Not only is it apparent that the world needs to use more renewable energy and fewer fossil fuels, but the falling costs of renewables mean that the economics of doing so are increasingly favourable in many parts of the world today.

However, with the ongoing addition of that cheap, abundant energy comes the challenge of integrating diverse sources of distributed energy into the overall mix. Furthermore, in many cases, it isn’t just a question of adding renewable sources, but often directly replacing or even hybridising existing generation assets, including thermal.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

A new white paper from Wärtsilä Energy shows that being able to integrate and then optimise all of these different assets is the key to ensuring that your project – and your investment – is going to provide the maximum benefit, longest possible lifetime in the field – and the best business case.

Combining top energy storage system integrator Greensmith’s experience in delivering turnkey solutions: everything from the battery system down to power conversion hardware, state-of-the-art software and management platforms, with Wärtsilä's decades of know-how as a big player in the power sector, the white paper, Energy Optimized, looks at practical solutions to some of today’s big challenges. Risto Paldanius, Director of Business Development, Energy Storage and Integration at Wärtsilä told us a bit more about what optimization really means in today’s energy market.

It seems such a no-brainer to combine variable renewable energy sources with energy storage, but why is it still considered a challenge to put this into action?

A lot of people might think that energy storage is a simple asset, like a solar panel. But an energy storage system is an extremely complex asset. For what it can potentially do, you need good business case modelling. You are either participating directly in markets, such as frequency regulation, that will make you money and in other cases you will want to see what other costs the energy storage could be used to offset. Unless you’re able to define these costs, then you’re not able to make any viable business case.

The white paper talks at length about the ‘trade-offs’ that need to be made, not only in the way battery systems are operated to give them the maximum lifetime versus revenues, but also in figuring out how to intelligently combine different energy resources, which could mean anything from solar and wind to gas engines and diesel backup.

We look forward to having a dialogue and an intelligent discussion with our customers. How can we improve your system? It often needs good data crunching and evaluation to find the optimal solution right now for that current situation.

But also taking into consideration the future integrated resources plants (IRPs) that utilities put out. What are the future for islands and the requirements of vertically integrated utilities? There, in particular, we hope we will have a chance to truly discuss with the customers and bring our knowledge on the modelling side of things.

Wärtsilä is a big player in more ’traditional’ energy industries, but nonetheless has a vision for how to reach 100% renewables. Obviously, the acquisition of Greensmith is a key part of that overall strategy, but why Greensmith?

We started by looking at what energy storage could be to Wärtsilä as a company. We looked first at hardware and inverter market, there are good battery and inverter manufacturers, but eventually we started to understand that there are also system integrators like Greensmith.

This team is actually making the hardware and the software work. They really had experience on the hardware side, which mean they understood the technical limitations which ultimately define any system. How do you utilise and maximise the assets and still operate it within those parameters?

We found a company that understood and was not focused only on the software but also had expertise on how the actual real world operates.

The white paper runs through some real-world scenarios different grids are facing: California’s ‘Duck Curve’, Hawaii’s ’Nessie Curve’ and the Danish grid, which looks like a hedgehog. Each of them demonstrate the challenges of integrating diverse energy sources in different settings. Leaving aside the animal metaphors for a moment, what opportunities do these cases studies illustrate, for your customers around the world?

We thought a lot about how a solar plant could be run in the future with energy storage – how do you optimise the size of the energy storage based on the output and the size of the solar plant, how do you want to run it? Could you guarantee the output of a solar power plant in a day ahead market?

The capabilities of the software and energy management system (EMS) is already here. We’ve delivered island grid projects that boosted renewable penetration from 15% to 65% and the biggest challenge has been integration. Our GEMS technology makes asset allocation more precise than ever before, using data-driven acumen informed by a range of inputs to forecast pricing and market participation, transition between assets in fractions of a second ensuring grid reliability and flexibility, adjust systems based on regulatory and technological changes to prevent stranded assets, and more.

