by the team at Energy-Storage.news. To download the entire article as an individual paper, or to subscribe to or download the entire 89-page book, visit the PV Tech Store.