Here in the US, and also in places like Australia, we’re introducing this idea: how can you optimise the solar output and therefore revenue? Maybe there’s not a business case for dispatchable solar yet in these markets, but, to give another example, how could you be paid for solar ramp rate control, if it only meets the grid operator’s technical requirement?

For us, as the provider of the energy storage system and the optimisation platform, taking the weather and therefore solar production into account, how can we can help our customer make the most money with that hybrid, in that particular market environment? Off-takers and end users would like to have some guarantees on it, at the end of the day.

Can you leave us with one example of where the smart combination of energy storage and the Greensmith optimisation platform can help customers today overcome some of those complex challenges?

Well, of course nowadays most of the Requests for Proposals (RFPs) are well structured and there, it’s fairly easy to demonstrate competitiveness. The challenge typically comes with the less know optimization software, how to compare those. One customer asked bidders to demonstrate how their software would operate under certain parameters in different market scenarios. But I think most visible way of demonstration software still is by seeing its actual operation in multi-revenue market environment or optimizing multi-assents for the Lowest Cost Of Electricity (LCOE) at reference plants.

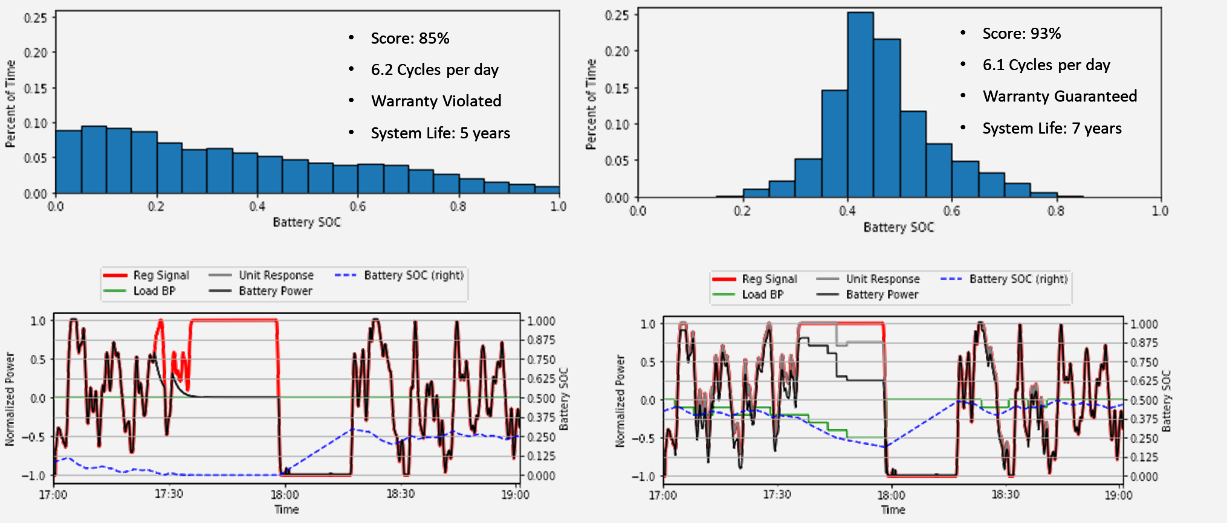

More specifically, the paper mentions PJM: It’s a significant example. Following the regulatory changes in the market product, our team was able to upload new optimisation software to the assets that we had deployed in the PJM market within about a week of receiving the signal change notification. We go into more detail in the paper of course, but essentially, using a good algorithm, you’re able to maintain the state of change of your batteries to where it should be for frequency regulation. If you need to cut the batteries off from the market to recharge them, you’re not only losing the opportunity to make money, you’re actually ‘consuming’ money, while you recharge that battery.

But if you have smart people in your software and algorithm development team, you’re able to develop a way to operate the battery so you’re able to stay in the market all the time. That’s a practical example of what our smart algorithms can do – a relatively straightforward one!

Download the sponsored white paper below: